Fortune News | Apr 13,2024

Dec 23 , 2023

Expanding access to trade finance for developing countries is crucial for the health and growth of the global economy. It represents an investment in a more equitable world; hence, the international community must dismantle the barriers preventing developing countries from fully benefiting from global trade finance, argues this writer, whose identity we withheld on request.

In a joint commentary published in this newspaper last week, World Trade Organization (WTO) Director-General Ngozi Okonjo-Iweala and International Finance Corporation (IFC) Managing Director Makhtar Diop warned of a widening gap in trade financing between developed and developing countries. Their argument centres on the premise that unequal access to trade finance is not just a hindrance to emerging economies' participation in global trade, but also a catalyst for deepening global economic inequalities.

Their perspective offers a nuanced look at how financial disparities can shape international commerce and economic development. I cannot agree more.

The stakes are high, and the moral and economic benefits are undeniable. Addressing the issue of trade financing is not only a matter of economic policy; it should be a step taken towards a more balanced and fair global economy where the growth and prosperity of developing countries are integral to the health of the world's economic system.

Trade finance could be a vital component in the global economic machinery. Yet, it is often overlooked as a significant force in enhancing international commerce and promoting economic advancement. This importance is particularly pronounced in the context of developing countries, where access to trade finance remains a substantial barrier, creating a condition that demands urgent and comprehensive action for several compelling reasons.

Serving as a cornerstone of international commerce, trade finance offers indispensable capital to exporters and importers alike. Its significance is amplified in the global economic order, where trade acts as a primary driver of growth and development. For developing countries, restricted access to trade finance frequently limits their participation in global trade. Improving this access could boost their export potential, accelerating economic development and reducing poverty.

Trade finance's role extends beyond capital provision; it addresses the diverse risks associated with international trade, such as currency fluctuations, payment defaults, and political instability. These risks are particularly acute in developing countries, where improved access to trade finance would provide effective tools to manage such risks, enabling more confident and skilled engagement in the global marketplace.

Facilitating access to trade finance can substantially aid in diversifying the economies of developing countries, which often rely heavily on a narrow range of exports, typically primary commodities, vulnerable to price volatility. Financing trade would also enable these countries to diversify their export base, reducing their exposure to economic shocks and encouraging a more stable economic environment.

The benefits of trade finance are not limited to large corporations or national economies. They extend significantly to small and medium-sized enterprises (SMEs) in developing countries, which form the foundations of their economies. However, these SMEs often face limitations in securing the funding necessary for global expansion. Easier access to trade finance can ignite innovation, enhance competitiveness, and spur growth, ultimately benefiting the broader economy.

Enhancing access to trade finance in developing countries can act as a catalyst for employment and income generation. Stimulating trade can create job opportunities across various sectors, improving living standards and contributing to social stability.

While trade finance is an indispensable element of the global economic framework, its benefits are unequal. Improving access to trade finance in developing countries goes beyond economic fairness and represents a strategic investment in global economic stability and growth. Assisting these nations in overcoming barriers can promote a more inclusive global economy.

The more effective integration of developing countries into the global trade finance infrastructure can have substantial positive impacts on the global economy. Enhanced participation of these countries in international trade can lead to a more balanced and sustainable global trading system. This diversification responds to the risks associated with reliance on a few major economies and contributes to a more resilient global supply chain.

Beyond economic benefits, there are also moral and ethical imperatives to consider.

Ensuring equitable access to trade finance aligns with global efforts toward sustainable development and poverty reduction. It aims to correct historical imbalances in global trade that have often marginalised developing nations.

These countries often harbour untapped markets and resources. By facilitating their access to trade finance, global businesses can uncover new opportunities and markets, resulting in mutual benefits. This not only promotes the growth of developing economies but also opens new avenues for global businesses to diversify and expand.

The transformative role of digital technologies in trade finance, especially blockchain, cannot be overlooked. These technologies can lower barriers to finance, particularly for SMEs in developing countries, offering more secure and efficient transaction processing methods. Such technological advancements could democratise access to trade finance, making it accessible to a broader range of businesses in these nations.

However, achieving this democratisation requires relentless efforts from international financial institutions, governments, and the private sector. Together, they must develop frameworks and policies that facilitate easier access to trade finance for developing countries. This collaborative effort involves reducing regulatory barriers, enhancing the capacity of local financial institutions, and offering guarantees and risk-sharing mechanisms to encourage more lending to traders in these countries.

PUBLISHED ON

Dec 23,2023 [ VOL

24 , NO

1234]

Fortune News | Apr 13,2024

Fortune News | Nov 27,2018

Radar | Apr 27,2025

Fortune News | Nov 23,2019

Fortune News | Dec 17,2022

Fortune News | Jan 23,2021

Fortune News | Feb 08,2020

View From Arada | Aug 27,2022

Fortune News | Mar 23,2019

Radar | Jun 29,2025

Photo Gallery | 156346 Views | May 06,2019

Photo Gallery | 146632 Views | Apr 26,2019

My Opinion | 135234 Views | Aug 14,2021

Photo Gallery | 135150 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

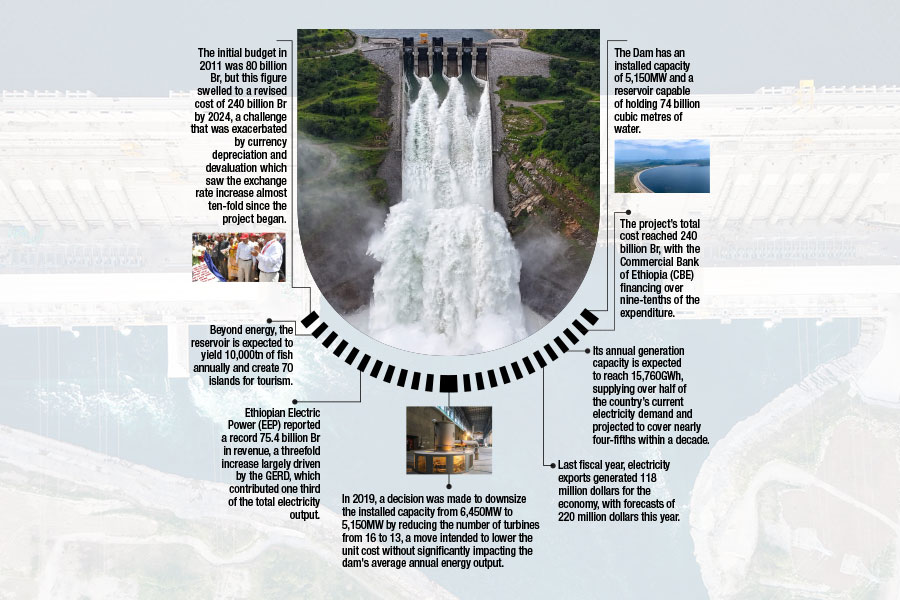

Sep 15 , 2025 . By AMANUEL BEKELE

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...