Fortune News | Mar 09,2019

At the end of a long workday last week, Yohannes Zenebe wanted to take a shower. He had spent hours lifting cargo at a customs warehouse in Addis Abeba Bole International Airport, employed by a local logistics firm as a porter.

Yohannes was at his parent's house near Menelik II Hospital, where he stops by a few times a week on his way home. His parents share public housing in a compound with nearly a dozen other households. It is one of the heavily subsidised kebele-owned dwellings nationalised after the revolution in the mid-1970s. The families residing there share a tap, depending on its water for washing clothes, cooking, and cleaning. Taking a bath in a standard shower at home is a luxury.

The 11 kebele-owned houses in the compound, each no larger than 40sqm and accommodating two to five occupants, are all made of mud. They represent a defining feature of Addis Abeba for decades as unplanned and informal settlements. None has a room for a shower. Only two communal latrines serve the 40 or so people living there, such as Yohannes' family. This is far from an isolated case for the neighbourhood. A survey Habitat for Humanity conducted estimates that 73pc of Ethiopians do not have access to safe drinking water, and 90pc have no access to sanitation facilities.

Close to 60pc of the 136,330 dwellings in Addis Abeba were dilapidated and needed upgrading or demolishing, finds a study by Sascha Delz, presented to a conference in Zurich in 2016. No less than 34pc of the houses built in the city that prides itself as a diplomatic and political capital of Africa in the seven years from 1996 were informal dwellings, known as Chereka Be't in the local parlance, dotting its outskirts.

Yohannes was born and raised in a dwelling with no separate running water and toilet. He lived his life there through adulthood until he moved out last year after getting married. He and his wife initially found a room they had rented for 4,000 Br a month in the same neighbourhood. Under the kebele administrations, these are informal but legal properties providing shelter to 40pc of the city's population, covering 11pc of Addis Abeba's 54,000hct.

Despite the steep rent, Yohannes thought urban life was manageable. He nets a little over 5,000 Br a month, including gratuity from customers. His wife contributed to their expenses, running a small eatery. However, she took a break from work due to pregnancy. Two months ago, she gave birth to twins.

With little in the way of options to support a family of four with his salary, Yohannes was relieved when his in-laws offered them a room in their home at no cost.

“We surely couldn't afford to live had we kept renting, especially with the two infants at home,” he told Fortune.

Deprived of basic provisions, life remains precarious for millions of residents. Yohannes had high hopes toiling life in a single room would have been over having his enrolment in a state-run housing scheme panned out. He had signed up for the Addis Abeba City Administration’s low-cost housing scheme in 2013, one of 700,000 who had hoped to benefit from the program popularly referred to as "20/80". Beneficiaries make a 20pc downpayment, and the state-owned bank provides loans to pay for the balance in a long term mortgage.

It was a signature policy of the EPRDF government to provide housing to the low-income segment of the city's ever-growing population. The centre-left approach of governance they upheld in the early 2000s led them to believe the housing scheme could help transfer wealth from the expanding middle-class to the low-income group. It was thought the massive projects of erecting 150,000 units in 54 towns would create business for 10,000 micro and small enterprises and jobs for 200,000 people. The scheme was hailed as a "pro-poor" policy for the largest public housing project in sub-Saharan Africa.

It began in the late 1990s after the federal government partnered with the German technical cooperation, GIZ, to experiment with the construction of low-cost dwellings. A pilot project was launched in the Gerji area; the condos there remain a source of envy for many for their better quality in the building materials used and quality construction. It was important enough for the government that Prime Minister Meles Zenawi inaugurated these units in the mid-2000s.

The federal government sought with the Integrated Housing Development Project (IHDP) the provision of land for free and made selected applicants (through raffle) pay for the cost of construction, whose material cost was substantially subsidised by the state. The subsequent years saw the construction of 175,000 units in Addis Abeba scattered all over the city, thereby changing the city's urban character.

