Nov 6 , 2021

By Akinwumi A. Adesina , Ngozi Okonjo-Iweala and Vera Songwe

As world leaders head to Glasgow for the United Nations Climate Change Conference, Africa needs decisive collective action rather than more encouraging words. In particular, rich countries should support a four-part financial and trade package that can ensure a transformative shift of resources to the region, write Akinwumi A. Adesina, president of the African Development Bank (AfDB), Ngozi Okonjo-Iweala, director-general of the World Trade Organisation (WTO), Vera Songwe, United Nations executive secretary of the Economic Commission for Africa (ECA), and Ibrahim Assane Mayaki, former prime minister of Niger.

Almost two years into the COVID-19 pandemic, the unequal nature of the global response to the crisis is glaringly obvious. Whereas very few African countries have managed to spend the equivalent of even one percent of their GDP to combat this virtually unprecedented health emergency, Western economies have mustered over 10 trillion dollars, or 30pc of their combined GDP, to tackle it. Europe and the United States have fully vaccinated, respectively, 75pc and 70pc of their adult populations against COVID-19, but fewer than six percent of Africans have been vaccinated. And while some Western countries are already administering booster shots, Africa cannot get initial doses.

This systemic inequity is equally evident in efforts to address the climate crisis. Climate disasters, like viruses, know no boundaries. But whereas governments in the Global North respond to such events by borrowing on capital markets at negligible cost in order to finance stimulus and investment packages, African countries must rely on either a trickle of liquidity through debt-suspension initiatives, aid pledges, or exorbitantly expensive capital-market funding. None of these options currently provide these economies with the upfront capital investment they need to improve their long-term prospects.

As world leaders head to Glasgow for the United Nations Climate Change Conference (COP26), Africa needs decisive collective action rather than more encouraging words. We, therefore, propose a strategic financial and trade package that can transform climate inequality into inclusiveness by ensuring a transformative shift of resources from historic greenhouse gas (GHG) emitters to Africa.

Our plan rests on four pillars. First, developed economies must keep the promise they made in the 2015 Paris climate agreement to deliver 100 billion dollars a year to help cover developing countries’ adaptation and transition costs. After all, the commitments that developing countries made in Paris were conditional on this pledge. Failure to fulfil this overdue commitment now, with half of the 100 billion dollars earmarked for adaptation costs, will undermine the very principle of multilateral action. It is a provision in an international agreement, and it must be honoured.

The fact that the developed world mobilised 10 trillion dollars to counter the pandemic in 2020 alone demonstrates just how small an amount 100 billion dollars a year really is. Yet, in that same period, official development assistance increased by only 3.5pc in real terms.

The second pillar is to align financial markets with the Paris agreement’s goals. Mainstreaming the impact of climate change in investment decisions is critical, and judicious deployment of private capital in green sectors will transform African countries and developing economies in general. To that end, the Glasgow Financial Alliance for Net Zero, chaired by former Bank of England Governor Mark Carney, has brought together firms with a combined 90 trillion dollars in assets.

There must now be an urgent and determined effort to channel this private finance into growing climate-friendly sectors in Africa and other developing countries. With that in mind, the UN Economic Commission for Africa earlier this year proposed a liquidity and sustainability facility that aims to reduce borrowing costs linked to green investments by developing a repurchasing (“repo”) market for the continent. The initiative, which ideally will be financed through seed funding of three billion dollars in special drawing rights (the International Monetary Fund’s (IMF) reserve asset), is intended to de-risk private investments in Africa and help the region increase its share – currently less than one percent – of the global green bond market.

The Republic of South Africa recently issued a 196 million dollar green bond to refinance its energy sector. Such issuances are an example of the type of investment that is possible by unlocking bond markets for Africa. We need to make such investments the rule rather than the exception.

In addition, the African Development Bank (AfDB) Group has proposed establishing an African Financial Stability Mechanism. Such a scheme will help prevent future financial shocks in Africa – the only continent without a Regional Financing Arrangement – from having spillover effects.

The third pillar is to provide the significant resources Africa needs to enable its economies to adapt to global warming. Climate change is costing the continent seven to 15 billion dollars annually and threatens both food security and the use of hydropower. But Sub-Saharan Africa, which accounts for less than four percent of global GHG emissions, receives just five precent of total climate finance outside the OECD.

