Radar | May 02,2020

Directors and senior managers of the state-owned Commercial Bank of Ethiopia (CBE) mull over the dilemma of forming a subsidiary bank for Sharia banking, people knowledgeable of the bank's transformation strategy disclosed to Fortune.

The Bank has been under reform as part of a transformation and strategic plan launched two years ago following the Board's restructuring, which brought on board Eyob Tesfaye (PhD), now working for the United Nations, and Mamo Mihretu, a senior government official in charge of the Ethiopian Investment Holdings.

Chaired by Teklewold Atnafu, who governed the central bank for nearly two decades, the Board has identified major gaps and recommended that CBE be reformed. The Board established a project office, which floated an international tender. McKinsey & Company was hired to develop a strategic design for 1.7 million dollars, completed in seven months.

The Board has considered establishing a full-fledged Islamic bank, said a person familiar with the subject. However, the consultant recommended keeping the current business model, improving the product base and training staff. The source disclosed that the consultant examined the experiences of countries categorised under highly conservative, hybrid, and liberal interest-free banking (IFB), urging the CBE to follow the hybrid model.

The Bank has formed a Sharia Advisory Committee (SAC), under the chairmanship of Jeylan Khadir (PhD), comprising members of five known Muslim scholars. Jeylan also serves as a chairperson of the Ethiopian Sharia Scholars Council and the African Sharia Scholars League.

Shariah banking was raised to the division level. A Vice President and three directors were assigned, and the organizational structure of the Bank's interest-free banking was redesigned into two directors, 13 managers, and two team leader positions were introduced. The main trigger for CBE reform was the unmatched surge of operational expenses.

"It was on the brink of crisis," said Emebet Melese (PhD), vice president of the project office.

The transformation and strategy plan has transformation, strategic, and implementation phases, each with a project office.

Led by Eyob, the transformation project was concluded last year, and implementation was launched earlier this year. It aims to prepare the Bank for the upcoming changes in the financial sector and make it competitive, financially stable and digitally upgraded. The regulators at the National Bank of Ethiopia (NBE) have been pulling a bill that allows the financial industry to open for foreign banks.

Left to the CBE's management, the implementation has met a snag, according to individuals familiar with the progress.

McKinsey has identified a dozen pillars to make reviews of CBE's operations. Redefining its mandate to domestic and international banking approaches, and from credit and resource structure to risk management are among the pillars. It has provided a five-year strategic map to the Bank.

McKinsey identified five core operational problems the CBE faced in its interest-free banking services: creating well-assessed service models, value propositions, sufficient service products, and technology adoption.

A proposed change to overhaul the interest-free banking division is to provide credit services to clients through the Murahaba financing model, an Islamic financing structure where customers offer the materials they want to buy, and the bank covers the costs. The loan would be repaid within the contract's time, allowing Muslim customers to get credit services.

Amin Abdela (PhD), an economist, has conducted a market analysis on interest-free banking and its economic impact. He sees the absence of a well-designed project model as a gap in the industry. Interest-free banks do not have several options enabling them to generate funds to cover expenses; the industry is unstable. It is highly dependent on the profit and loss sharing scheme, where banks use the deposits for investment and customers share both the profit and loss.

"It's relatively new to the market, still growing," said Amin.

However, precaution and expertise are in high demand.

CBE introduced a full-fledged Sharia branch model dedicated to serving interest-free banking services three years ago. It provides customers with sharia-complaint services at close to 120 branches. However, increasing complaints from existing clients led the Bank's management to reexamine its market position in the face of growing competition from full-fledged interest-free banks.

"Customers began abandoning the Bank," said Nuri Hussein, CBE's vice president for interest-free banking services.

CBE's Noor Tawakal Branch, in Furi area on the outskirts of Addis Abeba, is among the fully-fledged interest-free banking windows with 8,000 clients. The branch provides account services with over eight products, including Amanah, Mudarabah, Haji, Nikah, and Sharia-compliant investments. The investment account is among the services where the Bank uses the deposits to invest in Sharia-compliant businesses and share the profit with the clients. It paid customers 1.9 million Br last year.

The total deposits registered 350 million Br in the last fiscal year.

According to Amin, interest-free banking should be aggressive in investments to survive because it would require no collaterals for crediting customers, and the risk is high. Inflation could be a major challenge.

"People don't deposit as much," said Amin. "Money isn't transacted through the banks."

Hassani Teyeb, 29, is a client of the CBE at the Ayer Tena Branch. The pharmaceuticals importer believes CBE is making "a remarkable move" in improving its services. He asked the Branch Manager two weeks ago about credit services and how it was provided.

"They said there is a budget for it," Hassani told Fortune. "However, customers are not aware."

His company, Nirvana Pharmaceuticals, was incorporated three years ago with a registered capital of 4.5 million Br. It imports drugs and medical supplies from India, China, and Thailand. Hassani prefers accessing credits from CBE through Murabaha, presenting proforma to get credit. The Bank pays for the materials purchases, transportation and duty taxes included.

"The service not being flexible is a limitation," said Hassani.

PUBLISHED ON

Nov 12,2022 [ VOL

23 , NO

1176]

Fortune News | Jan 12,2019

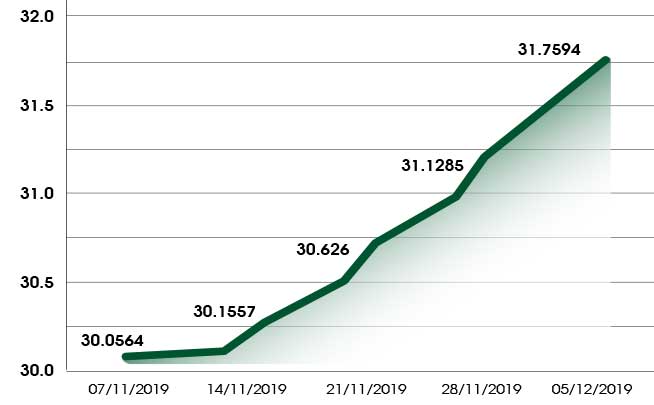

Fortune News | Dec 07,2019

Radar | Dec 21,2019

Fortune News | Jun 10,2023

Radar | Aug 04,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...