Fortune News | Jun 23,2019

Mar 21 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

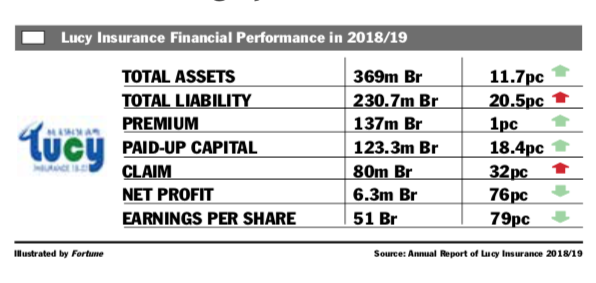

In the reporting period, the firm netted 6.3 million Br in profits, a sharp drop from the 26 million Br it recorded the preceding year. The firm's earnings per share (EPS) also fell by 193 Br to 51 Br.

In the reporting period, the firm netted 6.3 million Br in profits, a sharp drop from the 26 million Br it recorded the preceding year. The firm's earnings per share (EPS) also fell by 193 Br to 51 Br. Lucy Insurance, one of the late entrant insurance firms, recorded a 76pc decline in profit after tax during the last fiscal year.

In the reporting period, the firm netted 6.3 million Br in profits, a sharp drop from the 26 million Br it recorded the preceding year. The firm's earnings per share (EPS) also fell by 193 Br to 51 Br.

Stagnant gross written premium, an increase in commission payments, a surge in claims and rising expenses have resulted in the dwindling profits and EPS.

This must be disappointing for the shareholders, according to Abdulmenan Mohammed, a financial analyst with close to two decades of experience.

Tewodros Teklu, acting chief executive officer of Lucy, explains that the firm faced many challenges in the reporting period, including a surge in claim expenses for motor and bond class businesses.

Lucy's claim ratio, the percentage of claims paid to the premiums earned, stood at 80pc, which is well above the 70pc minimum standard set by the National Bank of Ethiopia (NBE).

In the reporting period, Lucy’s gross written premium increased by only one percent to 137 million Br. Out of the total gross written premium, Lucy ceded 24pc to reinsurers, leading the retention rate to decrease by 76pc.

Gross written premium has expanded slightly due to not only unfair but unethical competition in the industry based on price-cutting, according to Tewodros.

"The slowdown of the export and construction businesses, as well as the political instability, have affected the nation’s economy in general and the industry in particular," said Tewodros.

The board of directors of the firm urged the shareholders to work with the insurance company to address the problems.

"To address the problems ... the board of directors strongly believe the contribution of the shareholders is indispensable," reads the statement to the shareholders, "hence, we urge you to closely work with your own insurance company for a better result."

Despite the reduced retention rate, claims paid and provided for soared by 32pc to 80.1 million Br. This hugely undermined the underwriting surplus, which decreased by 42pc to 25.1 million Br due to surging claims and increased commission payments. Commissions paid to agents went up by 19pc to 11.1 million Br, whereas commissions from re-insurers increased by only two percent to 7.3 million Br.

“The growth in claims is very concerning," comments Abdulmenan, "The management should thoroughly review the risk pricing and management of the company."

Tewodros says that the management of the firm is working on tracing the cause for the growth in motor and bond claims as well as outstanding bond claims registered for the period.

Abdulmenan adds that the increase in commission payments while the gross written premium was the same should concern the management of Lucy.

"It should adjust the commission policy in a way that will increase the gross written premium of the company," said Abdulmenan.

In the reported year, Lucy did well in investment activities. Interest on deposits increased by 14pc to 18.8 million Br, and dividends on shares soared by 42pc to 4.9 million Br.

A surge in expenses accompanies Lucy's income swell. Lucy’s employee costs and other administration expenses jumped by 22pc to 42.6 million Br. The expansion of costs consumed a considerable portion of the underwriting surpluses and investment income.

"The management should design a cost-control mechanism to keep expenses at bay," commented the expert.

Although the company supposed to underwrite two and half fold of its capital to maintain its expenses in the required level, the expense has been registered above the required standard, according to Tewodros.

Total assets held by Lucy increased by 11.7pc to 368.9 million Br. Out of which 141.7 million Br was held in an interest-earning deposit account and 47.5 million Br in shares. The investment in interest-earning deposits and shares represent 51.3pc of the total assets of Lucy.

The liquidity analysis shows that the liquidity level at Lucy decreased in value and relative terms. Cash and bank balances decreased by 21pc to 22.1 million Br. Cash and bank balances to total assets decreased to six percent from 8.5pc.

“Lucy should watch out for a further reduction of liquidity, as it is at the lowest level,” recommended Abdulmenan.

The company has made more payments related to claims affecting its liquidity position, according to Tewodros.

Lucy increased its paid-up capital by 18.4pc to 123.4 million Br. Its paid-up capital and non-distributable reserves account for 35.9pc of its total assets.

“As it is well-capitalised, Lucy should use its capital efficiently rather than expanding it further,” recommends Abdulmenan.

To boost its capital, the company aggressively sold shares through a commission agent called Medon Marketing.

Abayneh Kebede, the founding shareholder of the firm who also served as a director of the board, mentioned that motor risk policy and bond class coverage reduced the insurance firm’s profit from the preceding year.

"Considering this, the new management has to work and turn around a lot on underwriting and claim management as an area of improvement," he suggested.

PUBLISHED ON

Mar 21,2020 [ VOL

20 , NO

1038]

Fortune News | Jun 23,2019

News Analysis | Nov 09,2024

Fortune News | Jan 25,2020

Fortune News | Jan 25,2020

Life Matters | Feb 24,2024

Agenda | Aug 01,2020

Fortune News | Dec 14,2019

Fortune News | Jun 29,2025

Radar | Nov 28,2020

Radar | Feb 01,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...