Officials had registered around 300,000 people in the first round; another round eight years later brought the figure close to one million. Applicants were given three options - 10/90, 20/80, and 40/60 - based on the downpayment they were expected to make upon signing up. The balance was to be paid off through bank loans in 20 years. The bank takes 7.5pc in interest on the mortgage, half the market rate, but also offer a 5.5pc interest on their savings, 0.5 percentage point above the threshold rate on deposit.

The price of a three-bedroom unit at one of the condos was around 27,000 Br a square metre when the second round kicked off in 2013. In comparison, private real estate firms charge as much as 60,000 Br a square metre for a three-bedroom house at present.

These 14-storey buildings are part of the Saris Abo condominium site. As is evident in the photo, rubble from the construction litters the streets while some of the units seem to be missing window panes.

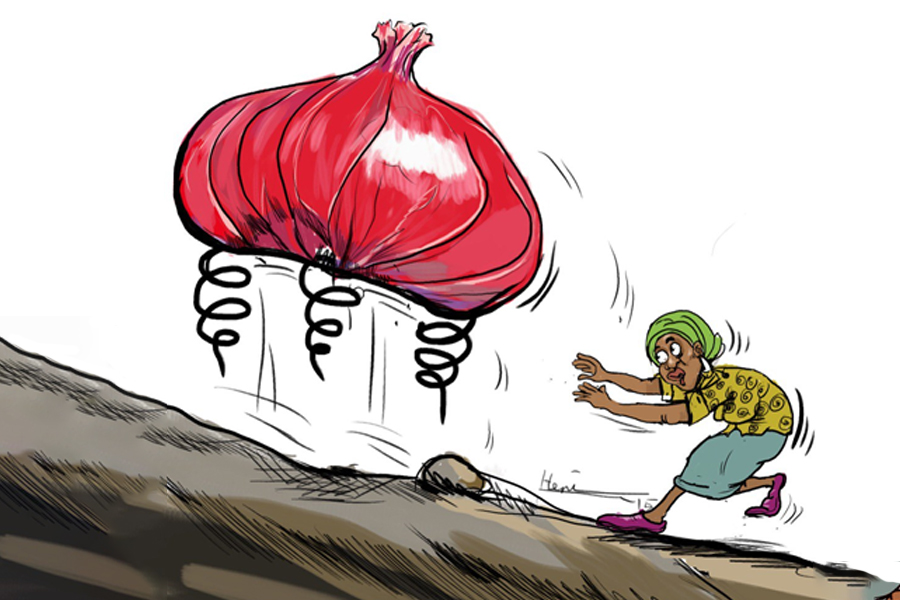

Those who have saved but are unable to get their flats feel trapped. They are in a constant dilemma seeing their savings eaten up by runaway inflation and hope against hope that the city administration eventually would deliver the condos.

Yohannes was one of these who had been saving 300 Br a month in the hopes of landing a two-bedroom condominium unit in seven years, as city officials had promised. Nine years later, there was no sign of this working out. He had to spend most of what he had saved when he got married.

“I’m afraid my kids may go through the same troubles with housing,” he said.

His fears are anything but unfounded. Only a fraction of the registered has moved into these units thus far. The City Administration's housing scheme has been moving at a snail's pace since first introduced in 2006. Construction costs ballooned; hence the price of units skyrocketed from 76,615 Br initially projected.

The Addis Abeba Housing Development & Administration Bureau, under Yasmin Wohabrebbi, a former state minister for Finance, is tasked with constructing the condos and administering them through the Addis Abeba Housing Development Corporation. Budgeted with a 1.9 billion Br this year, the Corporation has over 139,000 units on hand, with 59,000 of them having already been allocated to homeowners. Close to 73pc of these have been handed over, city officials claim.

In the scheme's early days, the Corporation would transfer the units to homeowners upon completing construction. However, financial troubles have led it to hand over unfinished housing. A visit to any inner city’s condominium sites meant for middle-class buyers makes the paralysis obvious.

