Fortune News | Oct 11,2020

Nov 26 , 2022

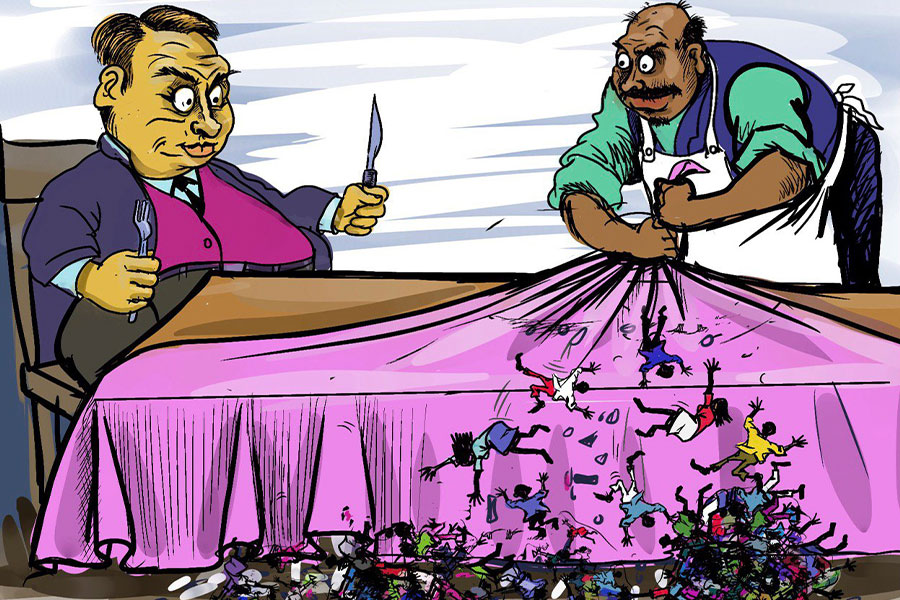

Awash Bank shareholders voted to boost paid-up capital to 55 billion Br in the next four years, claiming a one billion dollars threshold in the current exchange rate. Achieving such height will make the first private bank the most capitalised among the league of private commercial banks.

Three billion Birr shares will float to the Bank's loyal customers for the past 28 years with half of the premium value. The remaining two billion shares will be offered to the staff.

Tsehay Shiferaw, Awash's president, says the move is one way of preparing to compete with foreign banks anticipated to enter the domestic financial sector.

The Bank has recorded meritorious growth raising its paid-up capital to 10.2 billion Br, already doubling the ceiling put by the central bank way before the deadline in 2026. Dibaba Abdeta (PhD) marked the year as commendable, despite instability, pandemic, drought and inflation.

Awash Bank's gross profit stood at 7.4 billion Br and increased by 2.6 billion Br from its operation in 2021/22. The Bank mobilised 152 billion deposits, higher by 44 billion Br from the previous year.

Fortune News | Oct 11,2020

Advertorials | Sep 13,2021

Radar | Jun 01,2019

Radar | May 09,2020

Commentaries | Jun 08,2024

Radar | Aug 21,2021

Fortune News | Apr 16,2022

Commentaries | Nov 19,2022

Fortune News | Feb 19,2022

My Opinion | 130105 Views | Aug 14,2021

My Opinion | 126404 Views | Aug 21,2021

My Opinion | 124409 Views | Sep 10,2021

My Opinion | 122169 Views | Aug 07,2021

May 31 , 2025

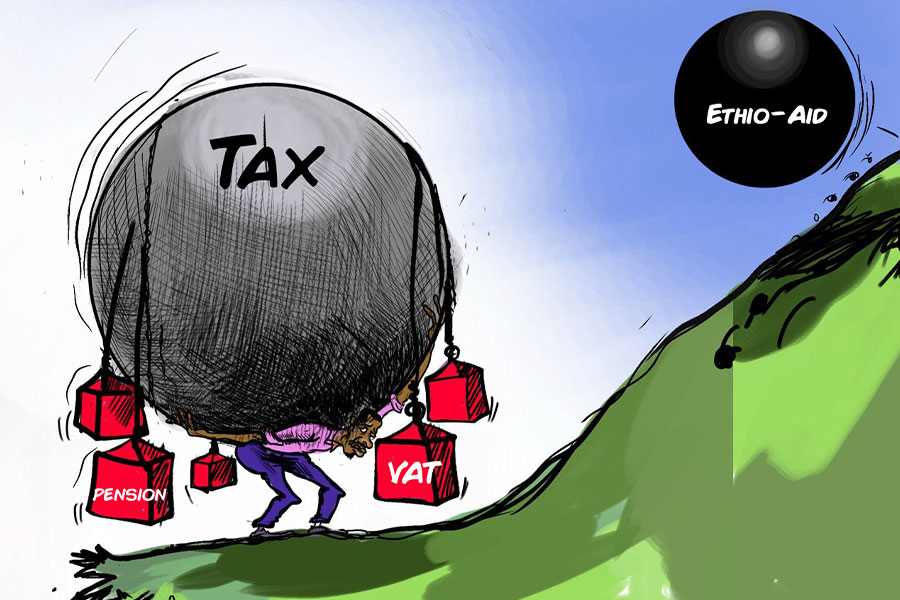

It is seldom flattering to be bracketed with North Korea and Myanmar. Ironically, Eth...

May 24 , 2025

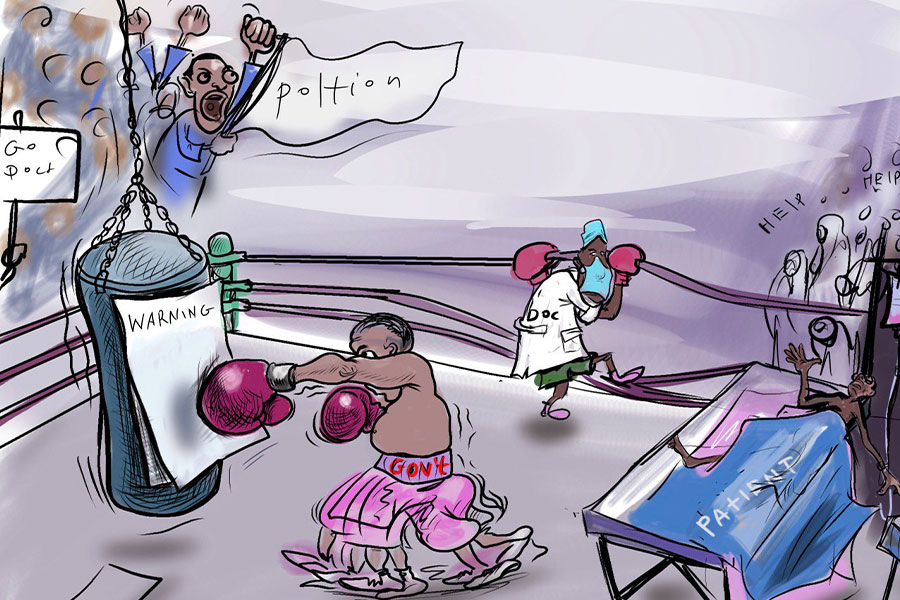

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...

May 10 , 2025

Federal legislators recently summoned Shiferaw Teklemariam (PhD), head of the Disaste...