Fortune News | Jun 10,2023

United Insurance, which celebrated its silver jubilee, amassed 124.3 million Br in net profit last year, a 17pc rise from the previous year. The firm was also able to reverse the profit decline course it faced two years ago, when its profit soured by 14pc.

Even though the firm's profit grew considerably, the earnings per share (EPS) shrank to 299 Br. Shareholder return has fallen considerably in the past two years. Last fiscal year's EPS for its 487 shareholders was just 59pc of the 2018 figure.

This must be disappointing news to shareholders, according to Abdulmenan Mohammed, a financial statement analysis with two decades of experience.

Meseret Bezabih, CEO of United, attributes an injection of fresh capital and last year's seasonal expenses as causes for the rise in spending that led to the drop in EPS.

Last year, United spent close to 12 million Br to celebrate its 25th year in business, inaugurate its new headquarters, and support an effort to offset the impact of the Novel Coronavirus (COVID-19) pandemic.

"We used the celebrations as a promotion to build the image of the company," she said. "And all of them are one-time investments."

Mulualem Berhane, the chairperson of United, mentioned that last year was challenging for the firm due to the slowing economy, political instability and the outbreak of the pandemic.

"These were some of the key challenges that had adversely impacted our performance," he said. "Despite the challenges, the firm attained most of the plans set for the year."

United did well in both the insurance business and investment activities. Interest on savings increased by 19pc to 54.9 million Br, dividend income went up by 14pc to 22.7 million Br, and rental income rose by 99pc to 34.3 million Br. Commissions earned from reinsurers also jumped by 42pc to 46.7 million Br.

The total gross written premiums stood at 597.4 million Br, an increase of 12pc. Out of the total gross written premiums, 76pc was retained, a one percentage point drop.

Meseret attributes the new Political Violence & Terrorism Insurance Policy, which require the firm to cede more to reinsurers, as one of the reasons for a retention rate reduction.

"We also sold big insurance policies that require us to reinsure them," she told Fortune.

The reduction in retention rate was followed by slower growth in net claims paid and provided for. Net claims increased by six percent to 240.6 million Br.

"This may have been due to good risk management," commented Abdulmenan.

Direct underwriting expenses of the firm soared by 44pc to 36.1 million Br, while expenses on employees and general administration rose by 29pc to 176.6 million Br.

Rising expenses were directly related to last year's non-recurring items, according to Meseret, who added that the company has been devising mechanisms to control expenses. She explained that the firm cut expenses on branch expansion by switching to online services for policy renewals and the sale of some new policies such as life insurance.

Last year, United opened just one branch, pushing its total physical presence to 51, including contact offices operating with 428 employees.

The total assets of United increased by a modest rate of seven percent to 1.6 billion Br. Out of this balance, a considerable amount of money, 55pc, was kept in income-generating investments. United invested 464.5 million Br in time deposits, 280.6 million Br in investment property, and 157.6 million Br in shares.

United’s liquidity ratio improved in value and relative terms. Its cash and cash equivalents increased by 30pc to 43.7 million Br, while the ratio of cash and bank balances to total assets increased to three percent from 2.3pc. Despite the increase, United was operating under tight liquidity.

United should be careful when working with such tight liquid resources, according to Abdulmenan.

The paid-up capital of United increased by 16pc to 436.2 million Br. Its capital and non-distributable reserves reached 517.2 million Br. The capital and non-distributable reserves represent 31.8pc of its total assets.

Asnake Sisay, a former employee of United for nine years and a shareholder for the past 11 years, is quite satisfied with the firm's performance.

He joined the company as a shareholder by buying 10 shares after the management had approached the employees to invest their provident fund in the firm's shares. Now the number of his shares has grown to 52 without adding any new investment but instead following the recapitalisation policies of the firm.

Asnake saw the company survive through ups and downs. When he was hired as a credit collection officer in 2004, the company had declared four million Birr in losses. Back then insurance policies had been sold on a credit basis, leading the company to incur losses and triggering the board of directors to hire credit collection officers such as Asnake to collect 32 million Br in outstanding balances.

The company rebounded quickly, according to Asnake, who climbed through multiple promotions and finally was appointed as a branch manager before he departed to join Abay Insurance a decade ago.

Asnake says the insurance industry is characterised by unpredictability and is dependent on special situations.

"Even though there are issues related to some individuals," said Asnake, "it has a great company culture and is good to its employees."

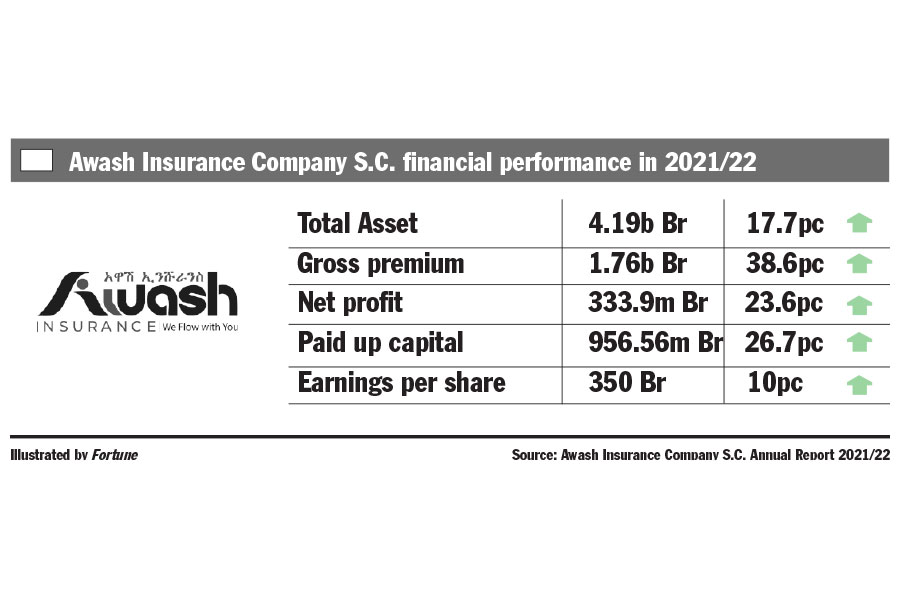

United's nearest competitor, Awash Insurance, has managed to boost its net profit by 31pc to 209.8 million Br during the past fiscal year. It also shored up its paid-up capital by 24pc to 528.6 million Br.

After COVID-19 arrived in the country, the company's business was affected since the sale of some insurance policies such as travel and life insurance have fully stopped, according to Meseret, who says the stage of recovery has started recently.

"We don't expect much growth in the current fiscal year," she said. "But we aim at maintaining our current strong position."

PUBLISHED ON

Nov 14,2020 [ VOL

21 , NO

1072]

Fortune News | Jun 10,2023

Fortune News | Mar 09,2019

Radar | Oct 28,2023

Radar | Oct 05,2019

Radar | Dec 04,2022

Fortune News | Oct 21,2023

Radar | Feb 09,2019

Fortune News | Nov 21,2020

Radar | Dec 25,2021

Fortune News | Aug 21,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...