Radar | Oct 09,2021

Authorities at the National Bank of Ethiopia (NBE) have lifted a consequential restriction imposed on manufacturers, removing a cap on the number of proforma invoices they can submit to commercial banks for foreign currency requests. Central Bank's Governor Mamo Miheretu's decision two weeks ago is a relief to an industry troubled by sourcing issues due to the previous limitation on importing inputs from multiple suppliers.

Under the new policy, commercial banks are authorised to process more than two proforma invoices, given that the importer can demonstrate the necessity of multiple sources to compile the required inputs for production. This shift in policy is particularly crucial for industries like pharmaceuticals, where a diverse range of inputs is often essential.

According to YeneHasab Tadesse, the central bank's director for the Foreign Exchange Department, the initial cap was introduced to streamline the foreign currency request process and ensure equitable access. However, after two years of case-by-case handling of requests for multiple proforma invoices, the central bank recognised the cap's adverse impact on the manufacturing sector and decided to rescind it.

Tadesse Hatiya, president of Sidama Bank, noted the growing frequency of complaints.

"Stringent oversight to identify loopholes will be necessary," he said of the new procedure.

The move was partly in response to increasing complaints from manufacturers about the limitations imposed by the performance invoice cap, with the pharmaceutical industry being particularly vocal.

The domestic pharmaceutical industry, whose leaders had recently appealed to Governor Mamo over the two-invoice cap, would benefit from this policy change.

In November, Ethiopia became a signatory of the African Medical Agency Treaty, requiring inspection fees in the source country's foreign currency to determine product suitability. The treaty added another layer of complexity for pharmaceuticals in obtaining foreign currency, especially amid a partial shipment ban.

The Ethiopian Pharmaceuticals Suppliers & Manufacturers Sectoral Association (EPSMSA), representing 24 members with only 15 active, sees this development as an opportunity to expand markets beyond Ethiopia, thereby increasing foreign currency revenues. Domestic manufacturers supply only a fraction of the country's pharmaceutical needs, accounting for eight percent of the stock worth 10 billion Br last year, a significant decrease from peak years when it reached approximately 25pc. They supply 13 of the 800 varieties distributed by the federal agency in charge of pharmaceutical procurement.

Yared Hirpo, deputy manager of Cadila Pharmaceuticals, expressed relief over the central bank's decision. He observed that foreign suppliers had been leveraging the situation to impose additional costs for aggregating performance invoices from different sources.

"Suppliers use every chance to increase margins," he said.

The 20-year-old company, incorporated with 10 million dollars capital in Gelan Town, has been restricted to 30pc capacity for capsules, tablets and syrups in the last four years due to the forex squeeze. Yared said a popular over-the-counter medicine like Paracetamol requires up to 35 inputs and package materials sourced from separate suppliers.

However, some industry players believe the recent measure does not address the core issues plaguing the domestic pharmaceutical industry. Humanwell Pharmaceutical Ethiopia Plc, a Chinese subsidiary, has struggled to stay in business. Despite its incorporation with 25 million dollars capital, Humanwell has only been able to use thousands of dollars for essential plant maintenance, according to its manager, Fiseha Woldegiorgis.

"We've relied on our holding company to stay afloat," Fiseha told Fortune.

The policy change also benefits larger industrial entities.

Etsegenet Berhe, a significant shareholder, manages Tana Drilling & Industries Plc, incorporated with 600 million Br capital, with plants in the outskirts of Addis Abeba. He believes the cap failed to consider various businesses' diverse and complex input needs. The company, which requires regular imports of materials like dyes, calcium carbonate, lithium, and stabilisers, has faced an operational downturn due to foreign currency constraints.

The company received permits for 5,000 dollars in letters of credit seven months ago, despite needing around three million dollars annually. According to Etsegent, the company needs at least 10 proforma invoices to import inputs from South Korea, the United Arab Emirates, and China.

"It's meaningless to access letters of credit if all the inputs are unavailable," Etsegent told Fortune. "The cap removal is a step towards more realistic business operations."

Eshetu Fantaye, a veteran banker, echoed the sentiment, commending the removal of the cap. He saw the cap unintentionally creating a regulatory loophole, allowing agents to aggregate items under a limited number of invoices, which strained the foreign exchange reserves. Eshetu believes that the policy change will help address the risk of over-invoicing and encourage a more efficient and transparent system for manufacturers.

"It's a progressive move for the country's manufacturing sector," said Eshetu.

PUBLISHED ON

Jan 19,2024 [ VOL

24 , NO

1238]

Radar | Oct 09,2021

My Opinion | Aug 16,2020

Fortune News | Jul 13,2024

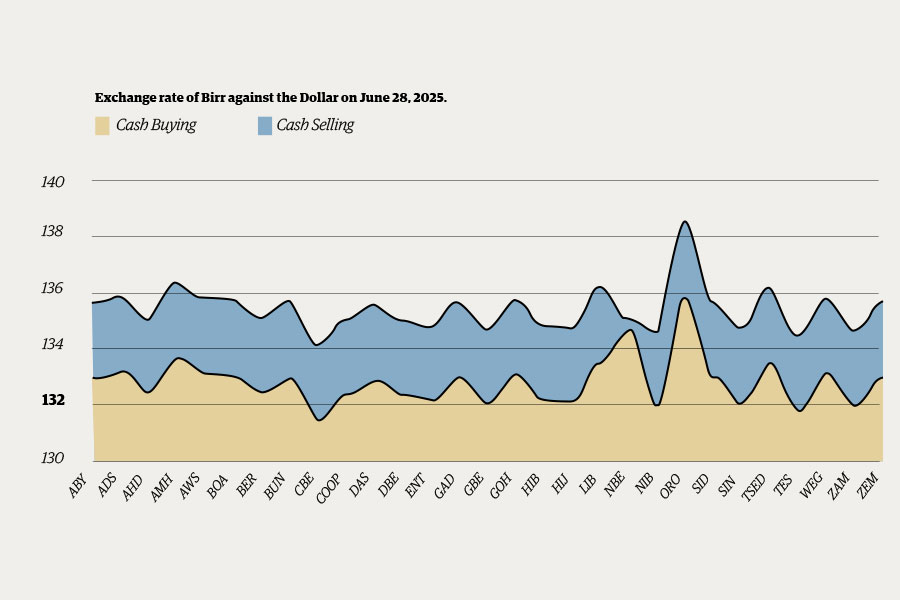

Money Market Watch | Jun 29,2025

Fortune News | Mar 26,2022

Fortune News | Nov 10,2024

Fortune News | Aug 12,2023

Editorial | Aug 19,2023

Commentaries | Nov 30,2024

Radar | Jul 21,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...