Sunday with Eden | Oct 12,2019

Sep 24 , 2022

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

Federal authorities are pushing heads of financial institutions - yet again - to contribute up to two percent of gross profits to the Ethiopian National Defense Forces (ENDF). They are expecting the sector to chip in no less than 800 million Br, people familiar with a series of meetings held last week disclosed.

Muferhiat Kamil, minister of Labour & Skills, attempted to persuade executives of banks, insurance and microfinance institutions to back the federal government in the renewed fighting in the country's north. In a meeting held at the Hilton Hotel two weeks ago, a federal committee for resource mobilization for the war was unveiled, comprising central bank Governor Yinager Dessie (PhD), Abie Sanu, president of the Commercial Bank of Ethiopia (CBE), and Nestanet Lemessa, CEO of the Ethiopian Insurance Corporation (EIC).

They have asked the banks to contribute 1.5pc of annual gross profits and insurance firms to chip in half a percentage point more.

Data from the National Bank of Ethiopia (NBE) indicates that the banking industry netted nearly 50 billion Br last year. Deposits grew to 1.7 trillion Br.

It marks the third time the financial sector is facing a push to donate to war efforts. Banks contributed close to 200 million Br through the Ethiopian Bankers' Association in December 2020, a month after the war in the north broke out. Half of this amount was made by the state-owned CBE. Awash, Dashen, Abyssinia, United, the Cooperative Bank of Oromia and the Development Bank of Ethiopia (DBE) donated 10 million Br each.

In August 2021, the banking industry donated close to 400 million Br. Insurance firms and microfinance institutions contributed close to 100 million Br, people close to the matter revealed.

Executives of the financial institutions have requested time to discuss the request from the federal authorities with their respective boards. They have also inquired about the confidentiality of the contributions for fear that it could potentially affect relationships with international business partners.

"We're waiting for guidance on how to make the contributions," Kassa Lisanework, CEO of Tsehay Insurance, told Fortune. "We'll table the issue to the board of directors."

Tsehay Insurance registered 32.8 million Br in profits last year.

There are banks and insurance companies that have received the approvals of their boards. Not all have yet.

"The board is yet to decide on how much the Bank will contribute," Melaku Kebede, president of Hibret Bank, told Fortune.

Banks will forward their final decisions to the Ethiopian Bankers' Association, a lobby group for all private and state-owned banks, chaired by CBE's Abie. Recent industry entrants such as Amhara, Tsehay, Goh and ZamZam banks are also expected to contribute.

The latest request comes amid growing fiscal pressures on the federal government and a record defence budget. A year ago, Prime Minister Abiy Ahmed (PhD) told Parliament that his administration had spent over 100 billion Br to pay for the war and humanitarian provisions in Tigray Regional State. It is a cost that has undoubtedly spiralled in the year since, though by how much remains unclear. Nonetheless, the cost of the militarized conflict continues to pile up.

Finance officials proposed close to 90 billion Br in military spending in the budget bill, four times what Parliament approved last year. Members of Parliament have raised concerns over the 787 billion Br federal budget and the share appropriated to defence.

Parliament passed the budget bill, comprising 40pc higher than what lawmakers had approved the previous year and around 16pc larger when accounting for the 122 billion Br supplementary budget approved last December.

Experts from the Ministry of Health estimate a 20 billion Br budget for reconstructing health institutions in conflict-affected areas. Officials at the Ministry of Finance said the civil war caused 40 billion Br in losses to the federal government revenues last year. Authorities at the Ministry of Revenues have previously stated the armed conflict has been a stumbling block in their tax mobilization efforts.

Mounting budget constraints are the reasons behind a nod from the Council of Ministers to a new type of tax imposed two months ago. Dubbed "social welfare levy," officials look to charge importers an extra three percent on the commodities they import to bridge financial gaps in rehabilitation and reconstruction efforts. Tax officials hope to generate an additional 22 billion Br through the new levy this year.

PUBLISHED ON

Sep 24,2022 [ VOL

23 , NO

1169]

Sunday with Eden | Oct 12,2019

Fortune News | May 06,2023

Editorial | Apr 24,2021

Fortune News | Apr 13,2024

Radar | Jul 08,2023

Radar | Nov 28,2020

Commentaries | Sep 30,2023

Exclusive Interviews | Jan 05,2020

Fortune News | Apr 15,2023

Radar | Jun 15,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

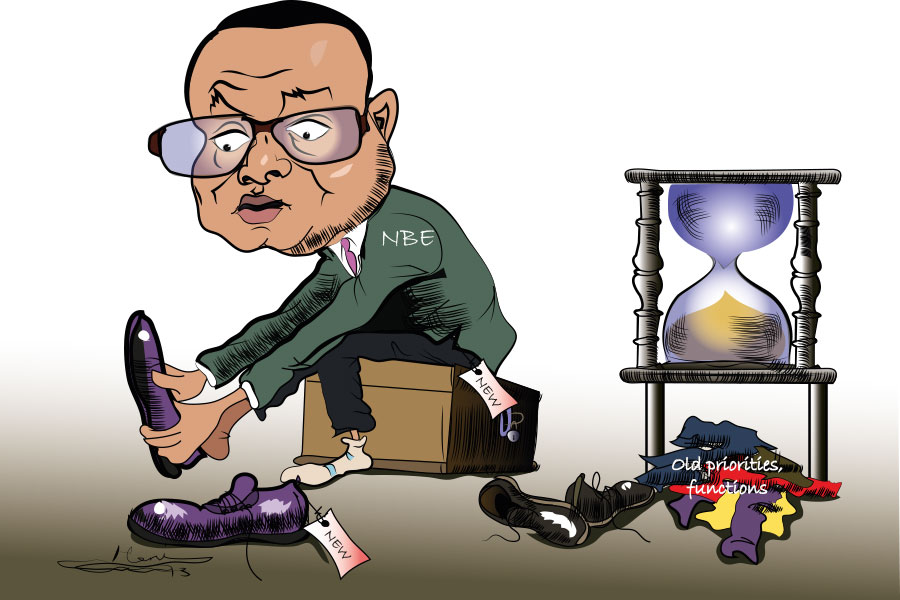

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...