Agenda | Sep 28,2019

It did not take much time for Ageze Moges, 25, to get a job when he moved to Addis Abeba six years ago. Relocating to the capital from the Gurage zone, he found work as a casual worker serving shops in Mercato. No sooner, he had moved to the Teklehaimanot neighbourhood, making a living porting metal products for the many stores in the area catering to the construction industry.

It was not a bad start, Ageze recalled. He worked nearly every day and saved most of what he had made - up to 300 Br a day. In his second year, he went back home visiting family, with supplies, gifts and household items. It is customary for those from the region to join family members and celebrate the Mesqel holiday, a sort of a Thanksgiving season.

To his disappointment, Ageze did not make the trip this year.

“I couldn't buy anything to take to my parents,” he said.

Ageze has been having trouble finding work. Lately, he has spent his days wandering idly near the stores in the Teklehaimanot area.

Businesses have been affected over the past year due to the slowdown in the construction industry brought on by the COVID-19 pandemic. The rebar stores in the neighbourhood where Ageze hangs around were hit by a dearth in supply of items, putting a strain on his livelihood. He was hopeful things would have gotten back to normal soon, though it seems the situation has gone from bad to worse. The neighbourhood has become a target of a crackdown by authorities of the city administration. Accused of hoarding and price gouging, the rebar stores in the Teklehaimanot area remain mostly closed.

With the inflationary pressure spiralling beyond authorities' control, state-directed market interventions have become the norm lately.

Some regions have already introduced a price cap, while others, including the Addis Abeba City Administration, have capped traders from making price adjustments on merchandise, overlooking the supply gap equally contributing to the inflationary pressure. Those defying the new normal have already fallen victim to the government's big-stick policy approaches.

One of the city's busiest areas, and under Wereda 01 of the Addis Ketema District, Teklahaimanot has alone seen the closure of over 70 businesses, a third of which are rebar stores.

United Alpha is one of nearly 1,900 businesses closed by the authorities in the capital to stem what they call "economic sabotage." Its store in the area was closed three months ago, and its warehouse in the Kolfe Qeranyo District followed a month later on allegations of hoarding metal products, tyres, and tubing. A further 800 businesses in the city have had their trade licenses revoked by the authorities, while around 30 face criminal charges.

Agricultural productivity of teff showed a decrease of almost five percent, where as productivity of crops like khat increased by over 21pc.

“Unfair price increases and making the lives of residents miserable are the main reasons," said Yeshidinber Amare, head of the Wereda, justifying the decision for the widespread closure of businesses. "A few businesses were found supporting armed groups in Tigray.”

Nonetheless, dozens of these businesses have been attempting to reopen using new trade licenses. Another 15 have filed appeals before his office. United Alpha, continuing to pay its 50 employees while closed, is among the latter.

Similar measures were taken in Oromia Regional State, affecting over 10,000 businesses that have been fined, closed or are facing criminal charges.

The figure for the whole country is staggering. Over 60,000 businesses were closed in the last three months, according to the Ministry of Trade.

There is a federal task force headed by the Trade Ministry overseeing the crackdown. It comprises members from the Federal Police Commission, the National Intelligence & Security Services, the Customs Commission, the Trade Competition & Consumer Protection Agency, and representatives of regional trade offices.

Akeberegn Wugagen, deputy head of the Addis Abeba Trade Bureau, is among a slew of officials at the city, regional and federal levels who claim hoarding and price gouging are behind the skyrocketing cost of living, though evidence shows otherwise. He is responsible for coordinating with officials in neighbouring towns, convinced that the crackdown has been a success in stabilising the market and holding those "responsible" accountable.

Headline inflation registered at nearly 35pc last month, while food inflation hit a staggering 42pc.

Despite the authorities enthusiasm for their heavy-handed intervention, experts see employing administrative measures does little to help tame the inflationary pressure. Keeping inflation at bay requires an understanding of the source of the problem, with an insight into its historical context, says Alemayehu Geda (Prof.), a professor of economics who has published several studies on inflation.

Inflationary pressure is not new to Ethiopia. It has been a major macroeconomic problem recurring since the mid-2000s.

