Radar |

Nib Insurance has carved out a space between industry giants and new entrants in the competitive insurance market. The past year marked a major chapter in its 22-year history as the company surpassed the billion-Birr mark in Gross Written Premiums (GWP).

The London-based financial analyst Abdulmenan Mohammed (PhD) praised Nib's management for this rebound, noting that the 55.8pc increase in gross premium to 1.1 billion Br, along with gains in investment and commission revenues, boosted the insurer's overall standing.

"It's quite impressive," Abdulmenan remarked.

Zufan Abebe, CEO of Nib Insurance, concure. According to her, the firm's performance across key metrics has improved immensely due to well-executed strategies.

Nib Insurance's gross written premium exceeded the private insurance industry average of 903.2 million Br but was lower than United's 1.51 billion Br. It also far outpaced Global's 290 million Br and Lion Insurance's 827 million Br. The firm ceded 343.53 million Br to reinsurers, increasing its retention rate by 4.5pc to 68.9pc. Commission from reinsurers surged by 39.4pc to 106.76 million Br, while claims paid out rose by 56.2pc to 58.21 million Br.

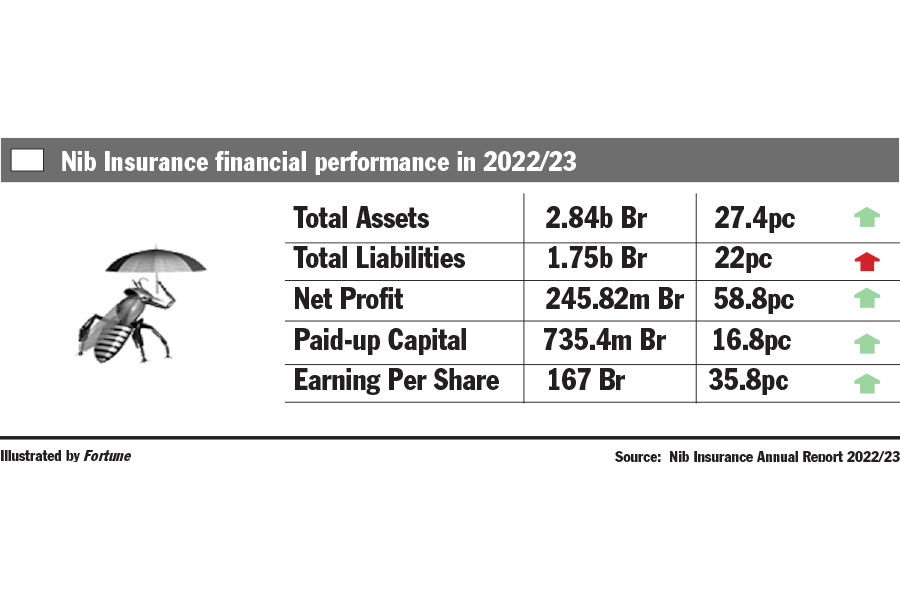

Net profits soared by 58.8pc, reaching 245.82 million Br, placing it in a strong position relative to its competitors. Nib Insurance's profits were nearly four times those of Global Insurance, which posted 67.1 million Br, and Lion Insurance's 70 million Br. However, it still fell behind United Insurance, which reported 327.02 million Br. Earnings per Share (EPS) rose from 123 Br to 167 Br, placing EPS at 33.4pc, marginally below the industry average of 34.2pc.

Nevertheless, it surpassed Lion Insurance's 7.8pc and outperformed peers like Global Insurance, which had an EPS of 30pc, though it lagged behind United Insurance's 47.9pc.

During an annual meeting at Sheraton Addis in February, Board Chairperson Siraj Abdella praised these achievements to the shareholders.

"The achievements could not have happened without your continued support," he told the shareholders.

He particularly cited the restart of the headquarters construction project in Bole District, on a 1,453Sqm plot, which had been delayed due to prolonged negotiations with China Communications Constructions Company (CCCC).

A shareholder, Tamene Lema bought 600,000 Br in Nib's shares 15 years ago.

"Every performance aspect was better this year," he told Fortune.

Although pleased with the increased operational performance and EPS, Tamene voiced concerns about the delayed headquarters building, whose costs have escalated over the years with the contractor demands.

Incorporated with equity raised from 658 founding shareholders over two decades ago, Nib Insurance has doubled its shareholder base to 1,207. Many were pleased to see the firm's paid-up capital increase by 16.8pc to 735.44 million Br, although it falls short of United's 840 million Br and is more than three times the capital of Global (242 million Br) and Lion (244 million Br). Nib's position is further solidified by capital and non-distributable reserves, which account for 30.2pc of its assets.

"Nib has a strong capital that should be used to expand its business," said Abdulmenan.

The shareholders were asked to surrender nearly half of their retained earnings to cover the increased costs. The ongoing construction, with nine floors completed out of the planned 18, has cost 150 million Br for structural work so far.

"Who is going to bear this for us?" Tamene contested.

Zufan attributed the decision to retain half of the net profit for share recapitalisation to a general assembly resolution.

