Fortune News | May 27,2023

In a triumph over the trials of the pandemic, a rising tide of construction costs and inflation, Zemen Bank has opened a stunning 32-storey headquarters on Ras Abebe Aregay St., Sengatera area, a hub for banking in Ethiopia’s bustling capital. The architectural tour de force stands as an unignorable testament to the burgeoning prowess of the country’s financial sector.

With its inauguration presided over by an illustrious cast that included Mamo Mihretu, the central bank governor; Dereje Zenebe, Zemen Bank’s president; and Ermias Eshetu, the bank’s Board chairman, the building was revealed to the public five years after breaking ground. The project’s total cost, inspired by the shape of a bull’s horn, exceeded 1.5 billion Br, with an additional off-budget 300 million Br due to the extended construction period.

Constructed on a sprawling 2,300Sqm plot, the new headquarters represent a milestone for the Bank that began its journey with a modest paid-up capital of 87.9 million Br. Zemen Bank has notably broadened its reach this year by establishing 37 new branches, boosting its network to 100 branches - a significant deviation from its initial single-branch model it launched 15 years ago. The Bank’s paid-up capital had impressively increased to 3.64 billion Br last year; Ermias expressed confidence during the inauguration that they would meet the central bank’s five billion Birr capital threshold by the end of next month.

China Wu Yi Co. Ltd constructed the headquarters, while Jdaw Consulting Architects & Engineers Plc, a domestic firm, was enlisted for consultancy services. The sky-coloured tower graces the skyline of the banking district, a.k.a Addis Abeba’s Wall Street, joining a multitude of other towers by Hibret, Nib, and the state-owned Commercial Bank of Ethiopia (CBE) that have already erected their monumental buildings in the area.

The landscape of Ethiopia’s banking industry has been progressively evolving since its inception in the 1930s, reaching 31 licensed by the central bank. Operating close to 11,000 branches nationwide, these financial institutions collectively hold over two trillion Birr in deposits, a significant landmark for the banking industry. Governor Mamo underscored that the central bank is actively working on reforms to enhance the financial sector. He also urged the banks to prepare for active participation in the impending capital market. He emphasised the need for robust corporate governance, risk management, and prudent measures against liquidity crises.

PUBLISHED ON

May 27,2023 [ VOL

24 , NO

1204]

Fortune News | May 27,2023

Radar |

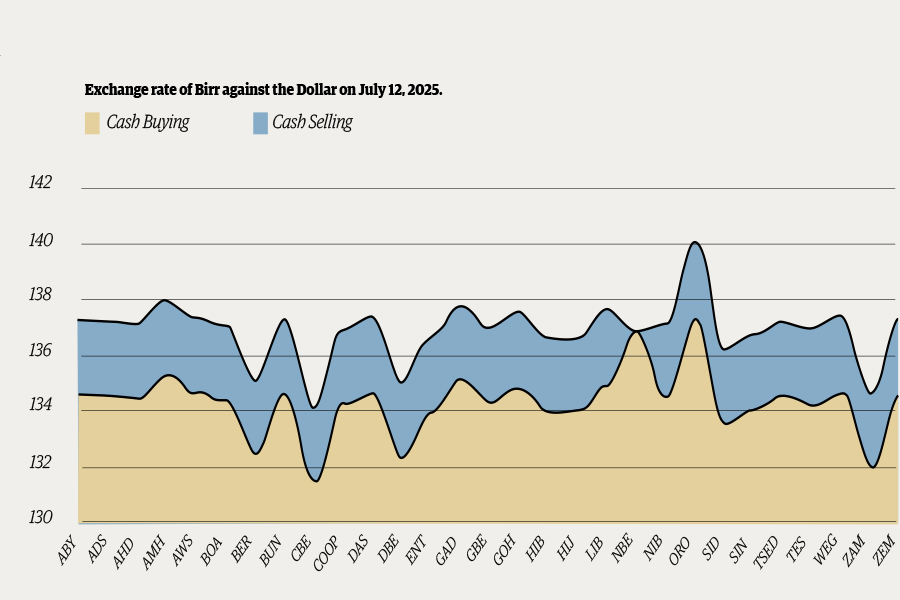

Money Market Watch | Jul 13,2025

Radar | Oct 12,2024

Fortune News | Aug 17,2025

View From Arada | Jun 04,2022

In-Picture | Mar 16,2024

View From Arada | Feb 03,2024

Commentaries | Jan 16,2021

Agenda | Oct 12,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...