Fortune News | Nov 25,2023

Aug 1 , 2020

By Dejen Yemane

To much domestic fanfare, Ethiopia announced the impoundment of 4.9 billion cubic metres of water earlier this month - the target for the first filling of the Grand Ethiopian Renaissance Dam (GERD).

It was a testament to the strength of character shown by citizens and, in the end, the government and how far the nation has come in self-sufficiency. It was apparent that the project was exposed to abuse, corruption and mismanagement, forcing it to go way over budget. It is now estimated to cost over 100 billion Br. In this, the government’s performance deserves condemnation as well as praise.

More than a massive development, the GERD was also a subject of external diplomacy. The logjam had become a hot topic since Ethiopia, Sudan and Egypt took their case to Washington, D.C. to mediate their dispute. Ethiopia’s acceptance of the United State’s and the World Bank’s mediation role received a different reaction from different stakeholders at home and abroad.

Experts and opposition political parties were at the forefront of the chatter over the mediation. The point of overlap for commentators was that Egypt was negotiating in bad faith, with the sole purpose of putting pressure on Ethiopia to accept an unfair deal. There were also concerns of partiality by the mediators for Egypt, a concern which later became true.

But what has been left unanalysed is the tool that might have been used by the mediators to bend Ethiopia to their will: dollar diplomacy. A term introduced by William Howard Taft, 27th president of the United States, it was explained as a foreign policy tool for America’s expansion of influence, both political and economic, to other countries through the offer of aid, loan and debt cancellation instead of use or threat of military force. In other words, it means substituting dollars for bullets. Latin American countries are well acquainted with this term.

Was GERD a hostage of dollar diplomacy?

Knowingly or unknowingly, Ethiopia might have indeed been a victim of this. It is hard to know whether explicit or implicit offers were made to this end, but there are traces we can follow that give us a general picture of what may have happened.

One element of the negotiation process that was strange to the eyes of many were the mediators themselves. The United States government attempted to deal with this through its Treasury Secretary, not the State Department. The inclusion of the World Bank did not allay any fears either.

Both Treasury Secretary and WB lack natural jurisdiction to deal with negotiations having foreign policy implications. Both bodies are institutions primarily concerned with financial matters – they did not have enough of a precedent or gravitas to mediate such as issue. This misplaced assignment of roles signals Trump’s dollar diplomacy approach.

Besides their unfitness to mediate the GERD dispute, the statements of Steven Mnuchin, secretary of the US Treasury, and David Malpass, president of the World Bank, add to the suspicion that both bodies were attempting to buy off the country.

“Final testing and filling should not take place without an agreement,” Mnuchin recklessly wrote in a statement on February 28, 2020, a clear indication of the lack of direction the United States wanted Ethiopia to take.

On June 17, 2020, Malpass, in a Twitter post where he commented about his communication with Prime Minister Abiy Ahmed (PhD) about World Bank financial approvals, added a reminder of the need for Ethiopia to cooperate.

“Important [for] Ethiopia and its neighbours to sustain constructive dialogue [and] cooperation on water sharing,” he wrote.

His comment, in a post where he discusses financing approvals, was taken by many as an implied threat that Ethiopia may pay on the dollar front if it decided to remain stubborn on the GERD.

Yet another indicator has been the US’s move to mull withholding aid to Ethiopia in response to the country’s first-year filling of the GERD before reaching an agreement with Egypt and Sudan.

“The Trump administration is weighing withholding some aid to Ethiopia over a Nile dam project that has severely strained its relationship with downstream countries Sudan and Egypt,” wrote Foreign Policy magazine, citing officials and congressional aides familiar with the matter.

This came after Ethiopia announced it had met its first year goal of water impoundment at the GERD reservoir. Mulling to cut aid once the two countries have renewed and signed a new development partnership agreement worth 230 million dollars is ironic and disparaging.

Notable is also the existence of an enabling economic environment in Ethiopia for dollar diplomacy to sneak its head in. It is well-known that Ethiopia is highly dependent on foreign aid and loans and that the US is one of Ethiopia’s major development partners. Added to this is the Homegrown Economic Reform Agenda, which requires lots of dollars to stimulate the economy away from the developmental economic model the country had been following.

This connection of circumstances leads one to believe that the GERD was held hostage by the dollar until it was freed with national determination. Though the draft deal prepared by the US Treasury and the World Bank has been rejected by Ethiopia and the danger narrowly avoided, we should take a lesson about farsightedness on our future dealings and management of our national interests including the unfinished business of the GERD.

