Radar | May 28,2022

Nov 20 , 2021

By HAWI DADHI

Nassir Alemayehu runs a retail shop in Merkato. He was one of the first clients to enrol three months ago as a merchant on Telebirr. A mobile payment platform launched earlier this year by the state-owned Ethio telecom; 7,300 merchants have joined it.

Nassir's experience with customers proves a long way to go before the platform attains as much popularity as Mpesa has garnered in neighbouring Kenya. Nassir faces resistance from customers when he tells them to use TeleBirr for transactions. On average, he sells 1,000 Br worth of goods a month through the platform.

"Not a lot of people are aware of it," he said. "But it's easy to use."

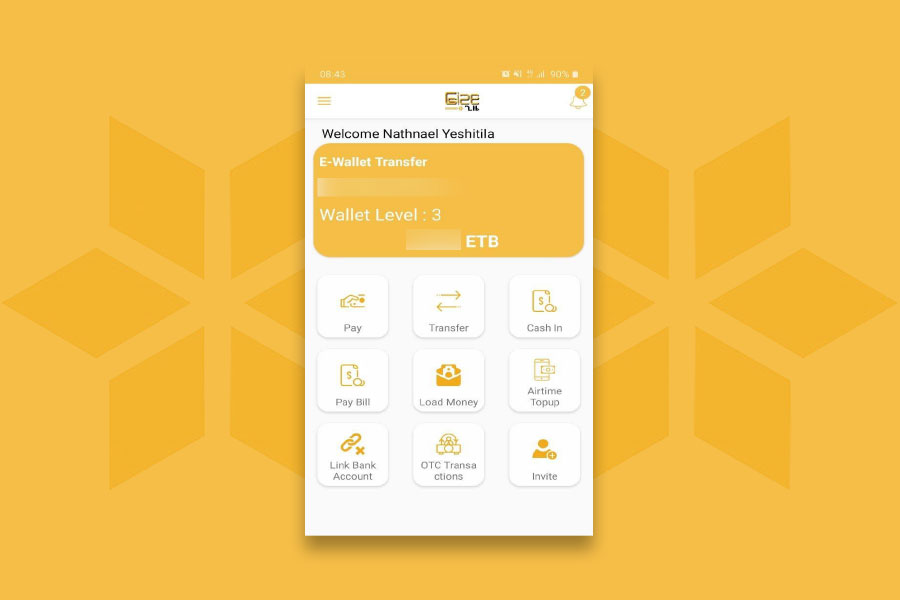

Mobile banking and money users have seen exponential growth in recent years. Telebirr allows users to buy goods and services as well as pay bills, but these account for a small part of the business conducted on the platform. Transactions remain significantly personal transfers of cash and mobile top-up payments. Fund transfers and airtime top-ups dominate the two billion Birr in transactions registered through the Telebirr platform thus far.

Telebirr is not the only player in the digitised market. More than two dozen mobile banking, mobile wallet, and mobile money outlets fight to get users' attention, but none sway as much as the state-owned Commercial Bank of Ethiopia (CBE) and Ethio telecom. Close to 25 million mobile money accounts have registered, with Telebirr claiming a user base of 11.2 million and the CBE commanding 5.4 million users on its CBE-Birr platform.

A visit to one of its branches shows how much effort the banking industry puts in charming customers to use digital banking outlets. Determined customer service officers try to persuade clients to register for mobile banking and money services. The numbers show their efforts have not been in vain. The CBE accounts for over 40pc of the 14.5 million users on mobile banking.

However, mobile money users have surpassed mobile banking users after Telebirr was launched in March this year. There were only seven million users with registered mobile money accounts in 2020.

Three years ago, mobile money services almost wholly relied on digitising mobile top-up services. The trend is shifting, but service providers have to create more enticing applications for users, according to officials at the National Bank of Ethiopia (NBE). One of the strategies the regulatory body aims to push is shifting public and private payments to digital payment outlets. There has been some progress as bill payments for electric, water, and vehicle-related payments have been integrated into several mobile banking and money services.

