Viewpoints | May 27,2023

Some nine years ago, Mahmud Nursacan, a Turkish textile dealer with almost three decades in the industry, was invited by a friend to visit Ethiopia. Fatih Mehmet Yangin was his friend in charge of managing SAYGIN DIMA Textile S.C. in Ethiopia, a textile firm established in a joint venture arrangement between a Turkish company and the government of Ethiopia. The latter had a 60pc equity share in the venture.

SAYGIN DIMA, considered one of the landmark foreign direct investments in Ethiopia at the time, was established in 2009 with a capital of 78.5 million dollars. Two years later, the plant`s inauguration ceremony near the town of Sebeta, in the western outskirts of Addis Abeba, was attended by the late Prime Minister, Meles Zenawi, in considerable media fanfare.

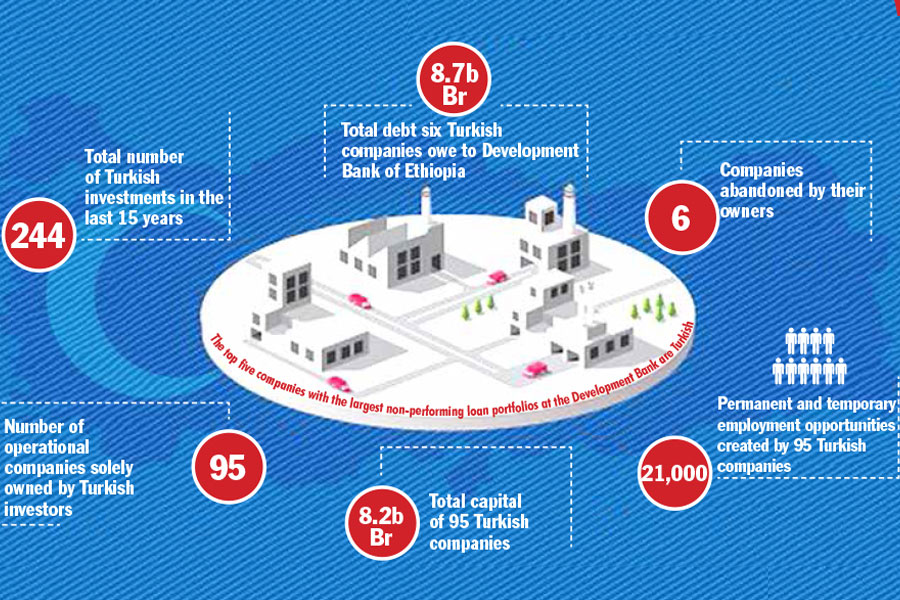

It was the former prime minister visit to Turkey in 2007 that stirred interest in Turkish companies to start the investment Hijira to Ethiopia. No less than 244 companies from Turkey registered their businesses in Ethiopia over the past 15 years.

Mahmud was one of several Turkish businesses briefed by Ethiopia`s delegates in those years; after his first visit to the country seven years ago he joined Milkay Tekstile Sanayi A.S, a Turkish textile company, and launched MNS Manufacturing Plc with an investment of 50 million dollars. It is a modern textile plant erected in Legetafo, in Oromia Regional State, 19Km east of Addis Abeba.

Of the projected investment, the founders secured 60pc of the financing with an 8.5pc interest-bearing loan from the state policy bank, the Development Bank of Ethiopia (DBE). Over the past four years, MNS produces international standard towels, yarn, carpet and fabrics.

MNS`s plant is more than an imposing sight to the area. It helped stimulate a once sleepy town`s economy, hiring 1,400 people, mostly locals, to operate in three shifts under three production lines. They also represent about five percent of the people employed by companies whose origin is Turkey. Of the 167 registered with the federal government, some have invested in joint ventures with local companies and individuals, others partnered with the government, while many more operated solo as foreign investors.

About 95 Turkish companies are operational now, with a total aggregate capital of 8.2 billion Br, showing how much direct investment from Turkey came to Ethiopia in just a decade. But Turkish investment in Ethiopia is not new. Neither is its diplomatic relations. Turkey`s first mission in Africa was opened in Ethiopia in 1912, even when it was the core of the Ottoman Empire.

Recently though, Narin Orme Textile Group, a private Turkish company, began operating in Hawassa and Arbaminch, under a managment lease agreement. However, the deal was not renewed as the Turkish company faced problems with the government.

When it reemerged a decade ago, Turkish investment came due mainly to a designed, targeted and active recruitment by Ethiopian authorities. But nothing parallels the persistent effort by Mulatu Teshome (PhD), a former president who was Ethiopia’s long-serving ambassador to Turkey for seven years, beginning from 2006.

