Radar | Mar 02,2024

As Ethiopia gears up to launch functional capital markets, an impetus to regulate the informal issuance of shares has resulted in a fourth draft directive by the Ethiopian Capital Market Authority (ECMA) to govern the issuance of public offerings and trading securities.

Currently open to public consultation as it makes its way to approval by the board, the directive has put forth a transitional provision for existing public companies to register securities with the Authority within a year of the implementation.

A parallel project to establish the first securities exchange is going through a capital raise scheduled to proceed for at least the coming three months. The government owns 25pc shares while the rest is availed for the private sector.

At a small gathering at the Authority's headquarters last week, senior staff comprised of Sirak Solomon, Solomon Bekele, and Assefa Sumoro laid out the implications of the new directives to existing and public share companies currently under formation.

Director General of the Authority, Brook Taye (PhD), opened the session with remarks on the importance of close and transparent communication to maintain the integrity of companies set to be traded. He recalled Wirecard, a payment behemoth in Germany that collapsed following an investigative piece in the Financial Times that exposed the country's largest fraud in its post-Second World War era.

"Collaboration in protecting the public interest is crucial," Brook noted.

The Director General recognised several share companies with over 350,000 shareholders have become thriving businesses even without a formal capital market framework in Ethiopia in what could be described as "impressive".

"We will have to balance promoting participation and regulating it," he underscored.

Consequently, the modalities for registration and the conditions for exemptions from issuing a prospectus were annotated.

According to Solomon, private placements such as less than 50 shareholders and government securities excluding state-owned enterprises and a few others will not be obligated to issue a prospectus.

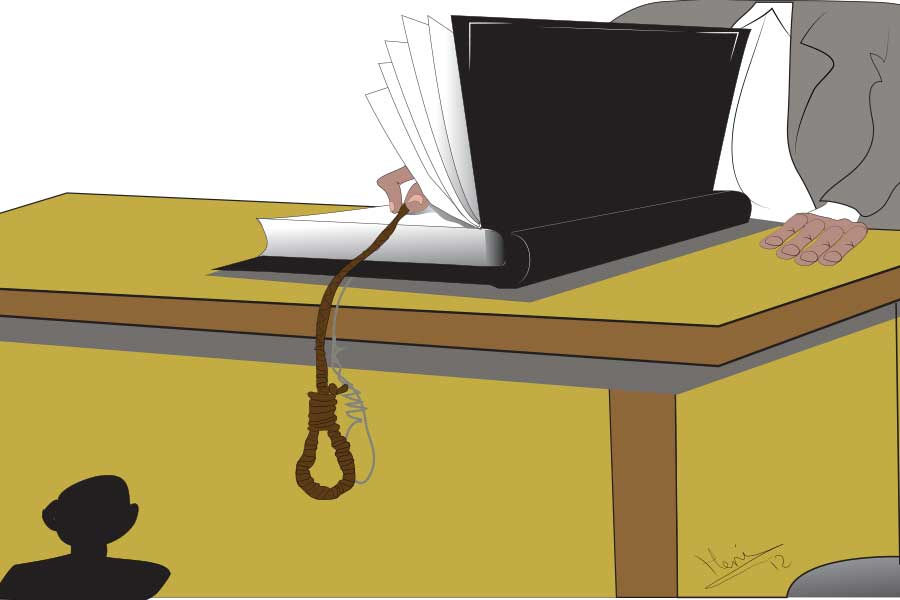

He indicated that companies will have their registration rejected if any senior issuing group have been convicted of a crime involving fraud, breach of honour or trust and an offence involving dishonesty.

The discovery of companies with questionable finances and high-risk business structures upon registration at the Authority will likely be an uphill battle.

"It will be tough," Solomon told Fortune.

One of the several conditions for approval of a company under formation is the requirement for a commitment of 10pc core investment, which Solomon noted brings a little "skin in the game".

The senior legal advisor also noted that the Authority is responsible for protecting investors, mitigating systemic risk, developing and ensuring fairness and orderliness in the market.

He emphasised that advertisements to the public before the approval of a prospectus document are prohibited unless of a looming prospectus.

"All contents in an Ad need to be consistent with the prospectus," he underscored.

Advertisements that suggest a rapid or guaranteed increase in profits and those containing misleading terms like 'top offer' or 'superior offer' will be absent under the pending reforms.

The directive set to be approved within a month has rigorous conditions for registering securities and issuing a prospectus, which Sirak noted will help weed out companies contrary to investor interest or the public in general.

Observers of the business landscape are looking forward to the varied implications of looming capital markets, further enthused by the improved access to finance.

Million Kibret, managing partner of BDO Ethiopia consulting, considers the transitional provisions under the proposed directive generous.

He believes large share companies should have already subscribed to most of the requirements while the International Financial Reporting Standards requirement should have been a no-brainer as previous regulations also clearly stated its necessity.

"Businesses relying on informality should prepare themselves," he told Fortune.

The managing partner indicated that the ability to mobilise finance from financial markets will be a crucial factor in the competition between businesses, as those that fail to keep up will be left behind.

He noted the role of improved access to finance through venture capital investments to budding start-ups as instrumental in fueling a thriving entrepreneurial ecosystem. Although tax services by the authorities in the past few years have improved, Million suggests: "Further adoption of technology will be needed."

PUBLISHED ON

Oct 28,2023 [ VOL

24 , NO

1226]

Radar | Mar 02,2024

Fortune News | May 11,2024

Editorial | Oct 26,2019

Fortune News | Feb 04,2023

Editorial | Mar 01,2024

Fortune News | Apr 27,2025

In-Picture | Apr 13,2025

Radar | Aug 22,2020

Radar | Jun 07,2025

Radar | Sep 10,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...