Fortune News | Sep 24,2022

Aug 28 , 2021.

The Central Statistics Agency (CSA) finally has an easily navigatable and pleasant looking website that seems to be updated regularly, no small feat for federal agencies. There, it released a crucial report on labour force and migration in Ethiopia conducted in a survey earlier this year. It covers the whole country except the Tigray Regional State, the flashpoint of a civil war since November last year.

The report has interesting statistics to share, although hard to digest.

It claims unemployment was only eight percent, defined as an economically inactive person over 10 years old. Data on Ethiopia`s social and economic trends are always hard to come by, but more so when it comes to the unemployment rate. Understandably, there is a widely held view that the army of the unemployed represents a much larger size than what the official sources claim, whether they are governemnt or multilateral organizations.

Perhaps more candid is the report`s admission that 44pc of households saw their incomes decline due to the COVID-19 pandemic. Urbanites were most affected as they do not depend on subsistence farming and are more likely to live in rented homesteads. Over a fifth of urban households lost their sources of income because of the consequences of the pandemic.

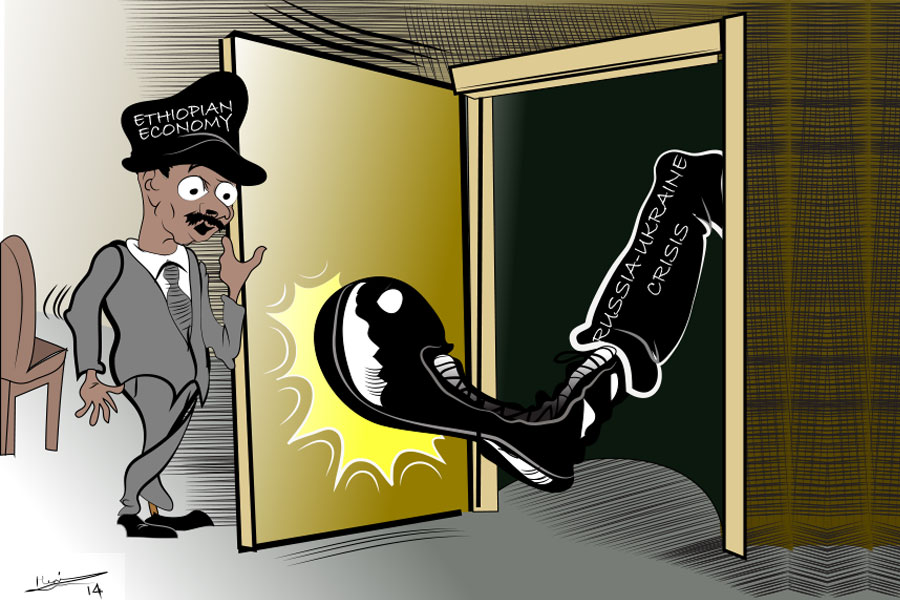

The elephant in the room: The report avoids talking about conflict, not even to explain why the Tigray region was not included in the survey. It only mentions it for readers to bear with the methodology it says was conducted during a difficult time. As is the case with the impacts of the pandemic, by the time the tally comes on the devastation of the civil war, it would surprise no one. The consequences of the civil war raging in the north and southwestern parts of the country have brought home distressful news in the form of inflation.

In those areas unfortunate enough to be in conflict zones, communities may feel burnt from the highly militarised engagements. But those who continue to follow the unfolding through the screens are no longer immune from the impacts of these wars. Many families are hosting displaced relatives due to the wars, additional burden on meagre family incomes when the cost of living hits the roof.

The authorities at the federal and regional governments find it convenient to resort to what is by this point a tired exercise - blame intermediaries and the private sector for surging prices in the market. It is the same old tactic of the political establishment externalising its policy failings at a macro level. Businesswomen and men are blamed for speculative behaviour, in taking advantage of the market distortions policy failure has created, to begin with.

Authorities in the Oromia and Southern governments and the Addis Abeba City Administration have basically pointed the muzzle of their guns on the businesspeople in the form of warnings against alleged hoarding of goods and speculative prices. Those in the Somali Regional State found it wise to initiate the unprecedented step of establishing an enterprise to import food items. They may have wanted to follow in the footsteps of the federal government. The latter is in the process of importing 400,000tns of wheat to curb inflation for a country 65pc of whose labour force is employed in the agriculture sector.

This time though, a few regional states are partaking in a revolution of an autonomous economic policy experiment. The Harari Regional State follows its neighbour, the Dire Dawa City Administration, in imposing price caps on commodities traded within their jurisdictions, hoping to subdue inflation that has reached a national average of 26.4pc, according to the CSA.

