Feb 20 , 2021

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

Claims paid and provided for went down by 19.3pc to 203.4 million Br.

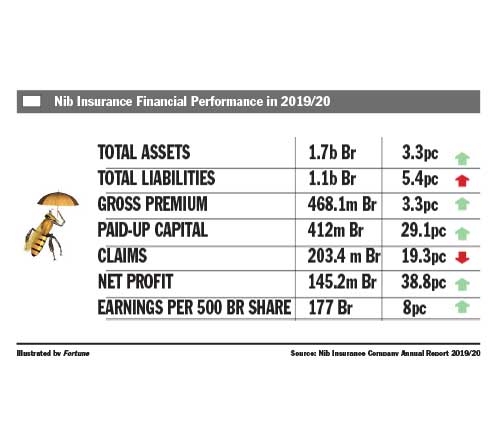

Claims paid and provided for went down by 19.3pc to 203.4 million Br. Nib Insurance, an 18-year-old firm, registered a remarkable leap in profit growth last fiscal year, netting 145.2 million Br, a 38.8pc increase from the previous year.

The massive expansion in profit pushed Nib's earnings per share (EPS), net profit divided by the total outstanding shares, to grow by eight percent to 177 Br.

It is an impressive performance, according to Abdulmenan Mohammed, a financial statement analyst, who adds that the management should be applauded for such an achievement in a time of economic slowdown and tough competition.

Abera Shire, the firm's board chairperson, also says that Nib's performance was remarkable considering the outbreak of Novel Coronavirus (COVID-19) and its impact on the economy and the insurance industry.

Almost half of the last fiscal year was overshadowed by COVID-19 and the pandemic clearly demonstrated the vulnerability of the globally interconnected economies. The containment and isolation measures taken by governments have painful consequences for the economy and for everyday life, according to Abera.

"Keeping this in mind, the company's results are remarkable,’’ said Abera. "This implies that Nib can register a better-than-ever performance again if there is a better playing field in the industry in the future.’’

A prudent policy underwriting style, which targets businesses with less risk; efficient claims management, including opening an office that handles claims and investing in areas with good returns, helped Nib to perform well, according to Zufan Abebe, CEO of Nib.

The main driver for such an impressive profit performance is a significant reduction in claims, reduced commissions payments and improved investment activities.

Claims paid and provided for went down by 19.3pc to 203.4 million Br.

"This is a huge reduction," said Abdulmenan. "The management must have maintained a strong risk-management mechanism."

Though the rate has shrunk, Nib settled major claims, according to Zufan.

Last fiscal year, Nib settled nine million Birr in life and personal claims to the families of four passengers who passed away along with 145 other passengers from 35 countries when a 737 MAX Boeing aircraft operated by Ethiopian Airlines crashed while flying to Nairobi, Kenya.

Gross written premium at Nib has increased marginally to 468.1 million Br, a 3.3pc growth from the previous year. The firm ceded 90.4 million Br of the total premium, leading the retention rate to decline by 2.2 percentage points to 80.7pc.

Despite the reduction, the retention rate was still higher than the industry average, according to the expert.

Commissions from reinsurers increased by 20pc to 38.9 million Br, while the commissions it paid declined by 12pc, reaching 28.5 million Br. Nib's investments in time deposits, savings and government bonds grew by 36.5pc to 119.2 million Br.

Nib did very well in investment activities, which significantly contributed to the improved profit level, according to Abdulmenan.

Expenses on employees’ salaries and benefits rose significantly to 84.6 million Br, a 45.4pc hike. Operating and other expenses also climbed by 11.8pc to 61.5 million Br.

"The increase in employees’ expenses is concerning," said Abdulmenan, urging the management to keep an eye on these expenses.

Nib made huge salary adjustments amounting to double the regular annual raise, according to Zufan.

"We raised employees' salaries due to high staff turnover," she said. "We also increased the transport allowance after the government doubled transportation tariffs because of COVID-19."

At the end of the last fiscal year, the number of Nib’s total branches stood at 41. During the past fiscal year, the 18 insurance companies opened 37 new branches, pushing the total industry's branch network to 605.

The total assets held by Nib increased by 13.3pc to 1.7 billion Br. Of this amount, 599 million Br was invested in interest-bearing deposits, 22 million Br in investment properties and 202.3 million Br in shares and bonds. These investments accounted for 47.5pc of the total assets of Nib.

Ratio analysis shows that the liquidity level of Nib went down in both value and relative terms. Cash and bank balances decreased by 16.5pc to 27.9 million Br. The ratio of cash and bank balances to total assets decreased to 16.6pc from 22.2pc.

Nib operated with tight liquid resources, which could cause a liquidity problem, according to the expert, who advised the management to be careful when operating with such a low level of liquid resources.

Zufan states there was a cash outlay for the under-construction headquarters, which has 18-storeys along with a mezzanine and four basements. Currently, the construction of the four basements, the mezzanine and four storeys has been completed.

The paid-up capital of Nib increased by 29.1pc to 412 million Br. The capital and non-distributable reserves of Nib represent 28.3pc of its total assets.

Habtamu Tesfaye, a shareholder for the past seven years and a former employee at Nib, says that the firm's performance was striking.

“I was sure that the firm would be profitable,” Habtamu said, “but not at this level.”

Habtamu became a shareholder after the management of Nib offered shares to employees. At the time he bought 24 shares with a par value of 500 Br. At the end of the past fiscal year, he had 82 shares through dividend payments and extra investments.

However, Habtamu fears that this level of profitability might not continue in the coming years since there is a price war in the industry as well as different interests from the parties involved in the process.

PUBLISHED ON

Feb 20,2021 [ VOL

21 , NO

1086]

News Analysis | May 25,2024

Fortune News | Jan 01,2022

Exclusive Interviews | Jan 05,2020

Fortune News | Apr 22,2022

Agenda | Jun 15,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...