Fortune News | Dec 11,2021

Dec 14 , 2019

By MESAY BERHANU ( FORTUNE STAFF WRITER

)

Commission from reinsurers increased by 12pc to 29.4 million Br, while the commission it paid also increased only by two percent, reaching 32.4 million Br.

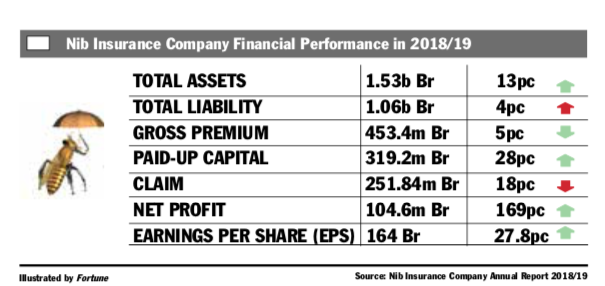

Commission from reinsurers increased by 12pc to 29.4 million Br, while the commission it paid also increased only by two percent, reaching 32.4 million Br. Nib Insurance Company, a firm that paid record-high claims two years ago, registered a huge leap in profit last fiscal year with a 169pc increase that reached 104.6 million Br.

The firm, which paid 308 million Br in claims in the 2017/18 fiscal year, also managed to increase earnings per share (EPS) by 40 Br to 164 Br.

Increased retention rate, unearned premium transferred from the preceding year, a reduction in claims and increases in commission, investment and rental income were the major factors for the improved performance of the company, according to Zufan Abebe, general manager of Nib, which has 43 branches.

The rate of retention rose to 82.9pc from 80pc in the previous fiscal year’s total gross written premium, while claims paid, including in actuarial liability for life insurance, went down by 18pc to 251.8 million Br.

Abdulmenan Mohammed, a financial analyst with close to two decades of experience, says that the management adopted a good risk management system.

"The firm also employed a careful balancing in the portfolio mix for life and general insurance premiums," Zufan said.

Zufan explained the high motor premium and other big claims were carefully structured with other premiums in fire, engineering and bond purchases.

Even though the underwriting surplus both for general and life premiums increased by 91pc to 8.1 billion Br, the firm's gross written premium fell slightly by five percent to 453.4 million Br.

This shows that Nib has faced strong competition in the market, according to the expert.

“The management should work at least to maintain its market position,” Abdulmenan said.

Abera Shire, board chairperson of Nib, shares Abdulmenan's view on the tough competition in the industry.

"Even though we have registered a remarkable result ... stiff competition and unfavourable economic and political conditions were among the challenges," remarked Abera in the financial statement.

Nib also improved its income-generating activities. Commission from reinsurers increased by 12pc to 29.4 million Br, while the commission it paid also increased only by two percent, reaching 32.4 million Br. Its investments in interest on time deposits, savings and government bonds resulted in a six percent increase to 64.1 million Br.

The insurance company’s dividend income went up by nine percent to 22.4 million Br, while rental income increased by 30pc to 7.7 million Br.

Out of its total assets of 1.5 billion Br, which already increased by 13pc in the last fiscal year, Nib invested 474.8 million Br in time deposits and 181.4 million Br in shares and government bonds. Both investments account for 42pc of total assets.

Abdulmenan suggests the management of the company invest the 309.2 million Br receivables it has with the reinsurers in income-earning investment activities.

Revenue growth was also accompanied by an upsurge in expenses, with those related to salaries, benefits and general administration reaching 114.3 million Br, a 12pc year-over-year increase.

“The total expenses of Nib increased reasonably, and it was well managed,” Abdulmenan observed.

Nib's liquidity position went up in value terms, while it slightly dropped in relative terms. Despite the cash and bank balances of the insurance company showing a four percent increase to 78.3 million Br, the ratio of cash and bank balances to total assets declined by one percentage point to five percent.

"This reveals that Nib was operating with tight liquidity," says the expert.

Nib's paid-up capital registered a 28pc rise and reached 319.2 million Br. The company’s capital and non-distributable reserves also represent about 24.4pc of its total assets.

“Nib is a well-capitalized insurance company," says Abdulmenan, "so it should use its strong capital position to bring in more income and increase its returns to shareholders."

The firm completed the construction of two buildings in Dire Dawa, a seven and a five-storey building, each used as guest houses and for commercial purposes, respectively. It also started the construction of its future head office, a 22-storey building including four basement floors in the Bole area with an investment of 82 million Br.

A shareholder at the company, Minassie Wendmagegnehu, says that the company is now in a better position after escaping from earlier issues where it had been paying a notable debt for failed contractors, who it had provided insurance coverage for.

"Sound management strategy and prudent monitoring mechanisms put in place by committed leadership had improved the performance of the company," Minassie told Fortune.

PUBLISHED ON

Dec 14,2019 [ VOL

20 , NO

1024]

Fortune News | Dec 11,2021

Radar | Jul 28,2024

Fortune News | Jul 19,2025

Radar | Dec 04,2021

Fortune News | Feb 29,2020

Fortune News | Jan 05,2020

Fortune News | Jan 05,2019

Fortune News | Dec 29,2018

Radar | Jan 28,2023

Radar | Nov 11,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...