Advertorials | Aug 02,2025

Abay Insurance’s upswing in profit and impressive earnings per share (EPS) growth last year was marked by foreign currency shortages, rising costs and violent conflicts affecting the industry. The company’s net profit climbed by 55pc to 105.05 million Br, rewarding shareholders with 60 Br more EPS than the previous year’s 250 Br.

These results positioned Abay Insurance between its peers, Ethiopia Life & General Insurance and Oromia Insurance, in an increasingly competitive industry.

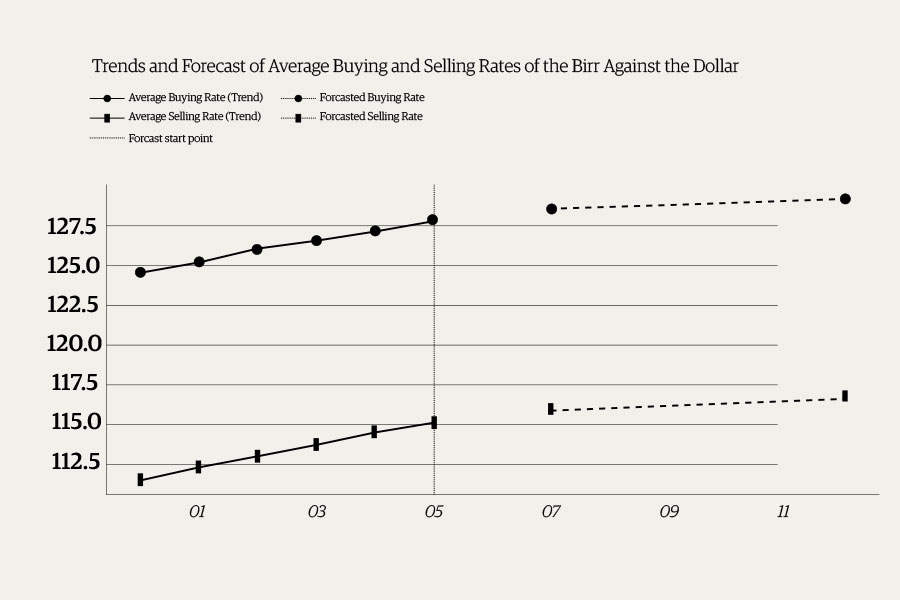

The insurance industry demonstrated mixed underwriting results, with net claims increasing by 15.7pc to 5.7 billion Br. Its ratio rose slightly by 2.1 percentage points to 61.3pc. Industry insiders attribute this trend to the Birr’s continuous depreciation against major foreign currencies, resulting in more expensive imports and rising vehicle maintenance costs.

Ethiopia’s insurance industry witnessed an average annual growth rate of nearly 19pc and 21.7pc for non-life and life insurance, respectively, and a 20pc increase in gross premiums collected last year, reaching 16.7 billion Br. Motor insurance accounted for 40.4pc of this growth, followed by medical at 5.8pc and aviation at 15.3pc. Agriculture-related insurance, including crop, coffee, and livestock, constituted a mere 0.4pc.

With an 18.7pc average growth from the preceding year, insurance firms such as Awash, Oromia, and United led the industry’s growth, retaining 61pc of the total non-life gross written premium. However, the industry has grown consistently for nearly a decade at a compound annual growth rate exceeding 16pc.

Awash Insurance secured the highest premium of 1.25 billion Br in general insurance, claiming 0.9pc of the gross premiums. United and Oromia insurance firms trailed Awash, collecting 845 million Br and 920 million Br, respectively. These three companies accounted for over half of the total premium collected by all insurers. Nib Insurance also reported a robust 30.3pc growth rate in premium collection.

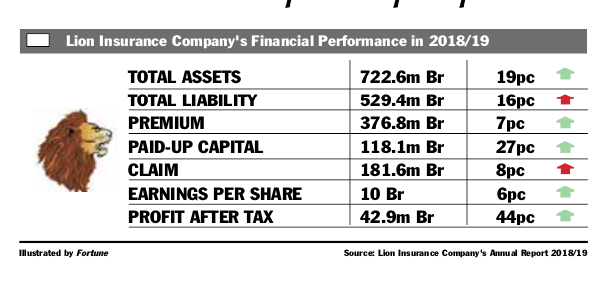

Awash Insurance led with 8.2pc in market share, followed by United (5.5pc) and Oromia’s six percent. However, Tsehay Insurance recorded the most significant market share increase, rising by 1.2 percentage points to 3.8pc, indicating growing popularity. Lion, Buna, and Nyala insurance companies also experienced substantial growth rates, reflecting the industry’s promising trajectory. Still, there is potential for improvement in profitability and insurance penetration rates, remaining low at 0.7pc, compared to the African average of 2.9pc.

