My Opinion | Mar 26,2022

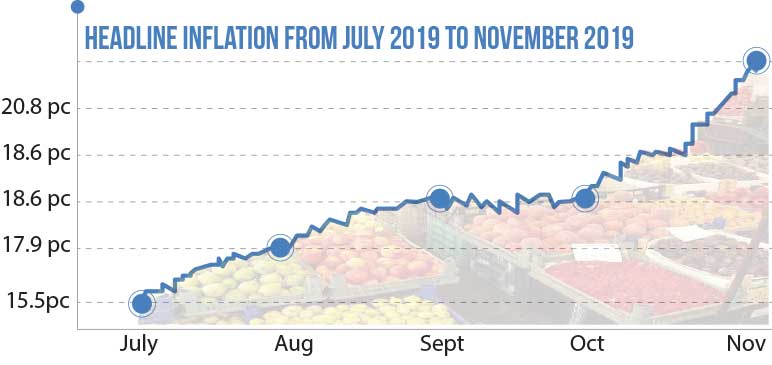

Headline inflation, an indicator of the cost of living, recorded a 20pc rate in August, according to the latest report from the Central Statistical Agency (CSA).

Gauged by the Consumer Price Index (CPI), the average rate of increase in the price of goods and services has fallen by 2.3 percentage points from the previous month. The rate of food inflation stood at 22pc - a three-point decline - while non-food inflation registered a 1.4-percentage-point drop to 17.5pc.

“The price of most cereals continued to rise during the month, which largely tends to drive up food inflation,” reads the report from the Agency.

The price of red pepper has been pushing the rate higher and also continued to increase last month following the trend of previous months, according to the Agency.

"However, major vegetable types, especially onions, garlic and potatoes, registered a decrease in their price," reads the report.

The rate of non-food inflation also rapidly increased by 17.5pc last month. A rise in the prices of alcohol, tobacco, khat, housing repair and maintenance, energy, transport, medical care, and jewelry made of gold pushed the rate higher.

The month-on-month general CPI, which measures the price change between the two latest months, has shown an increase of 0.5pc as compared to the preceding month.

The rate has been hovering in double digits for the past 15 years, marking an average of 15.5pc. Last fiscal year’s average headline inflation rate stood at 19.9pc, mainly driven by the growth of food inflation that registered a 23.3pc rate, while non-food inflation stood at 15.8pc.

The galloping inflation rate makes life difficult by eroding consumer purchasing power, according to Atlaw Alemu (PhD), an economist lecturing at Addis Abeba University.

"It's concerning and needs a solution," Atlaw said.

Atlaw believes that the rate is galloping due to the large broad money supply in the economy and supply shortage that fails to meet the demand.

At the end of the third quarter of the recently ended fiscal year, the broad money supply, the amount of money in the economy, reached 987 billion Br, depicting 18.6pc growth over the same quarter last year. The amount is rising mainly due to a 29.6pc expansion in domestic credit against a 195.7pc contraction in net foreign assets.

"This is a monetary failure," he said. "The inflation rate in the country is not even comparable with neighbouring countries."

Neighbouring country Kenya was able to control the inflationary pressure in single-digits by reporting a 4.4pc inflation rate in August, the same rate recorded the previous month.

To stop the rate from increasing, the government should first conduct a deep study to identify the root cause, according to Atlaw.

"The government should also stop deficit financing by printing and injecting cash into the economy to cover budget deficits," said Atlaw. "It should also work on boosting supply to fill the demand."

The federal budget of the current fiscal year estimates that the budget deficit will clock in at 125 billion Br, a spike of 28.3pc and 35.4 billion Br higher in absolute figures.

To narrow the budget deficit and to not increase deficit financing, Atlaw recommends the government cut revenues.

"The government should start to live within its means," he said.

For the current budget year, the Ministry of Finance intends to confine the headline inflation rate to the single digits at 9.8pc. The Ministry proposed to achieve the lower rate by combining public finance management as well as monetary policy and keeping the average budget deficit rate at no more than three percent of GDP, according to officials from the Ministry of Finance.

PUBLISHED ON

Sep 06,2020 [ VOL

21 , NO

1062]

My Opinion | Mar 26,2022

Editorial | Sep 21, 2024

Agenda | Apr 16,2022

Agenda | Aug 18,2024

Fortune News | Aug 10,2019

Fortune News | Oct 23,2021

Editorial | Aug 19,2023

Commentaries | Feb 13,2021

Editorial | Mar 18,2023

Fortune News | Dec 07,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...