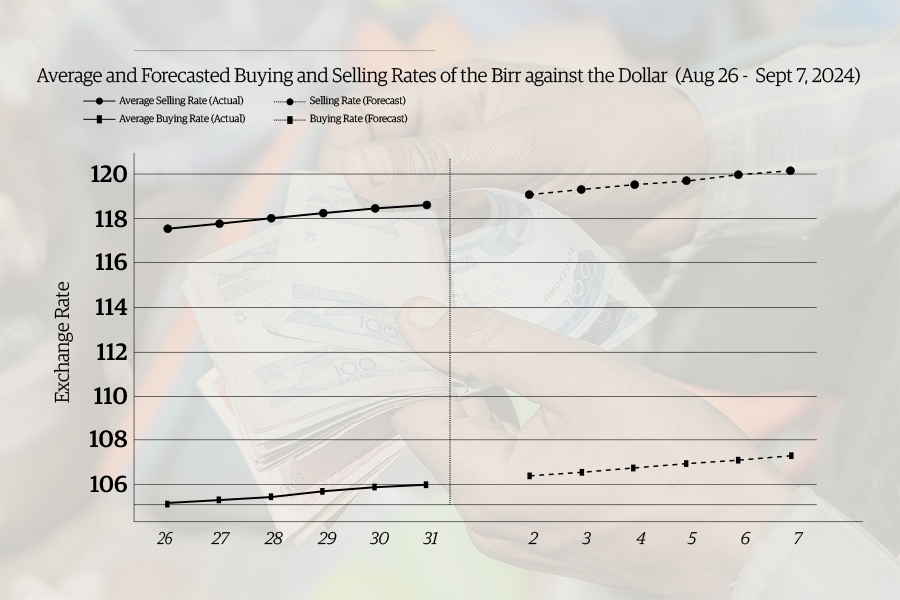

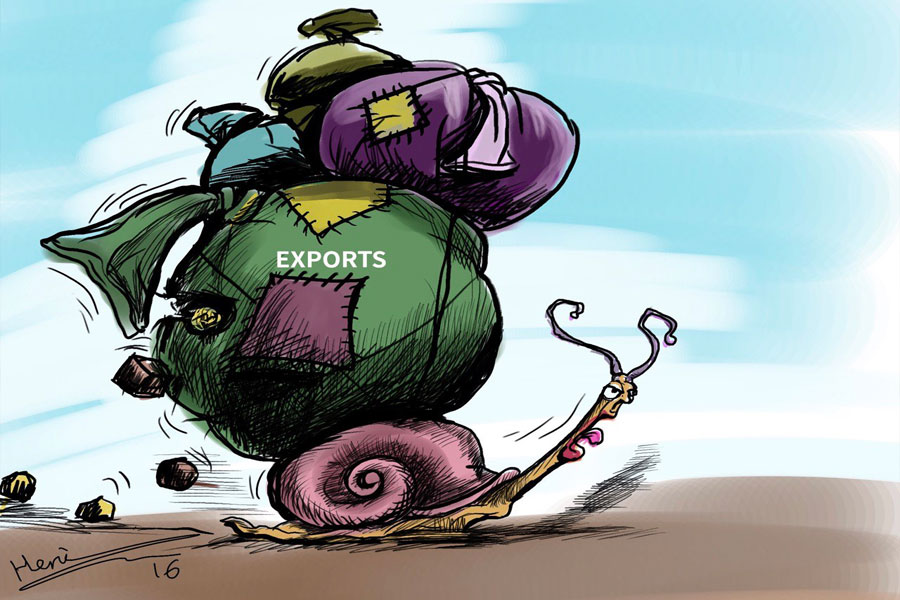

Money Market Watch | Sep 01,2024

Jun 15 , 2024.

The Central Bank has tabled a draft banking proclamation to commercial bank executives, signalling the onset of reform its Governor, Mamo Mehiretu, has been promising since his appointment last year. Concurrently, the Ethiopian Investment Board has approved a directive allowing foreign nationals to engage in retail, export, import, and wholesale business activities. Prime Minister Abiy Ahmed (PhD) has also hinted that foreign ownership of immovable assets, such as property, might soon be permitted.

Policymakers anticipate that these measures will stimulate competition, attract foreign investments, introduce new products, and - most desperately - boost foreign exchange reserves. However, the path to liberalisation is a tough road ahead.

Worries about the National Bank of Ethiopia's (NBE) regulatory capacity are understandable, if unsurprising, echoing sentiments expressed by the late Prime Minister Meles Zenawi over a decade ago. At a World Economic Forum meeting in Addis Abeba, Meles acknowledged Ethiopia's limited capacity to oversee foreign banks. Despite recognising their potential benefits, he questioned how his administration could have regulated products it barely understood. The core issue of regulatory capacity remains relevant even as global finance has evolved since then.