Zemen Insurance emerged as a top performer last year, boasting a 208pc premium growth rate. Berhan Insurance (37.50pc) and Oromia Insurance (40.67pc) followed suit. Africa Insurance reported a decline in premium collection compared to the previous year.

Nice, Global, Ethio-Life, Berhan, Lucy and Abay insurance firms held relatively low market shares.

Nonetheless, Abay’s gross written premium increased by 22.65pc to 410.72 million Br, positioning the company second among its peers, behind Oromia Insurance (823.2 million Br) and ahead of Ethio-Life (346.9 million Br) and Berhan’s 242.6 million Br.

Abay retained 63pc of the total written premium, slightly higher than the previous year’s 62.3pc. A considerable amount of premium is passed into reinsurers, a retention ratio Abdulmenan Mohammed, a financial statement analyst based in London, described as “very lower.” He urged Abay’s management to consider increasing the retention rate while managing the risk of retaining more premiums.

Abay Insurance’s CEO, Yohannes Zewdie, attributed the lower rate to insuring big businesses.

“It depends on the volume of businesses insured within the year,” he told Fortune.

Motor class accounts for 70pc of the claims Abay Insurance paid.

Gashaw Workneh, corporate resource chief officer at Tsedey Bank, recommends that the insurer follow stringent requirements before insuring vehicle owners with motor insurance policies.

“Evaluating the driver’s history should be done first,” he said.

He acknowledged the insurance industry’s growth amid global and domestic challenges and fleeting inflation. Gashaw suggested that the insurance firm increase its corporate members and develop policies tailored to the economically disadvantaged segment of society.

The company’s net claims increased by 13.5pc to 138.63 million Br, lower than Oromia Insurance’s but exceeding Berhan Insurance’s and Ethio-Life’s. Abay received a 51.71 million Br commission, a 26.4pc increase, and paid a 16.84 million Br commission expense, marking a 32.32pc growth. Its business expansion coincided with rising expenses, with wages and other operating costs increasing to 107.65 million Br.

The firm’s total investment income surged by 53.4pc to 69.06 million Br, which experts consider a remarkable performance. The industry’s net investment income increased by 42.1pc to over one billion Birr, compared to the previous year’s 747.5 million Br.

Board Chairman Abate Sitotaw attributed the company’s 1.47 billion Br total asset to the “well-articulated vision of the board and leadership of the management and effective performance of employees.” Abay’s cash and cash equivalents comprised 42.76pc of its assets, higher than the previous year’s 38.1pc and surpassing most of its peers, except for Oromia Insurance, which stood at 2.5 billion Br.

Established in 2010 with a 7.7 million Br paid-up capital raised from nine founding shareholders, Abay Insurance operates through 34 branches, including 19 in Addis Abeba. The firm has 270 shareholders and increased its paid-up capital by 28.8pc to 361.25 million Br. The company’s capital and non-distributable reserves amounted to 413.2 million Br, representing 28pc of its total assets.

“The strong capital base should be used efficiently,” recommends Abdulmenan.

Despite the positive investment income trend, overall industry profitability declined. Net profit after tax totalled 1.51 billion Br, marking a 12.9pc drop compared to the previous year. An increase in claims incurred and a decrease in commission earned may have contributed to the decline in industry-wide profitability. Net income earned decreased by 25.2pc to 1.55 billion Br, potentially due to heightened competition in the insurance market.

PUBLISHED ON

May 06,2023 [ VOL

24 , NO

1201]

Advertorials | Aug 02,2025

News Analysis | May 18,2024

Radar | Jul 28,2024

Agenda | Apr 22,2023

Fortune News | Mar 14,2020

Fortune News | Nov 27,2021

Fortune News | Jan 19,2024

Fortune News | Feb 16,2019

Money Market Watch | Oct 06,2024

Fortune News | Apr 06,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...