Hintsa Akirabi, a condominium site in the Gerji area, is one of these projects launched in 2013 under the “Addis Ababa Grand Housing Program”. It was meant to address the overwhelming housing backlog, estimated at 300,000 units, and replace half the kebele houses.

The yellowish buildings in the Gerji area have eight blocs of 14-storey structures in neat rows, comprising over 1,100 units. Last March, they were transferred to homeowners following a raffle held three years ago. There is barely anyone residing there as owners or tenants have yet to move in. The roads that criss-cross the site are littered with rubble from homeowners' attempts to refurbish their units to meet basic standards.

The scene in Ehil Nigid's site around Megenagna, comprising six blocs and 790 units, was no different. Homeowners received keys about the same time their counterparts in Gerji did, but only a few have moved in since. The majority are busy with finishing works to bring the flats to livable conditions. Not far from Ehil Nigid is another site, "Tourist Site." The Bureau has been readying to transfer keys of more than 1,900 units to homeowners. Here too, finishing works remain lacking.

The Corporation's officials concede a dearth in financing has forced them to transfer the units unfinished, leaving homeowners to share the burden. Infrastructure like sanitary and water services, electricity, and roads are incomplete at most sites. The blame for this does not rest on the Corporation's shoulders alone, argues Gashaw Tefera, communications director.

“Its responsibility is to build the units," he told Fortune. "Other agencies are responsible for providing infrastructure such as water and electricity."

Others point fingers at aspiring homeowners' default to make the initial payments following the raffles for the delays and unfinished housing.

“We've seen how big of a disruption drawing the lottery before completing the units has caused,” said Yasmin.

The state-owned Commercial Bank of Ethiopia's (CBE) reluctance to provide financing for the housing scheme brought the delay. When the low-cost housing project was launched 17 years ago, the CBE provided finance for constructing units across the country. Three years ago, it ceased funding for all sites but the capital. Nonetheless, projects in the capital are not receiving adequate financing. The Bureau had planned on receiving loans of over 38 billion Br in corporate bonds this year. Only 3.3 billion Br has been availed thus far, Yasmin disclosed. She has requested an additional 5.4 billion Br to finish the remaining 80,000 units.

The CBE has reasons for its reluctance to provide additional financing, disclosed Muluneh Aboye, vice president of credit management. Several billions of Birr in loans advanced to homeowners have yet to be recovered by the bank, showing badly in its balance sheet. The City Administration owes it 54 billion Br in debt disbursed thus far. These loans are three-year bonds, during which time the units were supposed to have been transferred to the homeowners and repayments begun.

Long delays have meant most of these debts are still outstanding, although the federal government guarantees them.

“The inefficiency affects not only the homeowners but also the Bank,” said Muluneh.

Executives of the Corporation try to ease the financial burden by auctioning off ground floors of the condominium buildings to businesses on lease terms. Last year, 149 shops at eight sites in Addis Abeba were awarded. Debub Global Bank made the highest offer of 151,000 Br a square metre for a shop at the Ehil Nigid site. Over 1,500 shops were up for bids a month ago, but the process was cut short after bidders lodged complaints to the City Administration, alleging corruption.

The Federal Police got involved, and the ensuing investigation led to the arrest of seven committee members in charge of the auction. Under custody for a month, the individuals have since been released and allowed to return to their jobs, though the case remains pending.

The financial constraints have also been tough on the individuals and businesses involved in the construction works. They face a range of problems, including delayed payments and vandalism.

Tariku Yitayal & Friends, an enterprise of five, was formed under the Akaki Qality District four years ago. Its members underwent training for metal works and were provided contracts by the Corporation following commendations from district officials. One of the 159 contractors, they supply doors, windows and rooftops for seven unfinished condominium blocs in Bole Arabsa. In the eastern outskirts of the capital, past the upscale neighbourhood of Ayat, Bole Arabsa is of the largest sites, comprising over 45,000 units, second to the Koye Fitchie site.