"It's not a gift they bestowed," she told Fortune. "We didn't want to take a loan."

With an economics degree from Addis Abeba University and currently pursuing an executive MBA, Zufan has over 25 years of experience in the insurance industry. She began her career as a trainee underwriter at United Insurance, eventually rising to Deputy CEO. She then held various leadership positions at Nib Insurance and became CEO eight years ago.

Under her watch, Nib Insurance also registered increased claims. During the financial year of 2022/23, it rose by 23.2pc to around 315.1 million Br. Despite this increase, claims were short of 26 million Br by the private insurance industry's average. They were also lower than United's 463.54 million Br, but nearly three times higher than Global's 109 million Br and Lion's 297.9 million Br.

"Increased claims must have accompanied the increase in retention rate," Abdulmenan noted.

According to Zufan, the increase in claims is likely connected to the higher premiums collected to cover risk in an inflationary environment. She disclosed that motor vehicle claims comprise most of the total claims paid out.

Branch managers at premium locations in the capital have observed a decline in policyholders' willingness to buy new insurance products due to high inflation.

Kaleb Grima, who manages the Meganagna Branch, noted a decline in demand for marine insurance policies as the forex crunch tightened its grip on businesses. Kaleb's branch, one of the 52, has focused on corporate clientele, including 3F Furniture, Noah Real Estate, and Great Abyssinia, to address a potential dip in collected premiums.

"Corporate clients were crucial to our premiums," Kaleb said.

Nib Insurance's investment activities also showed a marked increase, with dividends, interest, and other operational revenues rising by 19.9pc to around 155.8 million Br. Close to 161.16 million Br of these assets were held in investment properties, while 24.3 million Br was in bonds from the Development Bank of Ethiopia (DBE), with close to 373.43 million Br in equities and about 627.35 million Br in fixed-time deposits. Investment activities accounted for 41.8pc of the total assets, a slight increase from the previous year's 39.4pc.

Abdulmenan observed the surge as crucial to improving the firm's performance this year, noting that business expansion also led to higher expenses.

Nib's total employee benefits for 420 staff and operating expenses spiked by 24.7pc to 216.78 million Br during the financial year. It is higher than Lion's 173.9 million Br and Global's 184.26 million Br, but markedly lower than United's 299.81 million Br. Total assets also expanded by 27.4pc to 2.84 billion Br, placing it behind United's 3.29 billion Br, more than three times Global's 821 million Br, and moderately higher than Lion's 2.07 billion Br.

Zufan acknowledged the rise in expenses but believes that marketing efforts will eventually boost revenue growth.

Liquidity analysis showed that Nib Insurance's cash and cash equivalents increased significantly, with cash and bank balances growing by 88.2pc to 304.4 million Br. The insurer's cash and balances to total assets ratio also rose from 7.25pc to 10.7pc.

PUBLISHED ON

May 25,2024 [ VOL

25 , NO

1256]

Radar |

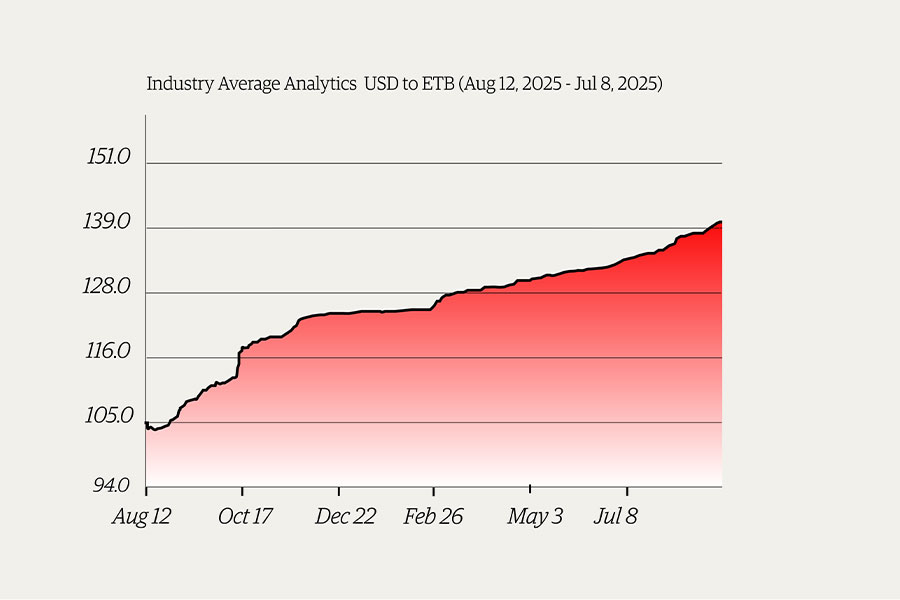

Money Market Watch | Sep 14,2025

Exclusive Interviews | Jan 05,2020

Exclusive Interviews | Jan 05,2020

Radar | Oct 12,2025

Sunday with Eden | Apr 15,2023

In-Picture | Feb 17,2024

Radar | Jun 30,2024

Exclusive Interviews | Jan 24,2023

Agenda | Jun 18,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...