Instead of simply waiting for such financing to materialise, Africa is tackling climate adaptation head-on with homegrown solutions. The AfDB currently devotes 63pc of its climate finance to adaptation, the highest share of any multilateral financial institution, and has committed to double such funding to 25 billion dollars by 2025. The AfDB and the Global Center on Adaptation have also created the Africa Adaptation Acceleration Program (AAAP) to help scale up bankable adaptation investments in the region. The mobilisation of 25 billion dollars via the AAAP will be a first step toward investing in a green recovery for Africa.

Lastly, any solution to climate change must address trade, the lifeblood of the global economy. The key to ending our current economic malaise is to ensure continued openness and predictability, including by committing to global trade rules that are aligned with the Paris agreement’s goals.

Regional blocs such as the newly formed African Continental Free Trade Area can provide an impetus for hardwiring our commitment to low-carbon development. We must recognise Africa’s specific needs, acknowledge the continent’s vulnerability to climate change, and identify the regions and communities where its consequences have caused the most harm.

Next year’s UN climate summit, COP27, will take place in Africa, and we look forward to welcoming the world. But developed countries must fulfill their longstanding climate promises to the region well before then – starting in Glasgow.

PUBLISHED ON

Nov 06,2021 [ VOL

22 , NO

1123]

View From Arada | Jun 22,2019

Radar | Aug 08,2020

Editorial | Apr 24,2021

My Opinion | Jun 22,2024

Commentaries | Sep 18,2021

Exclusive Interviews | Jan 22,2022

Advertorials | Oct 02,2023

Commentaries | Feb 17,2024

Viewpoints | Aug 05,2023

View From Arada | Apr 30,2022

Photo Gallery | 171567 Views | May 06,2019

Photo Gallery | 161808 Views | Apr 26,2019

Photo Gallery | 151542 Views | Oct 06,2021

My Opinion | 136305 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

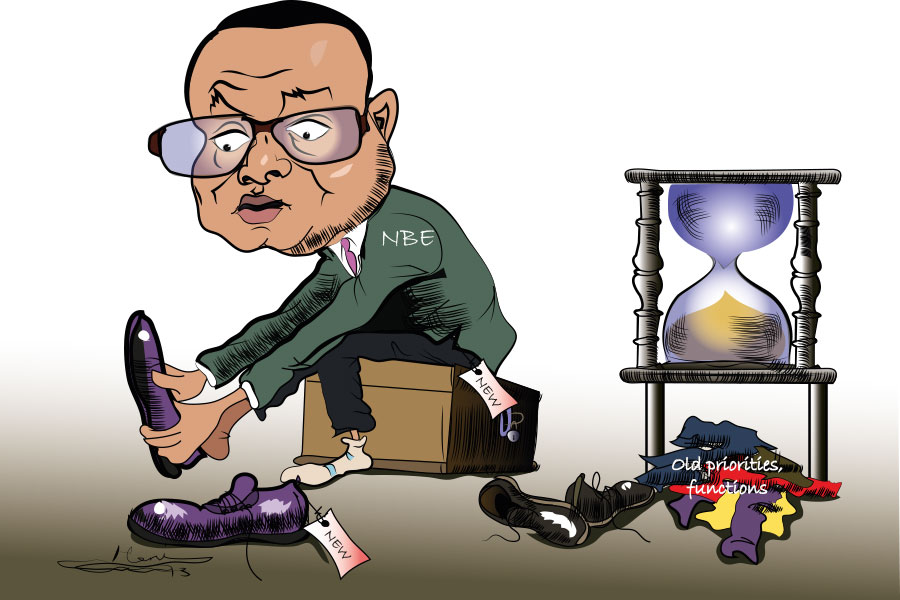

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Oct 5 , 2025 . By NAHOM AYELE

In Meqelle, a name long associated with industrial grit and regional pride is undergo...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The federal government is set to roll out a new "motor vehicle circulation tax" in th...

Oct 5 , 2025 . By NAHOM AYELE

The Bank of Abyssinia is wrestling with the loss of a prime plot of land once leased...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The Customs Commission has introduced new tariffs on a wide range of imported goods i...