In 2008, the late prime minister attended the Turkey-Africa Summit held in Istanbul, where he was a co-chair when cooperation was cemented between the two countries, whose first formal encounter was in 1896. In the three years beginning in 2011, various Turkish companies, including industry giants like Ayka Addis, Oyap Ethio Industry & Trading, Saygin Dima, BMET Cables and MNS Textile, were launched and became operational.

It was a time of high hopes and grand ambitions.

“When we started operations four years ago, we had big hopes,” Mahmud recalls.

Fatih Tazecloglu, deputy general manager of BMET.

His company with three plants rested on a 100,000Sqm plot, had a production capacity of manufacturing 10tn of yarn and 200,000m of poly-cotton yarn a month. It is a far cry from the 15pc and 30pc of production of carpet and yarn, respectively, today. He attributed a shortage of quality cotton supply, a lack of forex to import raw materials, and higher interest rates from the DBE as bottlenecks constraining the company`s hopes to thrive.

Three years ago, DBE revised interest rates from 8.5pc to 12pc, claiming that the rise will encourage companies to focus on exports. It was a deliberate policy decision to support companies which export 80pc of their products, with a lower 9.5pc interest rate loan provision.

To Mahmud`s disappointment, MNS, with an export record of less than 10 million dollars year, was not considered as an export company, for much of its products are supplied to the local market.

“Due to the challenges we face, we couldn’t export 80pc of the value,” Mahmud admits. “If we were to get a reliable supply of raw materials - mainly cotton - we could have operated efficiently and exported more of our products.”

It was 17 million dollars the company had earned in export revenues ever since it began production four years ago. One of the days a couple of weeks ago, MNS`s storage for raw cotton was empty, leaving the newly installed ginnery line idle.

Mahmud is now contemplating to close the carpet manufacturing plant, after MNS was compelled to pay a 30pc excise tax on the product. Initially, the company`s managment was not aware of the tax until the authorities demanded 65 million Br in outstanding tax bills and fines.

“We assumed that the excise tax was waived for all textile products, including carpet,” Mahmud said.

Constrained by lack of input supply and unable to access foreign exchange to import from abroad, and subjected to an unanticipated levies by the authorities, the company run into financial difficulties. It is unable to service the principal loan of 700 million Br owed to the Development Bank. The managment has placed its request for rescheduling of its debt, which the Bank agreed to, at least twice.

MSN paid 265 million Br in interest to date, an amount that has not kept it off the list of non-performing loans (NPLs) in the Bank`s portfolio. This makes it one of the top five Turkish companies that have the highest amounts in sick loans at the Development Bank, along with Kumtek Industrial, Etur Textile, Ayka Addis and B-MET Energy, the latter a modern plant found near Sebeta town, in the eastern outskirts of Addis Abeba, producing communications and high powered electric cables.

The five companies, along with another Turkish company, owe the Bank an aggregate of 8.7 billion Br in non-performing loans, claiming two-thirds of the 40pc NPL the DBE has in its books today. Of the 39.1 billion Br the DBE extended as loans to public and private borrowers, up until 2017/18, Turkish companies have no less than 20pc shares of these loans, earning the bank a cynical name in the private sector as, “the Development Bank of Turkey.”

Its perceived favouritism to Turkish companies did not stop DBE`s managment from taking over three of these companies - Ayka Addis, Angles Textile and Else Addis, due to failure in servicing their debts. In another related episode, SelenDawa Textile Factory and Saygen Dima Textile, which factored in Mahmud’s investment venture into Ethiopia, were also repossessed by the state-owned Commercial Bank of Ethiopia (CBE), for failing to pay their loans back.

For those following development in these investments, what resulted was of little surprise. They see many of these companies as over-indebted and over-financed. The evidence of these is the lack of interest among buyers when the banks tried to foreclose them.

Ayka Addis, Oyap Ethio Industry & Trading.

“No one has shown any interest to acquire them when put up on the auction block,” said a person working at the DBE, and following the case closely.

Even those that are still operational are struggling to survive. BMET Energy, Telecom Industry & Trade Plc is one of these few, braving the odds as MNS struggles to beat.

The company entered the Ethiopian market in 2011 with an investment of 150 million dollars, and it was operationalised two years later, producing fibre and data cables. Unlike MNS, the plant was vandalised by a mob in 2016, at the pick of public unrest that occurred across the country. A couple of its senior managers, who were Turkish nationals who were brutally attacked, while the General Manager`s life was spared, according to someone who witnessed the scene at the time.

BMET lost property valued at 100 million Br, according to Fatih Tazecloglu, deputy general manager of the company, which hired 720 employees. It was also subjected to a 45 million Br fine from Ethio telecom after it failed to deliver upon contract, due to the attack.