Tariku Yitayal & Friends was to be paid around half a million Birr for each bloc, depending on size, to install an average of 128 doors. However, none of the doors installed have had keys, leaving the work incomplete. Less than 10 of the more than 100 unfinished blocs have locks installed. Part of the payment is withheld until the enterprise completes the job, although the Corporation is responsible for providing the locks and keys.

Tariku and his partners have been visiting the Corporation’s head office since last April to collect 700,000 Br in outstanding payments. They have not had any luck thus far.

“We couldn't pay our taxes last year,” said Tariku.

The situation has also encouraged vandalism and theft at the site. Tariku saw two dozen doors were stolen from the blocs he works on. Officials at the Bureau are aware crimes are taking place.

"Some theft is observed at the sites due to the problems with finalising the projects in time," Yasmin confirms.

The troubles can all be traced back to the government's insistence to be the foremost player in the housing scheme from the very beginning, says Imam Mahmoud, chair of the housing department at the Ethiopian Institute of Architecture, Building Construction & City Development. He blames the government's limited capacity to execute massive procurement, supervision, and testing projects at housing development offices.

"The private sector had to be involved heavily," he said. "The government can't provide solutions for problems of such magnitude on its own."

City officials seem to have had similar views when they introduced a new model for affordable housing last year. They called on people willing and able to build housing independently by forming cooperatives, while the City Administration provides land.

“We had to compromise and come up with other plans,” said Yasmin

Over 12,000 people signed up online last year, ready to finance construction with their funds or through bank loans. However, nearly a year passed before any of them received any updates. Last week, the Bureau called on them to report to their respective wereda offices, where the cooperatives would officially be formed.

“Even though a little bit late, some works like identification of sites have been completed,” Yasmin told Fortune.

She declined to disclose the land size to be apportioned and where the constructions would occur.

Imam applauds the initiative to bring individuals into the process but questions the effectiveness of the new model. The scheme requires the registered individuals and cooperatives to cover over half of the total cost in advance.

“This defeats the project's goal in providing housing to those unable to do so on their own,” Imam said. “It was supposed to work for the poor; it doesn’t.”

What comes next in the tumultuous saga of low-cost housing in the capital is almost certainly not going to work, favouring Yohannes and the hundreds of thousands in the low-income group waiting with so much hope. Having lost faith in the scheme, Yohannes plans to build an attic-like residence, known in Amharic as "Qot", atop his parents' house. He believes the government's promise was made never to come.Over 12,000 people signed up online last year, ready to finance construction with their funds or through bank loans. However, nearly a year passed before any of them received any updates. Last week, the Bureau called on them to report to their respective wereda offices, where the cooperatives would officially be formed.

“Even though a little bit late, some works like identification of sites have been completed,” Yasmin told Fortune.

She declined to disclose the land size to be apportioned and where the constructions would occur.

Imam applauds the initiative to bring individuals into the process but questions the effectiveness of the new model. The scheme requires the registered individuals and cooperatives to cover over half of the total cost in advance.

“This defeats the project's goal in providing housing to those unable to do so on their own,” Imam said. “It was supposed to work for the poor; it doesn’t.”

What comes next in the tumultuous saga of low-cost housing in the capital is almost certainly not going to work, favouring Yohannes and the hundreds of thousands in the low-income group waiting with so much hope. Having lost faith in the scheme, Yohannes plans to build an attic-like residence, known in Amharic as "Qot", atop his parents' house. He believes the government's promise was made never to come.

PUBLISHED ON

[ VOL

, NO

]

Fortune News | Mar 09,2019

My Opinion | Jul 24,2021

Fortune News | Mar 27,2021

Fortune News | Jun 20,2025

Editorial | Sep 16,2023

Fortune News | Nov 02,2019

Radar | Nov 03,2024

Fortune News | Feb 04,2023

Fortune News | Jun 23,2019

Sunday with Eden | Apr 06,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...