Prime Minister Abiy has often criticised the banking industry for contributing to a robust parallel exchange market, high concentration of credit, and slow technological adoption. In his first year, Governor Mamo has embarked on ambitious monetary policy reforms targeting single-digit inflation and stabilising prices. He boldly plans to reestablish the central bank, digitise the financial sector, and shift towards open market operations.

However, these initiatives require substantial resolve and do not address the regulator's chronic lack of human capital and historical and cultural opacity.

The central bank's passivity when only 10 borrowers consumed nearly 23.5pc of the total 1.9 trillion Br in loans and advances should be concerning.

How can such a feeble institution regulate vastly more sophisticated foreign financial entities?

Nonetheless, the apprehensions about regulatory capacity extend beyond the financial sector. Liberalising the import, export, and wholesale sectors will introduce new regulatory complexities for the ministries of Trade, Industry, and Revenues, as well as the Investment Commission.

The tax administration, often criticised for its one-size-fits-all approach across industries, lack of flexibility, and human capital, will have to evolve to deal with foreign businesses' entry. The same practices that saw the tax-to-GDP ratio fall from nearly 13pc a decade ago to around seven percent last year would not suffice in a rapidly reforming economy. Without upgrades toward transparency, predictability, and certainty in tax administration, the "right" type of foreign investor is unlikely to come.

State regulation often depends on regulatory agents' and bureaucrats' capabilities and integrity. A joint study by Hossein Jalilian, Colin Kirkpatrick, and David Parker of UK universities has established the profound impact of state regulation on economic growth. However, they warned that limitations posed by the state's agents — those responsible for designing, implementing, and enforcing rules — could dramatically influence the outcome, often undermining the very goals that regulations want to achieve.

State regulations are supposed to address market failures, protect consumers, ensure fair competition, and promote an enabling environment for economic growth. Effective regulation can prevent monopolistic practices, reduce information asymmetries, and contain negative externalities such as pollution. If done well, regulation enhances market efficiency, protects public interests, and supports long-term economic stability. However, the practical enforcement of state regulation is deterred by the limitations of the capability and capacity of the state's agents. These limitations derive from inadequate training, lack of resources, corruption, and political interference.

Corruption is a critical issue that severely limits the effectiveness of state regulation. When regulatory agents prioritise personal gain over public interest, regulatory capture occurs. This happens when regulated entities exert undue influence over regulators, resulting in policies favouring a few powerful players at the expense of the broader economy. This leads to monopolistic practices, reduced competition, and increased consumer prices. In extreme cases, corruption within regulatory agencies can lead to a complete erosion of trust in public institutions, undermining the legitimacy of the regulatory body itself.

A recent study by two agricultural economists from Wolayita Sodo University, Tarekegn Tadewos and Berhanu Kuma, extensively explored the relationship between corruption, regulatory burden, and economic growth. Covering Ethiopia's economic performance over 25 years, beginning in 1996, the study revealed a persistent negative correlation between corruption and real GDP per capita, establishing that pervasive corruption impedes economic growth. The study shows that a one percent increase in corruption can lead to a 10pc reduction in real GDP per capita.