BMET is currently operating at a 15pc to 20pc capacity as a result of raw material shortages, mainly copper, an item that needs to be imported. BMET is another company that faced a decapacitating challenges of not having access to forex to open letters of credit (LC) for imports of inputs, although it has generated one billion Birr in revenues over the last few years of its operations. But in the same pattern with MNS, it too has only managed to record a five percent of that revenue from exports.

The automated scene inside the two plants inside a 115,000sqm plot was in sharp contrast to several people active at the back of one of these plants peeling recycled cables off to collect the copper inside. It is a modification exercise of the company`s managment, which added new machines that recycle dumped cables collected across the country. But the managers realise that it is a desperate effort they could not depend on for long.

The company has not come here hoping to transform itself into a mining firm. Nonetheless, desperate moments lead to desperate actions. BMET has resorted to a copper mining effort, taking exploration permit from the federal government and searching for the mineral in the Somali Regional State. This too was found to be an haphazard attempt, for the exploration has been terminated after locals in the area threatened the company to leave the area, Fatih told Fortune. BMET`s eyes the north, submitting an application for exploration in the Tigray Regional State, which is pending, according to him.

Despite hurdles and a little creativity in recycling waste cables, the company suffers from finding an industrial use for its market. The two state companies in need of large volume of cables are the Ethio telecom and Ethiopian Power Utilities are instead spending over half a billion dollars in importing cables from outside manufacturers.

“Even after producing our products passing through all these challenges, we don`t get buyers, while the country spends 350 million dollars annually to import cables,” said Fatih.

But the challenges faced by these companies are reflections of the macroeconomic situation of the country, according to Ahmed Kellow (PhD), managing director of First Consult, an investment consultancy firm.

“Any company in the country faces these challenges,” Ahmed said. “But, the Turkish companies are failing as they have an additional internal problem, which is mismanagement.”

This is not a view exclusive to those in the consulting business. Even senior officials in the administration share it. Abebe Abebayehu, a commissioner at the Ethiopian Investment Commission, is one of these.

“Most of the companies have management problems,” he told Fortune. “The country didn’t do well in carrying out proper due diligence, evaluation and conducting feasibility studies when the companies came to the country.”

Such frustration and realisation by the authorities led the Development Bank to make adjustments raising equity contributions of foreign companies to 50pc, raising it from 30pc and banning the import of used machinery.

“Now we have the opportunity of picking and choosing companies that will invest in the country,” Abebe told Fortune.

He admits that companies that operate in the country face challenges as the business and investment environment in the country is not permissive. Ethiopia`s ranking among 190 countries in the World Bank`s doing business index was 159 last year, improving by two from the previous year but far worse than its 104th rank recorded in 2010. In the decade from 2008, its average ranking is on 133rd, exposing that Ethiopia is not an exciting place to do business. Turkish investors are among those who bear witness to this fact.

Painful constraints in the electric power supply, foreign exchange crunch, raw material shortages and inadequate human resources are significant problems they face while trying to make ends meet here.

Yet, Ahmed believes that these challenges faced by the companies could be overcome with proper management.

“The government has to invest whatever amount of resources in bringing skilled management to drag out these companies and learn from the problems they faced,” says Ahmed.

He urges the government to develop competent and firm contracts, as well as strict audits to manage investments.

And Abebe believes his administration is “here to solve problems investors face.” The answer is the massive public investment in the expansions of industrial parks across the country, with pledges to provide what remains unavailable.

“We`re using the industrial parks as a testing ground for a certain type of policy reforms,” he told Fortune. “We`re applying the effects that worked well in that controlled environment.”

Both MSN and BMET are outside of this “controlled environment” to benefit from the state`s policy of proactive support. Nonetheless, their managers` optimism is demonstrated by their effort in finding solutions to overcome the hurdles and commitment in investing more.

MSN is now carrying out a 12 million dollar expansion project to boost the spinning capacity of the company by two-fold. Expected to be operational next September, the new spinning plant will raise the employment base of the company to 2,200.

“By any means, this company has to survive,” says Mahmud, with a sense of determination visible on his face.

PUBLISHED ON

Feb 16,2019 [ VOL

19 , NO

981]

Viewpoints | May 27,2023

My Opinion | Jan 04,2020

Agenda | Dec 04,2022

Fortune News | Nov 12,2022

Fortune News | Feb 16,2019

Editorial | Apr 22,2023

Commentaries | Jul 07,2024

Agenda | May 21,2022

My Opinion | Aug 03,2024

Life Matters | Oct 10,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...