Viewpoints | Jul 09,2022

Oct 3 , 2020

By Asseged G. Medhin

Ethiopia has a developing economy with immense potential. The world has noticed this; hence the increasing attention, interest and flow of foreign direct investment (FDI).

But investors also want to test the waters before making any commitments. They look for an enabling environment, reduced costs, high rate of returns and quality of infrastructure. In a nutshell, they look at the value chain. When a country attempts to attract investors, it is thus through advertising its value chain.

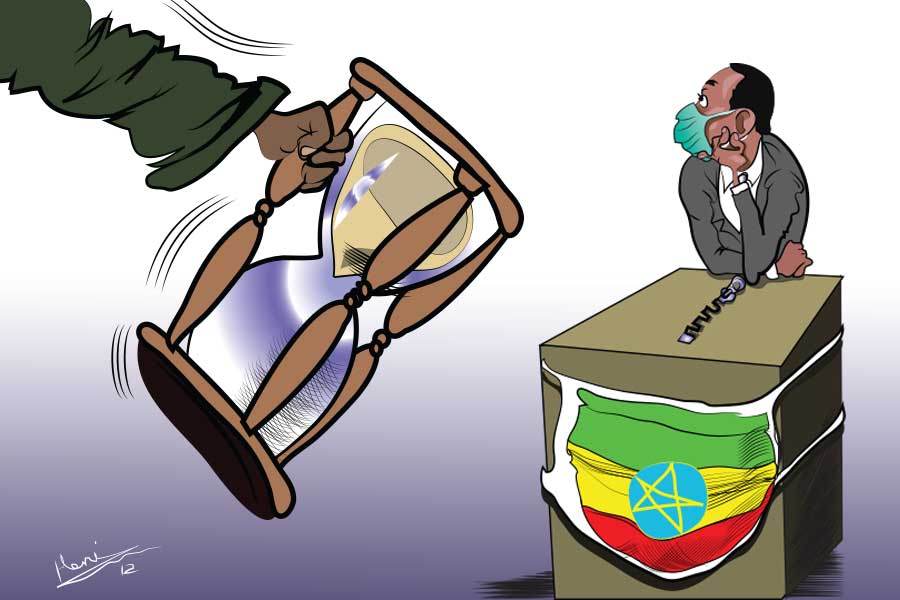

With investments pouring into industrial parks and the drawing of laws and regulations to create an ease of business for foreign investment, one major obstacle stands in Ethiopia’s way: political violence. It creates enough barriers that only extractive industries survive under such an environment.

The issue is further complicated by the lack of a financial sector designed to deal with the issue of political violence. This is despite investors’ demand for a well-developed financial sector capable of insuring against political risk. This is no longer a luxury service that the sector needs to cover under politically combustible situations; it is mandatory.

Investors put a large amount of money into most types of businesses. The risks they take go up in proportion to the cost of capital they put in and the concessions they get from the government. Evidently, this means that they try to cover as much of these risks through insurance coverage. In Ethiopia, as in other countries, this includes the risk of loss to violence as a result of political circumstances. It is one other thing that needs to be hedged.

Is insuring emerging and political risk unique from a business perspective? Are there solutions to it? What is the appetite of the regulator and policymakers?

The Ethiopian insurance sector has been shying away from answering these questions. But this is barely a strategy when the problem is clearly there. We should have to have at this juncture a revision of policy terms and conditions, even if we are several decades late to the game.

Developing a functioning risk insurance against political violence will not be easy. It would require the collaboration of the National Bank of Ethiopia (NBE), Ethiopian Investment Commission, Ministry of Trade & Industry and bankers and insurers.

Political risks are not unconquerable. It requires nothing more than developing a political risk roadmap and working on the mitigating factor and insuring and re-insuring. What is required is the will and the can-do attitude to inject dynamism into the insurance sector and address the prevailing risks of our time.

The Africa Trade Insurance Agency could come in handy here. It is a multilateral insurance institution established to cover risks in African countries so they can get more foreign investments. This is a major advantage for the government, local businesses and interested investors. By working with such institutions, it is possible to mitigate the risk that keeps investors away, if not address the problem wholly.

Just as worrying to investors as violence is political interference. Emerging markets with weak economies, assets, contracts and loans can be adversely affected by government actions, making the supply chain increasingly vulnerable. This is considered to be a problem only slightly less worrying than political violence.

Unforeseen political events can lead to confiscation, expropriation or nationalisation of assets; trade embargoes and cancellation of licenses; termination of or default on contracts and non-payment by government or government-owned entities, according to Aon, a multilateral insurance company.

Such a “broad range of possible government actions,” reads Aon’s website, can “lead to increased costs, penalties, forced shutdowns, loss of profit or liquidated damages.”

Institutions such as ATIC are designed to hedge against such risks. It can be used as a very good machine or tool that will open the eye of insurers and bankers in Ethiopia that are aware of the consequences of operating in an environment where risk can arise either out of political violence or interference.

Ethiopia has changed, for better or worse. If we accept it at its face value, we will grow complacent and fail to capitalise on the unseen opportunities that come with every change. We need to be courageous in our conviction and move fast to take charge of the situation.

We insurers should not waste a moment, not only in developing workable insurance policies for political risk and emerging risks, but also in developing a comprehensive road map that will help the public, the government and private investors. The role of insurers is paramount to anyone single stakeholder. It is a task for today, not tomorrow.

What insurers should focus on while developing such a policy is flexibility, especially in response to providing a combination of balance sheet protection and business facilitation. It must be possible to purchase insurance on a standalone basis, or within a tailor-made portfolio to increase efficacy from the flexibility of coverage.

No matter how rough the road of the 21st century is going to be, we must be optimistic enough to believe that we can traverse it successfully. The attitude of insurers to political risks should be no different. We need to face the challenge and lead the 21st century in business.

PUBLISHED ON

Oct 03,2020 [ VOL

21 , NO

1066]

Viewpoints | Jul 09,2022

Viewpoints | Jul 03,2021

Sunday with Eden | Aug 16,2020

Commentaries | May 11,2019

My Opinion | Feb 13,2021

Fortune News | May 14,2022

Exclusive Interviews | Jan 05,2020

Editorial | Apr 11,2020

Verbatim | Nov 20,2021

Agenda | Mar 30,2024

Photo Gallery | 178702 Views | May 06,2019

Photo Gallery | 168896 Views | Apr 26,2019

Photo Gallery | 159736 Views | Oct 06,2021

My Opinion | 137105 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...