Fortune News | Nov 03,2024

Jun 17 , 2023

By MUNIR SHEMSU ( FORTUNE STAFF WRITER )

A reform that excludes founding shareholders from additional revenues aside from their due dividends is underway, with a bill that governs the formation, management and dissolution of share companies put forth by the Ministry of Trade & Regional Integration (MOTRI).

Incorporating as a private shareholding company entails a founding member size not to exceed 50, where they will be spared from scrutiny by an auditor when they finish formation.

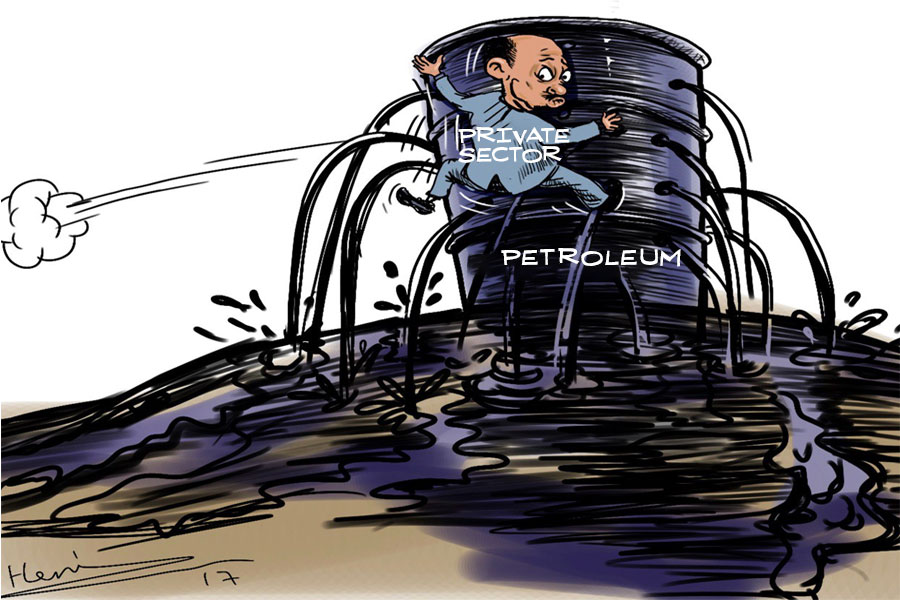

Inconsistency of laws regarding share companies has hindered their development and wider acceptance in the country, with officials hoping that the new wave of policies and directives will counteract the underdeveloped private sector scratching at liberalization.

Jirata Nemera, head of licensing at the Ministry, is part of the committee behind the bill. He prefers not to comment on the draft as consultations are still ongoing with stakeholders.

In a bid to bolster the implementation of the commercial proclamation ratified two years ago, a distinction between share companies that are formed with founders' contributions (private share company) and those founded with the intention of collecting capital through issuing shares (public share company) is laid out by the new directive.

The bill prohibits claims of investment return, profit margins and payback period during advertisements. Companies are obligated to develop websites within six months of the formation, while a cap is put on administrative costs not to exceed five percent of the total incorporation capital.

Yehualashet Tamiru, a corporate lawyer, suggested that the draft directive is necessary to update the governance of share companies in Ethiopia. He highlighted how marketing the value of share companies implies that lucrative returns are looming before the business even makes a profit, leading to exaggerated promises and speculation.

"This is a common yet unethical practice," he told Fortune.

The legal expert underscored that regulation into share premium prices has been a long time coming. He cited instances in which several founding members have managed to squeeze out share premium prices into their pockets, meaning the difference between par values and market values and leaving shareholders hanging.

All share prices below 100 Br will need to update their price to meet the mark within two years. In-kind contributions such as land, vehicles or intellectual property during formation are required to be backed by proof of ownership while internal rules and guidelines formed before the ratification of the commercial proclamation two years ago will continue to be binding.

Yehualashet noted that the prohibition on raising capital by revising the book value of properties years after construction, which might amount to zero after depreciation, will result in an over-representation of the actual capital.

"This is done to maximize deductibles while feigning lofty assets to shareholders," he told Fortune.

Ethiopia's commercial code saw its first revision after six decades a mere two years ago, with the Ministry drafting several directives to implement the new code in the past few months. The Agricultural & Commercial Development Company of Ethiopia was the first share company in the country established by Emperor Menelik's proclamation; the Law of Companies was formulated in 1933 to govern these entities, while the Italian invasion hindered formalization.

Data from the World Bank indicates that close to 40 thousand new businesses register annually in Ethiopia with a disclosure index of three out of 10. The later scale reflects the degree to which businesses reveal their inner workings and structure to the authorities.

Abebe Dinku (Prof) is a board member of several large companies, including Zemen Bank S.C. He sees the need for upgrading the shareholding policy framework of the country, expecting similar reforms, such as a revision to appoint a company's board member underway.

He recalls that several companies have peddled false promises and illusions in the past, applauding the pending prohibition of advertising investment returns when selling shares. He reflected on the experience of Hiber Sugar S.C., an embattled corporation that became a chasm for the hopes and funds of its 5,500 shareholders after having raised 81 million Br in equity.

"There are always random, unpredictable variables in any market," said Abebe concurring with the draft that emphasises promises should be made only after production begins.

Abebe noted how the revaluation of assets in a bid to raise capital favours the larger banks as they have already constructed giant headquarters, which have market values much higher than their construction costs.

"If it is not permanent, it favours competition," he said.

Secretary of the Ethiopian Chamber of Commerce and Sectorial Association Wube Mengistu disclosed to Fortune that a public consultation on elements of the draft directive will be held in the coming few weeks.

PUBLISHED ON

Jun 17,2023 [ VOL

24 , NO

1207]

Fortune News | Nov 03,2024

Fortune News | Mar 06,2021

Verbatim | Dec 04,2021

Covid-19 | Jan 31,2021

Radar | Apr 01,2024

Fortune News | Mar 16,2024

Fortune News | Feb 12,2022

Editorial | Dec 07,2024

Fortune News | Apr 03,2023

Viewpoints | Sep 14,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...