Radar | Jun 17,2023

Aug 25 , 2024

By HIWOT HABTNEH ( FORTUNE STAFF WRITER )

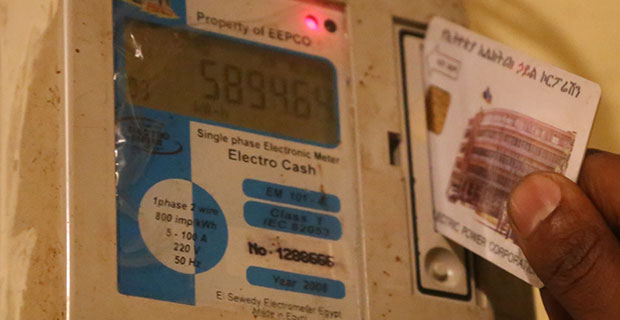

The state-owned power producer, Ethiopian Electric Power (EEP), has earned 27 million dollars from electricity sales to data miners in less than a year. CEO Ashebir Balcha disclosed that they achieved 97pc of their target in a few months.

“We had to restrict sales due to oversupply concerns,” he said.

The past two years have seen a surge in data mining companies establishing operations in Ethiopia, positioning the country as a new frontier in this burgeoning sector. EEP has signed contracts with around 18 companies to supply electricity for their mining activities, with four becoming operational by March. These operations are substantial consumers of electricity, each requiring between 10MW and 100MW. Consequently, the Russian company, Bitcluster, has set up a 30,000Sqm facility near the Kilinto high-voltage substation in the capital.

Concerns have been raised by experts about the impact of power exports and sales to data miners, fearing potential energy deficits for other sectors and the general population. Ashebir countered these concerns, noting that EEP prioritises national investments, including those in cement, real estate, industry, and economic zones.

He said that new projects are planned for the coming year, financed by the World Bank.

“We’ll resume once new projects are operational,” he said.

EEP generated 20 billion Br in revenues for the past fiscal year, with 140 million dollars from exporting nine percent of its generated power to neighbouring countries. Ashebir disclosed plans to begin transmission testing to Tanzania next month, while South Sudan has also expressed interest. Ethiopia has been exporting electricity to Sudan and Djibouti for the past decade, with transmission to Kenya starting in November 2022, reaching 200MW.

While exports increased by six percent, the growth in Kenyan imports was offset by reduced demand from Djibouti and Sudan. Imports to Sudan have plummeted by 90pc from a peak of 200MW due to the ongoing civil war. EEP is currently fielding requests for power supplies up to 300MW, equivalent to the total generation capacity of the Tekeze Hydroelectric Dam. Ashebir expressed concern over meeting rising demand, cautioning that demand might exceed capacity.

“Exports are not our priority,” he said.

Ashebir underscored that nearly half of Ethiopia’s population lacks access to electricity, with over 20,000Km of transmission lines vulnerable to environmental factors and theft. He emphasised that constructing a small substation requires five million dollars and that a tariff revision is essential to enhance accessibility.

“The current tariff needs adjustment to produce and distribute more power,” Ashebir said.

National energy consumption grew by 17pc, according to the CEO. Currently, 34pc of the power is sourced from the Gibe III Dam, with the Grand Ethiopian Renaissance Dam (GERD) contributing 17pc from two of its 13 turbines.

The energy mix comprises 96pc hydropower, 3.3pc wind power, and 0.2pc waste-to-energy. Hydropower remains Ethiopia’s dominant energy source, with a study by FSD Africa indicating that large-scale green energy projects like GERD could create up to 33,000 jobs, driving a green jobs revolution.

A noteworthy portion of the power is supplied to the Ethiopian Electric Utility (EEU), while seven percent was used by EEP for power generation purposes. Five power-generating projects are currently under construction, expected to add 7,242MW upon completion.

The performance report was presented at EEP's headquarters on Asmera Rd. Ashebir also highlighted additional revenue streams, including the leasing of optical ground wire (OPGW) cables, which serve grounding and communication purposes, to Ethio Telecom and Safaricom.

The past year has not been without challenges. Theft has been a marked issue, with 57 power transmission towers collapsing, resulting in a repair cost of 114 million Br, while the total cost reached 817 million Br. Ashebir noted that most of these expenses are in foreign exchange, hindering further investment and expansion in the electricity sector.

An annual review underscored economic reforms in the power sector, particularly local debt management, including low-interest coupon bonds from the Commercial Bank of Ethiopia (CBE). Executives expressed concern that EEP’s operations are at risk due to overwhelming debt.

Around 191.7 billion Br was transferred to the Liabilities & Asset Management Corporation (LAMC), while 263 billion Br, primarily borrowed for the construction of GERD, was absorbed by the Ministry of Finance.

“The government has consistently taken over our debt,” said Demere Assefa, EEP's Chief Financial Officer.

PUBLISHED ON

Aug 25,2024 [ VOL

25 , NO

1269]

Radar | Jun 17,2023

Fortune News | Mar 23,2019

Radar | Aug 23,2025

Fortune News | Jul 08,2019

In-Picture | Oct 19,2019

Radar | Jan 21,2023

Commentaries | May 08,2021

Advertorials | May 30,2025

Fortune News | Jun 01,2019

Fortune News | Apr 26,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...