PUBLISHED ON

Aug 01,2020 [ VOL

21 , NO

1057]

Fortune News | Nov 25,2023

Viewpoints | Jul 18,2020

Fortune News | Feb 29,2020

My Opinion | Mar 07,2020

Radar | Aug 13,2022

Fortune News | Dec 25,2021

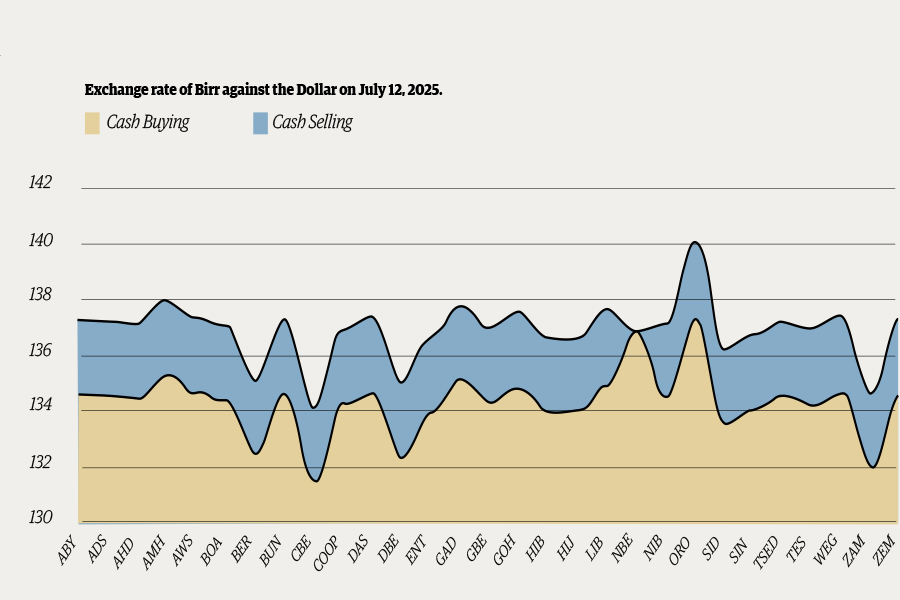

Money Market Watch | Jul 13,2025

Radar | Aug 01,2020

Viewpoints | Mar 14,2020

Radar | Sep 01,2024

Photo Gallery | 154220 Views | May 06,2019

Photo Gallery | 144470 Views | Apr 26,2019

My Opinion | 134938 Views | Aug 14,2021

Photo Gallery | 132763 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Aug 16 , 2025

A decade ago, a case in the United States (US) jolted Wall Street. An ambulance opera...

Sep 7 , 2025 . By NAHOM AYELE

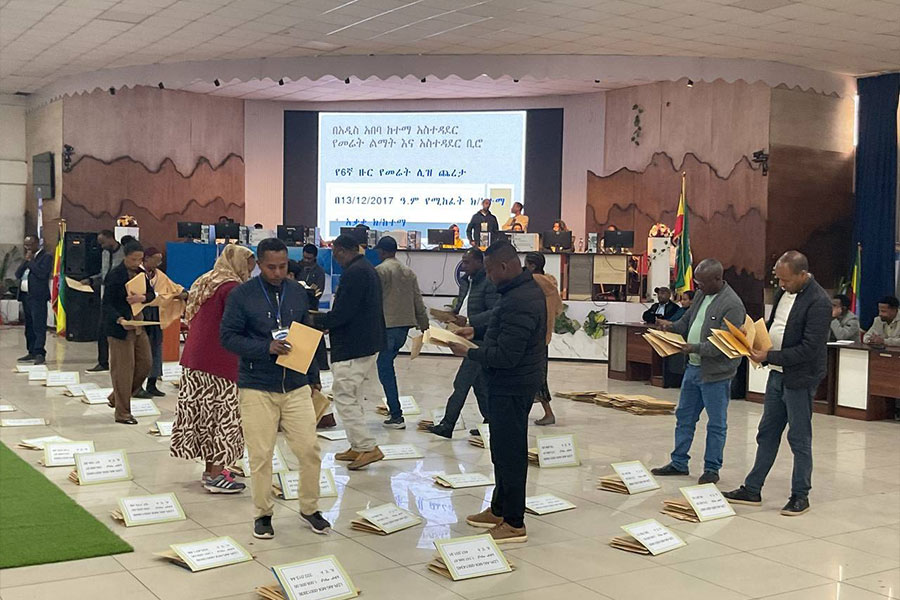

Addis Abeba's sixth public land lease auctions after a five-year pause delivered mixe...

Sep 7 , 2025 . By BEZAWIT HULUAGER

Brook Taye (PhD), the chief executive of the Ethiopian Investment Holdings (EIH), is...

Sep 7 , 2025 . By BEZAWIT HULUAGER

For decades, Shemiz Tera in the Addis Ketema District of Atena tera has been a thrivi...

Sep 7 , 2025 . By NAHOM AYELE

A dream of affordable homeownership has dissolved into a courtroom showdown for hundr...