Regulators at the NBE's payment and settlement department attribute the slow growth trajectory in mobile money services to the non-existence of a legal framework that allows fintech and non-financial institutions to operate in the market. Two directives launched last year to govern fintech are aimed at increasing the number of players.

Experts agree that these services cater to fund transfers and mobile top-up because customers have a few compelling reasons.

One of these experts is Tewodros Tassew, who studied business administration at Gonder and Jimma universities before joining Belcash. He had worked for seven years as a director for product managment and service delivery.

Tewodros sees bank executives as having an inadequate understanding of mobile money. He says that most solutions they provide do not offer any more utility to the customers than their mobile banking systems. Nonetheless, there is growth, particularly with mobile banking outlets, which hosted an aggregate 320 billion Br in transactions over the last fiscal year.

The CBE's mobile banking outlet transacted more than 44 billion Br last month, double the figure from the same period last year. The value of transactions made to over 38,000 merchants was 157 million Br, 10 times more than what was recorded in October last year.

However, of the total transactions of one billion Birr through CBE-Birr made last month, only 37pc has gone towards utility and merchant payment.

Officials see that the absence of incentives for merchants and users is a major challenge to the growth of CBE's mobile money platform.

This should be expected, according to Tewodros. Usually, transactions are dominated by top-ups and fund transfers at this stage before integrating payment systems to digital service providers such as ride-hailing services.

Unlike other countries where telecom firms hold the reins, the mobile money market has been bank-led without a legal framework. Safaricom and Vodafone have jointly run the M-Pesa mobile money service in Kenya since 2007. It has expanded to Tanzania, Mozambique, and South Africa since recording over 15 billion transactions last year alone.

Experts believe that a telecom-led mobile money market offers more options to users. The experience of other services that were initially conceived to facilitate payments tells a slightly different story.

Dashen Bank's Amole mobile wallet has about 3.5 million users. The application was not geared towards money transfer, instead focused on bill payments, according to Kassaye Eshetu, director of alternate channels at Dashen. However, the app still accepts fund transfers, and the volume of these transfers is comparable to bill collection.

Ethio telecom has also noted the need to diversify the options on Telebirr.

"We're strategically partnering with different system owners and integrating," a statement the company issued reads. "We can activate more merchants as use cases for our customers to encourage digital payments."

The resistance customers exhibit that Nassir experienced remains a challenge for services providers to overcome. The quick shift from cash-based transactions to digital has been bumpy for those in the mobile money game, including Ethio telecom.

"We've done our best to address these challenges by adding various encouraging incentives," reads a response from the telecom operator.

Other digital banking services, such as mobile transfers and ATM use, are thriving.

EthSwitch, a national switch operator incorporated by the central bank and commercial banks a decade ago, recently launched a system that allows interbank transfers. Over 45,000 transactions with a value of 480 million Br were made last month. Over 4.7 billion Br in interbank ATM card transactions was recorded over the same period.

Nearly all transactions from the 30 million debit cards issued by commercial banks were used for cash withdrawals. It represents seven times larger than transactions made last month through the 10,000 interbank point-of-sales (POS) operations that registered 61.8 million Br, according to data from EthSwitch. POS are heavily concentrated in high-end service providers and are mainly catering to international debit cardholders.

"It's too early to tell whether card payments or mobile money is the better option," said Tewodros.

PUBLISHED ON

Nov 20,2021 [ VOL

22 , NO

1125]

Radar | May 28,2022

Radar | Jan 05,2019

Advertorials | Jun 05,2023

Fortune News | Dec 04,2022

Radar | Jan 14,2023

Fortune News | Jan 16,2021

Fortune News | Mar 13,2021

Radar | Mar 18,2023

Editorial | Oct 19,2019

Addis Fortune Press Release | Oct 04,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...