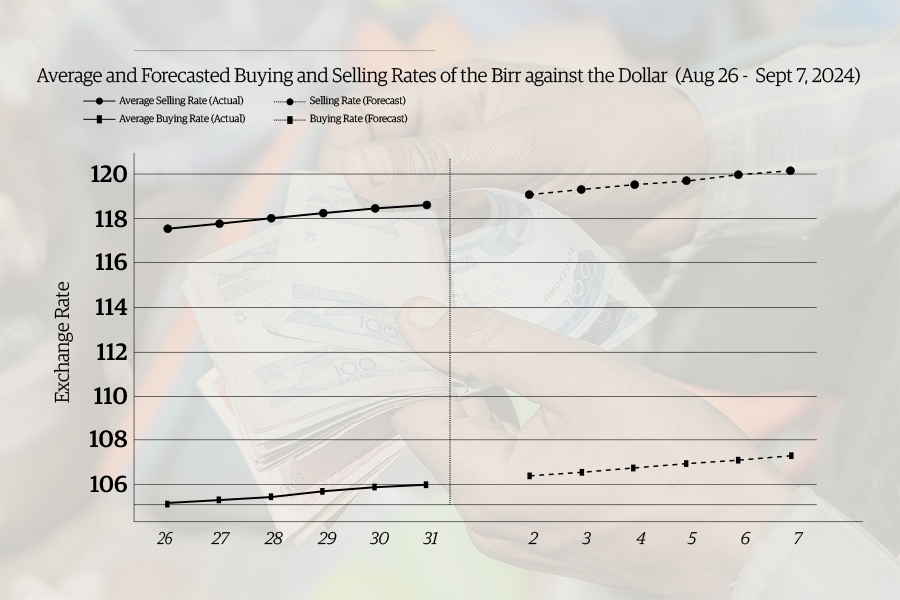

Corruption distorts public investment, leading to inefficient resource allocation, particularly in critical sectors such as education and infrastructure. Public spending on education, which ideally bolsters human capital and future growth, is undermined by corrupt practices, resulting in lower educational outcomes and productivity.

The regulatory burden deepens the negative effects of corruption. Businesses face bureaucratic hurdles, often resorting to bribery to overcome the complex regulatory ecosystem. This increases the cost of doing business and discourages domestic and foreign investment. According to Wolayita's University Duo's study, gross fixed capital formation, a crucial indicator of investment in an economy, is negatively affected by corruption. With a correlation coefficient of -0.46, their data shows that higher levels of corruption lead to reduced investment, stifling economic growth.

Ethiopia's rank of 87 out of 180 on the Corruption Perceptions Index in 2021, with a score of 39 out of 100, reflects its struggles with corruption. The need for comprehensive anti-corruption measures and regulatory reforms is clear. Reducing corruption and streamlining regulations could improve the economic environment, attract foreign investments, and drive sustainable growth.

Changes in political leadership lead to abrupt shifts in regulatory priorities, causing instability and reducing market participants' confidence. Ethiopia's recent episode illustrates this reality. Achieving political stability through negotiated settlements with rebel groups and the insurgencies battling Prime Minister Abiy's administration across teh country is no less critical to stabilising the country.

Regulatory agencies are often not fully autonomous from their political bosses and are subject to their pressures. Politicians may interfere in regulatory processes to serve their interests or those of their cronies rather than the public interest. The outcome is an inconsistent and unpredictable regulatory environment, creating uncertainty for businesses and investors.

The quality of regulatory institutions is crucial in determining how well regulations are implemented and enforced. Ethiopia is one of the developing countries where the institutional capacity to enforce regulation is weak. This is compounded by shortcomings in legislation, a lack of clear mandates for regulatory agencies, and poor coordination among different regulatory bodies. These institutional weaknesses lead to fragmented and inconsistent regulatory practices, further complicating the regulatory environment for businesses.

Rapid technological advancements and new business models often outpace existing regulatory frameworks. Regulatory agencies are pressured to continuously adapt and update their policies to keep pace with the changes, requiring investment in expertise and resources. For instance, the rise of digital economies and fintech has introduced new regulatory headaches for Governor Mamo and his staff, which their traditional policy tools are ill-equipped to handle. Failure to adapt can result in regulatory gaps that leave markets and consumers vulnerable to new risks.

These limitations are evident in the context of privatisation and economic liberalisation. Inadequate regulatory oversight can lead to adverse outcomes, where privatised companies since the late 1990s have been poorly regulated, resulting in reduced service quality, increased prices, and even financial instability.

However, there are ways to address the limitations of state regulatory agents and enhance the effectiveness of regulation. Strengthening the institutional capacity of regulatory bodies is one approach, providing adequate funding, training, and resources to ensure they can carry out their functions effectively. Promoting transparency and accountability within regulatory agencies can help reduce corruption and increase public trust. Implementing rigorous anti-corruption measures and ensuring that regulatory processes are transparent and inclusive can improve the credibility and legitimacy of regulators.

A comprehensive shift in working culture across the regulatory apparatus will be crucial as Ethiopia dissolves its protectionist mindset. The fruits of liberalisation can only be realised with a capable state apparatus, a reliable legal scaffolding, and massive investments in human capital. As the country opens the window for foreign capital, it would be wise to reflect on and address the intricacies of its bureaucratic maze.

PUBLISHED ON

Jun 15,2024 [ VOL

25 , NO

1259]

Money Market Watch | Sep 01,2024

Radar | Feb 22,2020

Editorial | Sep 14,2024

Commentaries | Jan 03,2021

Commentaries | Nov 23,2024

My Opinion | Oct 21,2023

My Opinion | Sep 14,2024

Editorial | Sep 23,2023

Radar | Dec 08,2024

Viewpoints | Nov 23,2024

Photo Gallery | 179421 Views | May 06,2019

Photo Gallery | 169617 Views | Apr 26,2019

Photo Gallery | 160532 Views | Oct 06,2021

My Opinion | 137177 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...