Fortune News | Oct 28,2023

May 28 , 2022

By Christian Tesfaye

Ethiopia’s economy ails from three fundamental and structural diseases that are self-inflicted. One is energy subsidies, aka fuel subsidies, which are bleeding federal budgets and distracting from pro-poor policies. It does not help stop inflation in the true sense because the government is deficit financing through central bank advances to support the subsidies. It does not help the poor because it is those in the higher income quantile that have the highest energy per capita consumption, and thus benefit the most.

The other self-inflicted ailment is the foreign exchange regime. It ensures that formal channels are starved of foreign currency while the black market has high levels of it. Recently, there were reports of shortages of raw materials for license plates. This is bizarre because it also means that there is enough foreign currency in the economy to import vehicles, which are much more expensive than license plates. It all makes sense, though, considering that license plates are funded using foreign currency from the formal channels while it is the black market that finances Addis Abebe’s burgeoning car import market. Ethiopia does not have a foreign currency problem. It has a black money market crisis.

Adding to these disasters is the long-held central bank stance that capital markets and foreign banks will have a negative impact. Equating capital markets to gambling platforms was ludicrous; much more of an ideological rhetoric than one grounded in economic fact. The decision to ban foreign competition is nonsensical when considering that local banks do not provide value to citizens in terms of helping the average Ethiopian access to credit but a few well-connected business types; why would such institutions be protected from the competition?

It is due time that this sad situation is addressed. Structural and regulatory reforms need to be enacted to ensure that the economy can wake from its slumber. But there is a response that comes up to such prescriptions these days; one that does not have to do with the rationale of such reforms.

But what about the timing? Are states of war and instability the right environments?

As an argument against following the highest possible caution, it is the proper response. For instance, lifting capital controls does require greater debate and reflection. But most other reforms are not just enactable. They are necessary.

Ethiopia’s political crisis did not start two years ago. It started six years ago. The current war may go on for 10 or more years. No one knows. Should we hold back necessary reforms to wait for the ideal time, then?

In fact, it could be improving the structural dilemmas in the economy that will help the political situation. No one said this would be easy. Development is always messy, and it is not a given (at least, it seems, in Africa’s case). Opening up, like in the telecom sector, needs to take place however bumpy the road may be or intimidating the challenge. Countries that opt to wait for the ideal time will never get there; the time to act is now.

The energy that the country should channel should be of one that has its fate in its hands, however hard things may seem when the going gets tough. Leaders should never be resigned to accepting their fate and hoping for the best, assuming the political situation will figure itself out. Ethiopia’s economic opening-up cannot wait, and neither can it be outsourced to political elites. We need to take our economic fate into our hands. If the political situation improves along the way, then great. If it does not, then we should work around it.

PUBLISHED ON

May 28,2022 [ VOL

23 , NO

1152]

Fortune News | Oct 28,2023

Viewpoints | Jul 01,2023

Fortune News | Aug 04,2024

My Opinion | Jul 17,2022

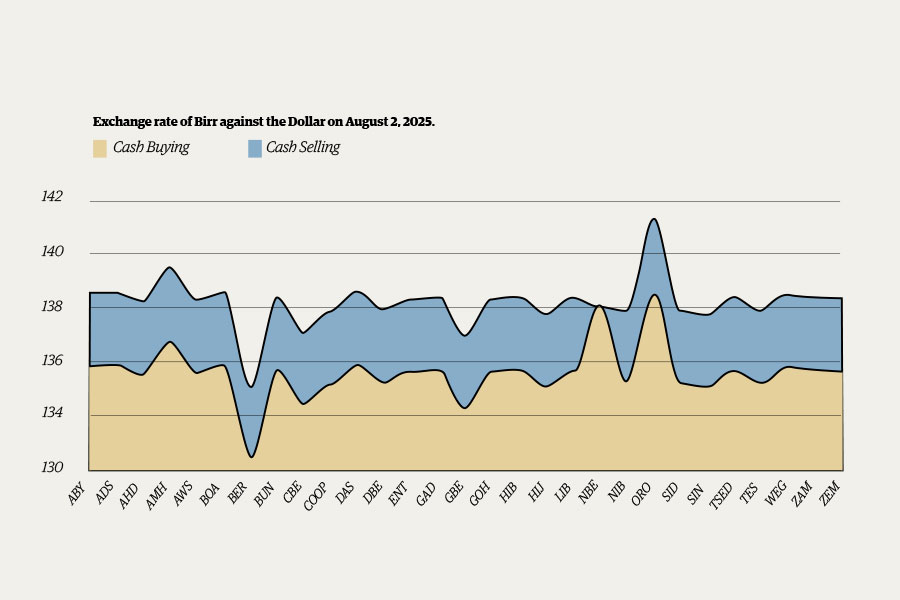

Money Market Watch | Aug 03,2025

News Analysis | Jan 05,2020

Fortune News | Sep 30,2023

View From Arada | Sep 24,2022

Exclusive Interviews | Sep 06,2025

View From Arada | Feb 20,2021

Photo Gallery | 174788 Views | May 06,2019

Photo Gallery | 165010 Views | Apr 26,2019

Photo Gallery | 155258 Views | Oct 06,2021

My Opinion | 136727 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

Oct 18 , 2025 . By BEZAWIT HULUAGER

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...