Editorial | Jun 18,2022

Executives of Nib Bank are looking to rebrand the first-generation financial institution's reputation on customer service and address liquidity issues. Upon taking the helm of leadership three weeks ago, Emebet Melese (PhD) wasted no time in terminating 10 high-level executives, including three of her vice presidents. The bold move was taken by surprise in the industry where human capital competition is currently heated up.

The Bank provides daily status reports to the central bank on key account balances, including its advanced fund utilisation. At the core of Nib Bank's crisis is illiquidity. Sources disclose billion Birrs of loan from the central bank with high interest, to honour a commitment to the depositors who are paid a seven percent interest. The general assembly of Nib Bank four months ago was marked by the intercession of senior officials from the central bank such as Belay Tulu, head of Insurance Supervision. He told shareholders that the central bank does not expect Nib's troubles to go away under the existing management.

An internal assessment based on the recommendations of the central bank's ongoing investigation resulted in Solomon Goshime, chief of corporate service officer; Sefiu Agenda, chief of customer & operation officer; Amine Taddese, VP of international banking; Abraham Tesfaye, VP for strategy & marketing; Melkamu Solomon, VP of human capital, Alemu Semaye, deputy chief of banking operation; Shiferaw Argaw, deputy chief of branch affairs, Ephrem Teshome, deputy chief of customer relationship, Sirak Yeferu, director of internal audit, Mulugeta Dilnesaw director of risk & compliance; receiving a letter of termination.

The details have not been made public. However, sources indicate that a seven-membered committee was involved in the assessment by comparing the former executives' activities with the procedure manuals and directives for banking operations by the regulator.

One of the terminated executives question the impartiality of the committee members in charge. He claimed that some of them had unresolved issues with the executives which may have influenced the result.

"We never got to see the report," he said.

Information related to branch performance, bonus payments, loans and contracts with external parties, dating back to three years, was part of the review, according to sources.

Another senior manager who was also let go said adequate information was reported to higher management and regulators at the central bank. He claims everyone was on the same page about Nib Bank's liquidity issues, and the climbing concentration of long-term loans and credit to the construction sector.

"We didn't have a mandate to act but report our findings," he said.

According to Emebet, the assessment began before she joined the Bank.

"The Board Chairman is the one with the details," she told Fortune.

While hitting a 25-year milestone, the Board of Directors Chaird by Shisema Shewakena has begun a spirited campaign to achieve a quick turnaround. Shisema has been exercising a hands-on approach to the Bank's activities since assuming the position. However, he refused to comment during the development of this story.

Industry veterans such as Taye Dibekulu applauded the recent moves while recommending caution. He said the reform is mandatory if the findings reveal a fraud-related case. However, he recommends considering training attempts in case of leadership issues.

"Losing a seasoned banker can be painful," Taye said.

Taye believes starting with a new management team results in a prolonged adoption period that may prove too slow for a Bank looking for a quick comeback story.

To fill the gaps left by the departures, Emebet brought in six veteran bankers, four of which are from her previous employer, the Commercial Bank of Ethiopia (CBE). This new team is expected to take Nib get back on track.

"We hired new management immediately to avoid gaps," Emebet told Fortune.

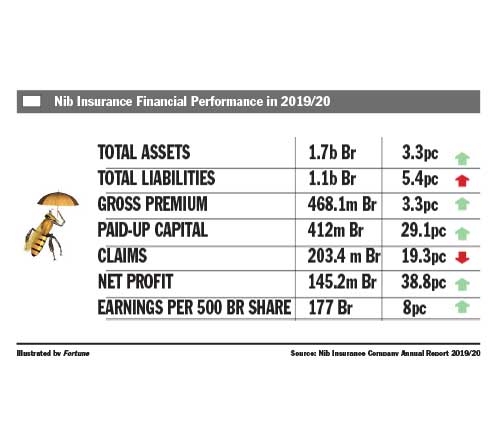

For the past three years, Nib has been facing several issues. The Bank has had difficulty meeting customer demand for cash withdrawals. It also has a high concentration of loans in the construction sector, which has been struggling. These factors have contributed to a decline in its overall performance.

A performance assessment in late 2022 revealed several red flags for Nib Bank. The Bank's CAMEL rating, a key health indicator, was low, while deposit growth lagged far behind the industry average of 28.8pc. Non-performing loans rose to 1.61 billion Br during the first quarter of 2022/23, and the report identified operational issues like slow cheque processing, high fraud, and poor customer service.

However, Nib's troubles partly stem from a liquidity challenge, which resulted in the Bank borrowing around 2.5 billion Br from the NBE amid a serious cash shortage. Cash withdrawals had become a source of frustration for many customers last year as withdrawals of more than 5,000 Br took prolonged periods to handle.

These problems likely contributed to the Bank's decision to shake up its leadership in hopes of regaining its footing. Nib's new leadership team is determined to improve customer service and address liquidity issues; only time will tell if their efforts will be successful.

PUBLISHED ON

[ VOL

, NO

]

Editorial | Jun 18,2022

Fortune News | Dec 19,2020

Fortune News | Apr 10,2023

Radar | Aug 25,2024

Fortune News | Oct 02,2021

Fortune News | Oct 05,2019

Fortune News | Oct 17,2020

Fortune News | Feb 20,2021

Radar | Apr 30,2021

Radar | Jan 15,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...