It is not surprising that a country that has spent the last half a century under regimes rooted in statist philosophies is prone to misdiagnose the private sector's role or the critical importance of markets in determining production and prices. Businesses are the favourite punching bags of state propaganda for every livelihood hardship under the sun.

The price of salt more than doubled in a few weeks because a large part of the Afar Regional State is embroiled in the civil war. It should not feel out of place that fuel is suddenly in short supply when retailers sense a price increase coming or when farmers get only a fraction of the price charged for their produces in Addis Abeba. Supply chain markets neglected during good times will act in their self-interests when the tough times come.

However, this does not mean that intermediaries have no role in exacerbating the inflationary pressure in the economy. But in brushing aside markets and the private sector as something to be policed instead of regulated, subsequent governments neglected to invest in their efficiencies. It is like failing to service a car and then turning around to blame it every time it breaks. The current woes of Ethiopia`s economy are a direct outcome of policy neglect over the past few years, where macroeconomic issues have been left on autopilot.

Neither should the regional and federal governments be surprised that intimidation, price caps and subsidised imports will not stabilise markets. At best, they are temporary reliefs. It is possible to bully around and make an example of some businesses, but many of them know they could get away with most of their hoarding and speculation. Goods will inevitably start showing up in the informal market at a price set by retailers. Shortages become rampant, and producers are disincentivised to produce for prices they do not find profitable enough. Look at how the huge margin between cement producers and the retail price is taken up by the intermediaries, largely due to misguided state intervention.

Hoarding and speculation are only symptoms of the broader problem: widespread conflicts, political uncertainty, and unsustainable money growth. In more normal times, part of the remedy would have been to invest in supply chains. But these are not such times.

Productivity has never been the forte of Ethiopia’s economy. This will only get worse with the war, which shows no sign of ease. It is not just central bank borrowing and valuable resources to finance the war effort that widens the budget deficit. It is also the refocusing of policymakers` attention away from productive sectors of the economy and leads to a fall in supply.

Every resource spent on buying weapons of destruction is money not spent in building roads, schools and hospitals. Every part of the country that becomes a conflict zone is neither used for growing crops nor developed as an industrial park. For every young soldier, rebel fighter and militia member recruited, the country loses an entrepreneur, a professional, a daily labourer or a farmer. Supply falls, but the number of people to feed, clothe, and shelter escalates. According to the International Organization for Migration (IOM), there are now 1.8 million people internally displaced and sheltered in 1,298 sites, making Ethiopia a country where the world's largest internally displaced population is found.

Like monetary growth leads to too much money chasing too few goods and services, too many mouths are chasing after too few a supply of food.

Policymakers on the economic front cannot contend with this on their own. They need a helping hand from the centre of power of Ethiopia's governments, the executive. This help is now only coming in blaming and persecuting businesses for setting prices too high. It should instead be in bringing about the war to a stop. It requires imagination in securing the peace.

Declaring a ceasefire and efforts at a national dialogue are good places to start. But goodwill is not established overnight. The state has an obligation to protect civilians from harm; it is its primary purpose of existence. But it needs to balance this by winning hearts and minds. Nothing less will suffice to protect households from falling lower down the poverty line.

PUBLISHED ON

Aug 28,2021 [ VOL

22 , NO

1113]

Fortune News | Sep 24,2022

Editorial | Mar 05,2022

Featured | Jan 01,2023

Fortune News | Jun 07,2020

Verbatim | May 01,2020

Commentaries | Dec 07,2024

Viewpoints | Apr 22,2022

Radar | Aug 03,2025

Sunday with Eden | Aug 08,2020

Agenda | Sep 11,2020

Photo Gallery | 180729 Views | May 06,2019

Photo Gallery | 170922 Views | Apr 26,2019

Photo Gallery | 162016 Views | Oct 06,2021

My Opinion | 137309 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 2 , 2025

The National Bank of Ethiopia (NBE) has scrapped the credit-growth ceiling that had s...

Nov 2 , 2025 . By SURAFEL MULUGETA

The burgeoning data mining industry is struggling with mounting concerns following th...

Nov 2 , 2025 . By YITBAREK GETACHEW

Berhan Bank has chosen a different route in its pursuit of a new headquarters, opting for a transitional building instea...

Nov 2 , 2025 . By BEZAWIT HULUAGER

Nib International Bank S.C. has found itself at the epicentre of a severe governance...