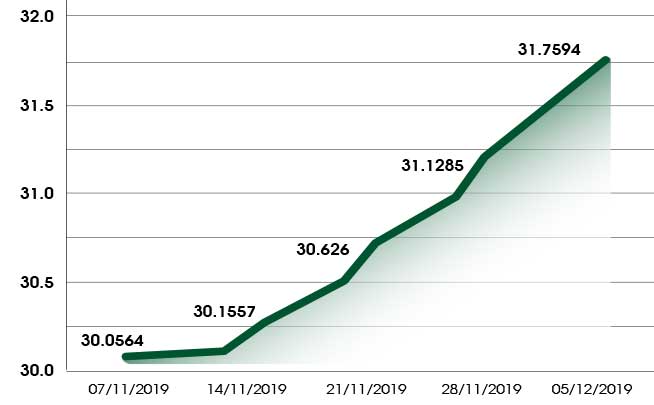

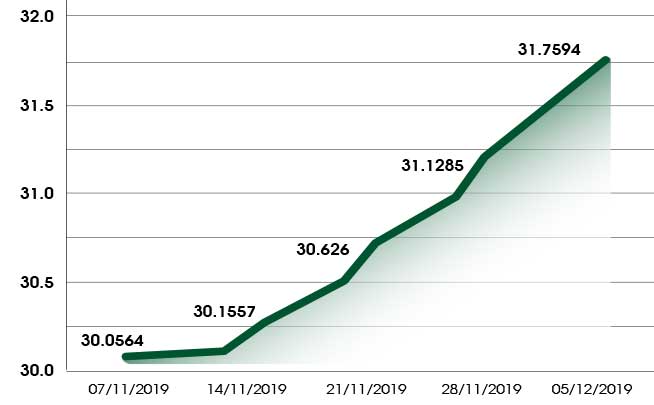

Fortune News | Dec 07,2019

The freeze placed on asset-based loans could not apply to microfinance institutions (MFIs), the National Bank of Ethiopia (NBE) said.

They are exempted from the freeze, irrespective of the types of loans they make, according to Asfaw Abera, head of the microfinance institutions supervision directorate, who advised the institutions in a letter issued on September 20, 2021.

The decision came over a month after the freeze on collateralised loans was first communicated through text messages to executives of commercial banks, while the central bank had offered no official clarification on whether the same rule applied to MFIs.

Officials of the central bank have justified their abrupt decision to freeze loans to control the exchange market in the parallel market after the gap with the official rate reached a historic high of 50pc. Commercial banks' outstanding credit to the private sector grew by 125pc in July, four times the annual growth reported last year.

The misunderstanding on whether MFIs should comply with the freeze pushed some of them to suspend providing collateralised loans to their borrowers temporarily. They asked for explanations from the central bank through the Association of the Ethiopian Microfinance Institutions, which comprises 41 members.

"It has come to our attention that some MFIs were facing challenges to provide services to customers looking for asset-based loans," said Asfaw, in his letter copied to regional and city administrations.

Microfinance institutions have an outstanding credit of 64.9 billion Br.

Tezera Kebede, general manager of Peace Microfinance, established 22 years ago, welcomes the decision from the central bank. Microfinance institutions helping to reduce poverty and serve people in the lower-income bracket are sufficient reasons for the central bank to spare them from the freeze, according to Tezera.

Communications between the central bank and authorities with the mandate to freeze collateralised assets have been a roadblock in providing service to clients, says Mamo Deddefo, general manager of Sheger Microfinance. Sheger was established three years ago with a capital of 35 million Br, providing up to 430 million Br in loans annually.

"Our customers were not able to fulfil credit requirements because of suspension of services by regional offices," said the General Manager.

However, for Teshome Kebede, executive director of the Association, the decision by the central bank can only be effective if the Documents Authentication & Registration Agency resumes services to review the status of assets borrowers present as collateral.

The loan freeze imposed by the authorities is an "acceptable trade-off", considering the economic consequences if authorities had not acted, Eyob Tekalign (PhD), a state minister for Finance, said last month during a press briefing held at the Prime Minister's Office.

A series of sectors in the market were winning similar concessions from the central bank over the past few weeks. The coffee industry has been exempted from the freeze, a measure that coincided with the coffee harvest season, expected to produce 280,000tn this year for the export market.

Despite the exemption, businesses still complain they have faced difficulties in accessing asset-based loans.

"We're still waiting until the banks comply with the instructions," said Fikadu Hailemariam, general manager of Homeland Organic Coffee Agro-Industry Plc.

Importers and edible oil producers have also been given the exemption to access asset-based collateral loans. While edible oil producers can access any loan, importers can only borrow to settle letters of credit once approved.

PUBLISHED ON

Sep 26,2021 [ VOL

22 , NO

1117]

Fortune News | Dec 07,2019

Fortune News | May 18,2019

Fortune News | Jan 22,2022

Fortune News | Dec 12,2020

Covid-19 | Jun 12,2021

Fortune News | Feb 06,2021

Featured | Oct 23,2021

Fortune News | Jul 03,2021

Fortune News | Aug 17,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...