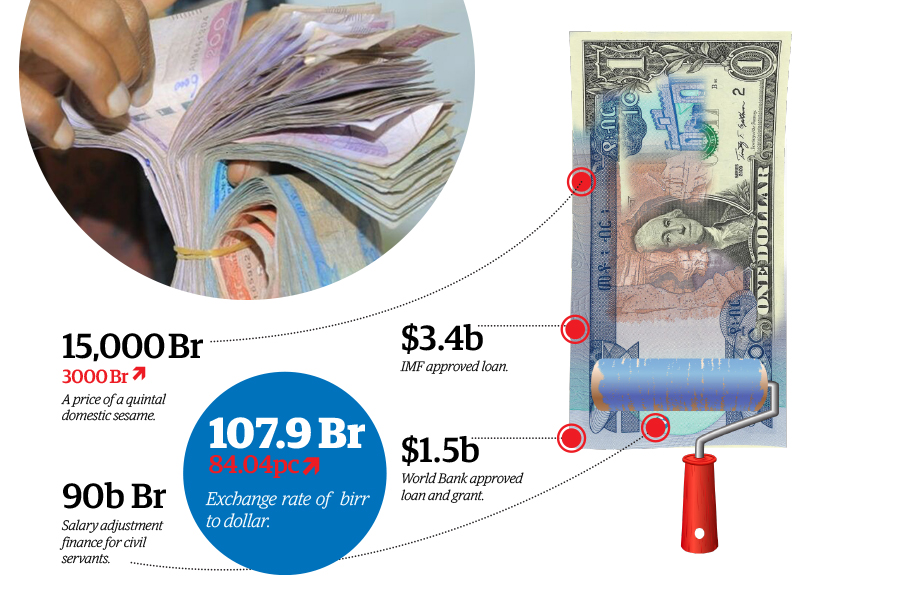

But the latest began in October 2017 following the devaluation of the Birr against the dollar by 15pc, a policy measure that pushed up the headline inflation to a five-year high within two months. Macroeconomic policymakers had hoped such an adjustment would make exporters competitive in the international market, making buying merchandise in the domestic market cheaper. Alemayehu was one of the vocal voices against the devaluation, and time has vindicated voices like his.

Members of the macroeconomic team, including Fitsum Assefa (PhD), publicly acknowledged that the exchange rate adjustment did not bring the much-desired outcome in boosting export proceeds while reducing import bills. It led to exacerbated inflationary pressure.

Complicating the task of bringing inflation down into single-digits, the exchange rate adjustment was akin to pouring gasoline on a fire for the troubled economy, owing to a surge in money supply with annual growth of over 25pc and a critical shortage of foreign currency. Soon after taking the helm from the then Prime Minister, Hailemariam Desalegn, the administration of Prime Minister Abiy Ahmed (PhD) was tasked with clearing up the inflation deadlock. It was an uphill task.

Many following the economy did not expect the new administration to come with yet another bitter pill to swallow, allowing the Birr to lose ground as it did over the past three years. The Birr has depreciated by 75pc since Prime Minister Abiy took the helm in April 2018, fuelling the inflationary pressure. Though his administration sees the depreciation as a long-term fix for an economy struggling with structural forex crunch, experts observe its repercussions outweigh what it could potentially bear.

"It's ruining everyone's life as everything is imported in the country," says Alemayehu.

In the year when the value of the Birr against major currencies began the nosedive, Ethiopia had sustained a 5.84 billion dollar trade deficit. Its export earnings in 2019 were 3.11 billion dollars.

The Professor sees a country with a historical deficit in the trade balance can only depreciate its currency, expecting a further soar in cost of living.

"It has to stop," says Alemayehu.

He urges macroeconomic policymakers to focus on increasing remittance flow, instead of boosting exports through exchange rate adjustment.

Economists say such policy measures must be supported by a transformation in the agriculture sector as faltering crop output is the main factor for the country's galloping inflation. That might be a valid point for policymakers to consider.

Teff production fell by nearly four percent last year to 55 million quintals, while barley, sorghum and oats production has fallen by 1.6pc, 14.2pc and 3.3pc, respectively. The land area used to cultivate these crops has also declined significantly over the same period. Compare this to farmland used for Khat, a commercial crop ingested as a stimulant. It has grown by over a fifth to 339,500ht. Coffee, which made up a quarter of last year's export revenues, is also expanding, with farms covering 14pc more than the 856,592ht of land used in 2019/20. The size of land teff covered went down by six percent to 2.9 million hectares.

Assefa Admassie (PhD), a veteran agricultural economist, urges the government to address the "poor market structure" in the agricultural supply line. Assefa recognises illicit trade activities undermine the effort to stabilise the market. But the depreciation of the Birr and the monetary policy in place are all factors behind the surging inflation, alongside addressing problems in the agricultural sector is vital.

"Economic sabotage might be one issue," said Assefa. "But it's not the main factor."

The National Bank of Ethiopia (NBE) is a federal agency whose task is primarily to use monetary policy tools to control inflation.

Its officials have doubled the reserve requirement banks hold to 10pc, and the interest banks are charged when they borrow from the central bank. It is an attempt made to limit the amount of money banks lend to their clients. Its officials have demonetised the Birr, hoping this would help them control the money supply outside the banking system, with cash-holding and transactions limits.

Outside of monetary policy, the central banks used regulatory muscle taking unorthodox measures. Their latest move was the freezing of collateralised loans targeted weakening those "sabotaging the economy."

All of these, however, have so far been unable to arrest the surging inflation. Officials urge citizens to wait a bit longer to see results.

"It'll take six months or more to see the real impacts," said Fikadu Digafe, vice governor and chief economist at the central bank.

What people like Ageze and his friend, Behailu Tadesse, have is patience.

Behailu, 34, is a father of two who works as a porter for the stores in the Teklehaimanot area. The last few months have been tough on him and his family. His income dried up, and his homestead had to rely on his wife's salary, which is around 1,500 Br, from her work at the Safety Net Project to get by.

"Imagine how difficult it would be for us if we didn't have this home," said Behailu, who lives in a government-subsidised, one-room lodging the family secured two years ago after living in a makeshift plastic home for years beforehand.

PUBLISHED ON

Oct 09,2021 [ VOL

22 , NO

1119]

Agenda | Sep 28,2019

Fortune News | Aug 04,2024

Fortune News | Feb 05,2022

Fortune News | Jan 12,2019

Fortune News | Sep 30,2021

Exclusive Interviews | Jan 05,2020

Viewpoints | May 23,2021

Viewpoints | May 23,2021

Fortune News | Apr 22,2023

Fortune News | Jul 26,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...