Radar | Dec 04,2022

Wegagen Bank, one of the 16 private commercial banks, has become the third bank, along with Awash and Dashen banks, to pass the one billion Birr mark in gross profits reported in its filings for the last fiscal year.

Its net profit increased by 53pc to 793.5 million Br, and its earnings per share of 365 Br surpass the industry average by 31pc.

The new strategy the bank implemented, branch expansion and resource mobilization, are the major factors attributed to the bank’s positive performance, according to Araya G. Egziabher, president of the Bank.

“We have been implementing a performance evaluation system for the past three years,” Araya told Fortune.

Wegagen Bank underwent a restructuring program that introduced a competency-based human resource framework three years ago.

Shareholders welcome the performance of the bank.

“The bank has performed well,” said Thomas G. Mariam, one of the 3,198 shareholders of the Bank. “I’m delighted with my returns.”

The Bank also performed well in financial intermediation. The income from loans, the National Bank of Ethiopia's bonds and bills, and other deposits reached 2.1 billion Br. When compared with its prior year performance, it showed a 57pc increase.

Wegagen earned a little less than one billion Birr from forex, service charges and commissions.

“We have been endeavoring to increase remittances and empower the export sector,” Araya said.

The increase in income came with a surge in expenses.

The interest paid to savings soared by 61.1pc to three-quarters of a billion Birr. Last fiscal year, Wegagen mobilised deposits of 20.06 billion Br, which it paid at least seven percent interest on. The salary and benefits expenses of the bank have also expanded. It spent 677 million Br for its 4,163 employees with adjusted salaries and benefits.

“To retain our staff, we have increased the benefits and salary,” said Araya.

Wegagen also opened an additional 64 branches in the past fiscal year which increased the administration cost.

The Bank was able to disburse roughly 74pc of its 20 billion Br in deposits and gained a loan-to-deposits ratio above the industry average of 67pc.

The provision for doubtful loans, advances and other assets reached 88.7 million Br.

“The level of doubtful debts is a bit concerning,” said Abdulmenan Ahmed, a financial expert, after analysis of the Bank's financial statements.

Total assets of Wegagen expanded significantly, reaching 27.39 billion Br.

“Wegagen did an impressive job in expanding its loan and deposit books,” Abdulmenan said.

The Bank recorded profits of 365 Br per share on the report and disbursed 153 Br per share to its shareholders.

However, some shareholders have questioned the authenticity of the vast difference between the earnings per share and the distributed dividend amount.

Abdulmenan says this is a usual trend in Ethiopia's banking sector.

“The entire earnings can't be distributed as there are reserves to be kept aside,” Abdulmenan said.

The banking industry keeps in reserve up to 75pc of the earnings before disbursing the dividend.

While distributing 42pc of the total profit, the company increased its investment in National Bank bonds to 6.4 billion Br. Looking at the investment account, the relationship accounts for 23.3pc of total assets. Compared with the industry average, a considerable chunk of the deposits is going to NBE bills.

Also in the last fiscal year, the Bank inaugurated its multi-storey headquarters, which cost a total of nearly a billion Birr. The Bank also started building a new data centre.

“We will continue investing in technology,” Araya said.

“This must have been due to the high level of the loan-to-deposits ratio,” argued Abdulmenan.

Despite the seed to the central bank, the liquidity of the Bank has improved slightly in value but declined in relative terms. Bank liquidity reached four billion Birr, yet the liquidity-to-assets ratio dropped to 14.8pc, declining four percentage points.

“Wegagen should take extra care against further reduction,” Abdulmenan suggested.

Established in 1997 with 16 shareholders and a paid up capital of 30 million Br, the bank now has 277 branches and operates with 2.3 billion Br in capital.

PUBLISHED ON

Dec 10,2018 [ VOL

19 , NO

972]

Radar | Dec 04,2022

Fortune News | Feb 13,2021

Radar | Oct 05,2019

Sunday with Eden | Sep 28,2019

Fortune News | Jan 25,2020

Fortune News | Dec 27,2018

Radar | Jul 13,2024

Fortune News | Feb 29,2020

Radar | Nov 20,2023

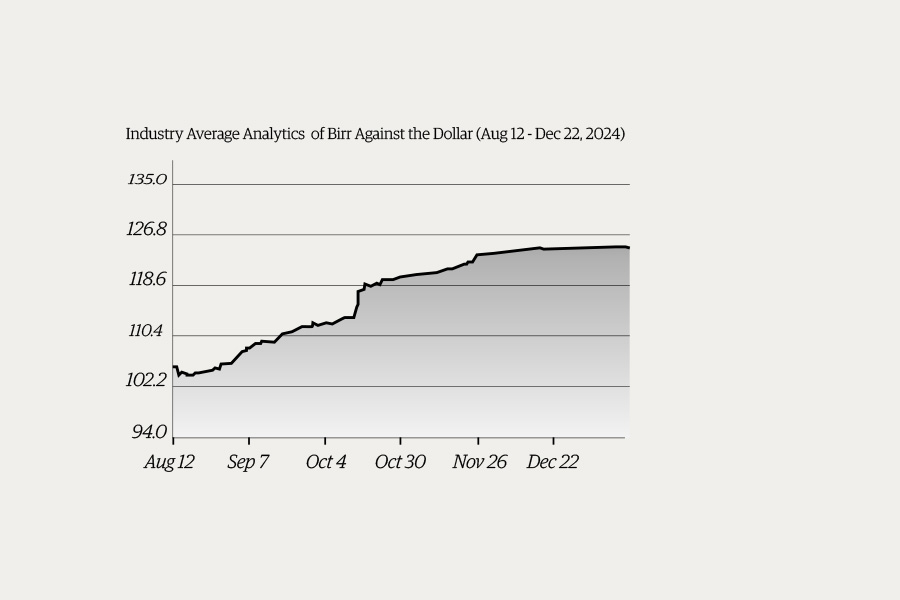

Money Market Watch | Jan 19,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...