Commentaries | Apr 01,2023

Nov 19 , 2022

By Ameha Tefera

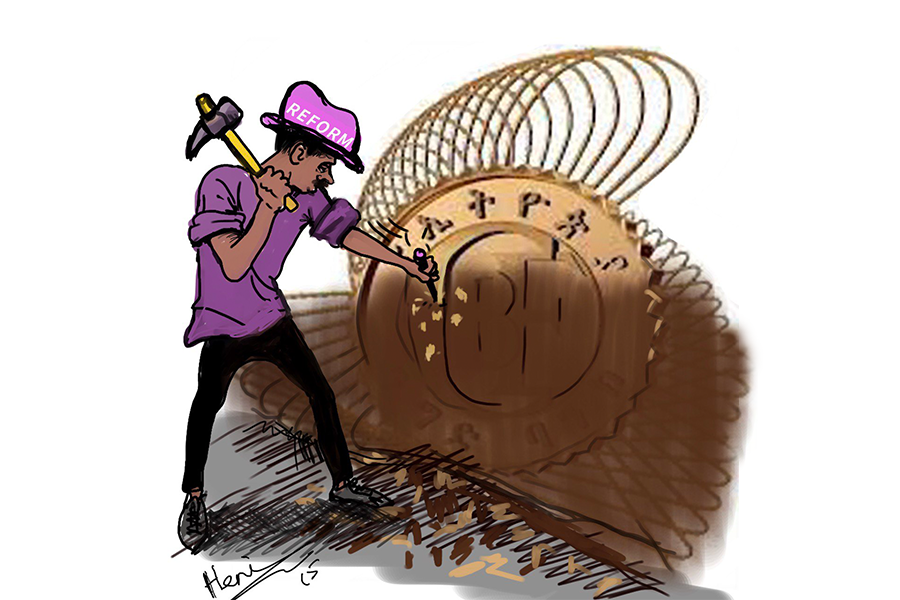

An interest rate commission agent banking system benefits investors and businesses, allowing depositors and banks to establish rewarding interest rate regimes that directly pay providers and satisfy the businesses' demand, writes Ameha Tefera (PhD). He works for the Commercial Bank of Ethiopia (CBE) and can be reached at ambet22002@yahoo.com

The banking industry has a defining place in an economy. Every sector borrows from and deposits money in the banks. Hence, banking crises can arise from credit risk in any industry. Strengthening the industry would lead to economic development, while a crisis retards it.

Banks' toxic and liquidity problems can disadvantage the economic system. They adopt several models to cushion risks even though most became a catalyst for financial crises. However, applying an interest rate commission agent banking system is worth considering. The system allows banks to be agents for investors, funding loans to businesses through fund seller and buyer agreements. This can be done by retaining a reasonable interest rate commission from the agreed loan funding credit price.

Banks' profitability increases since no saving interest rate can be paid on loans to an investor account.

Increasing deposit interest rates raises mobilisation, and discrete market interest rate incentives are also expected to rise with the same account. Similarly, increasing the credit price is proportional to the demand of investors providing loan funding.

The feasibility studies to manage risk are less linked to the borrowers' failure when a feasible project is actual. Uncertainty about the outcome of projects makes loan repayments doubtful, leading banks to lose. The result is standard worldwide.

Banks secure loans against collateralised assets, foreclosing the pledged property through auctions. However, the assets collateralised against default and sold may not cover the loan balance. Banks hunt for other properties registered under the principal borrower to recover their losses. When the remaining loan balance is uncovered, the toxic asset on the balance sheets exposes the banks to risks, leading to capital erosion and declines in deposits.

In traditional banking practice, the loan repayment collection process becomes too long after loan disbursement, leading banks to liquidity problems in a short period.

The balance sheets hold the customers' funds as assets because of the credit crunch and liquidity problems. Buying and selling funds to get excessive revenues from loans have deprived customers of the benefit from the deposit. Banks cannot control dynamic credit and liquidity risks at the same time. To prevent these problems, they are shifting from traditional to nontraditional banking products to get noninterest income and simultaneously avoid the risk of a credit crunch.

However, an interest rate commission agent banking system benefits investors and businesses. It allows depositors and banks to establish rewarding interest rates that directly fund providers and satisfy borrowers' demands. The banks administer loan funding from the investors' credit prices, and the balance sheets are not affected.

The system can work with other banking business models to incentivise businesses and improve the culture and skills of employees. It can protect firms and banks from other risks. Banks can get commission incomes without holding depositors' funds as assets, paying funding costs to investors. Their sustainability in the market can be maintained.

Designing the system is essential to enhance loans and deposit mobilisation. The interest rate negotiated between the fund holder and the investor would not exceed the rate set by the central bank. The benefit depends on the loan interest agreement signed with the business.

Based on the loan contract between the investor, the business and the agent bank, the latter can disburse loans from the investors' to business accounts. The loan repayment, which contains a portion of the principal and interest amounts, is credited into the investors' accounts periodically as agreed. A short-term deposit would not be paid for a long-term loan which could bring a liquidity risk.

PUBLISHED ON

Nov 19,2022 [ VOL

23 , NO

1177]

Commentaries | Apr 01,2023

Radar | May 23,2020

Fortune News | Feb 22,2019

Editorial | Oct 08,2022

Fortune News | Sep 19,2020

Photo Gallery | 179924 Views | May 06,2019

Photo Gallery | 170120 Views | Apr 26,2019

Photo Gallery | 161109 Views | Oct 06,2021

My Opinion | 137231 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Nov 2 , 2025

The National Bank of Ethiopia (NBE) has scrapped the credit-growth ceiling that had s...

Nov 2 , 2025 . By SURAFEL MULUGETA

The burgeoning data mining industry is struggling with mounting concerns following th...

Nov 2 , 2025 . By YITBAREK GETACHEW

Berhan Bank has chosen a different route in its pursuit of a new headquarters, opting for a transitional building instea...

Nov 2 , 2025 . By BEZAWIT HULUAGER

Nib International Bank S.C. has found itself at the epicentre of a severe governance...