Featured | Sep 28,2019

Small-scale gold miners will receive higher premiums for the bullion supplied to the central bank should regulators support findings on the feasibility of offering greater value to artisanal miners.

The National Bank of Ethiopia (NBE) pays these miners five percent above international gold prices. The premium goes up to 29pc for miners that supply over the five-kilogramme threshold.

The last two years have seen a marked rise in the central bank's buying rate, as global prices shot up beginning in mid-2019. The central bank had offered a little over 1,200 Br for a gram of 23 karat gold with near complete purity. The rate has more than doubled since reaching 2,900 Br (not including premiums) last week. The buying rate for a gram of 14 karat gold with half the purity has seen a similar increase to 2,000 Br over the same period.

International prices hover near 60 dollars a gram.

Officials at the Ministry of Mines say the adjustments to the buying rate and premiums have curbed contraband trade, encouraging small-scale miners to sell directly to one of the nine gold transaction centres.

Five years ago, less than half of the gold extracted by the miners was marketed through the formal channel – sold to the central bank for export. Instead, most of the mineral made its way to neighbouring countries smuggled before reaching markets in the Middle East, particularly in the United Arab Emirates (UAE). Modern gold mining was first introduced to Ethiopia in the 1930s, discovering gold deposits in the Bedakesa Valley of the Adola area in the south.

Formal export revenues fell to 28 million dollars four years ago. Beginning last February, experts at the Ministry of Mines and regional mining bureaus have been conducting a study on the viability of offering higher premiums to small-scale miners targeting contraband trade, which is still valued in the millions of dollars.

The study proposed to extend the premiums to miners who supply over one kilo of gold. Close to two-thirds of the gold shipped abroad annually is sourced from artisanal miners.

“The study is in its final stages,” confirmed Takele Uma, minister of Mines.

Miners operating in three weredas of Benishangul-Gumuz Regional State, including Kurmuk and Sherkole, were covered under the study. It aims to boost productivity, incentivising miners, according to Nasiru Mohammed, head of Benishangul-Gumuz Mining Bureau.

The regional state trailed behind the Oromia Regional State in gold output last year, with miners there extracting over two tonnes of the precious metal. It contributed to the 672 million dollars earned from gold exports last year, a whopping 242pc jump from the previous year. The revenues stand at 458 million dollars over the first three quarters of this financial year.

Artisanal miners have extracted close to seven tonnes of gold over the same period. Close to 550 associations engaged in small-scale gold mining in Benishangul-Gumuz supplied a little less than a third of the volume to the central bank, earning over six billion Birr. It shows how important artisanal mining is for the gold extraction industry, which comprises 90pc of mineral exports from Ethiopia. The share of gold they produced jumped from 0.82 million grams in 2018 to 3.18 million grams two years later.

Sitina Adele, 43, had served as a public service employee over the past 15 years. Last year, the mother of three decided to cut short her career in the civil service and join an association mining for gold in Sherkole Wereda. Sitina works as a sales representative for a 14-member association, employing 10 daily labourers to extract gold using metal detectors, jackhammers, and a generator. The tools are a long way from traditional mining methods, which involve digging pits and panning soil.

Although mining is labour intensive with high overhead costs, most associations hold on to the gold they extract until they can meet the central bank's premium thresholds before they cash in.

“However, some are forced to sell the small quantity of gold they extract to cover operational costs and support their families," she told Fortune.

Sitina and her colleagues are among the 1.26 million people engaged in small-scale gold extraction. They support an estimated five to seven million livelihoods, with an aggregate output accounting for less than one percent of its gross domestic product (GDP).

Kefyalew Girma, general manager of Waki Engineering Plc, in geotechnical and geological studies, applauds the efforts to lower thresholds and up premiums. He observed that more needs to be done as artisanal miners hesitate to use formal channels over the contraband market considered lucrative.

“The minimum volume miners are allowed to sell should be reduced further to encourage small-scale producers,” said Kefyalew.

Last year, regulators at the central bank quintupled the minimum weight threshold to 250g.

Minister Takele told Parliamentarians last week the state-owned Commercial Bank of Ethiopia (CBE) will begin buying from mines in the Somali Regional State, a hub for the contraband gold trade. The CBE has been collecting gold on behalf of the central bank since 2011.

The study may require more time to complete before forwarded to the central bank for review, disclosed Nasiru of the Benishangul Mining Bureau.

PUBLISHED ON

May 28,2022 [ VOL

23 , NO

1152]

Featured | Sep 28,2019

Radar | Apr 03,2023

Fortune News | Apr 29,2023

Fortune News | Apr 03,2023

Radar | Jul 18,2021

Commentaries | May 31,2020

Fortune News | Jan 29,2022

Fortune News | Apr 25,2020

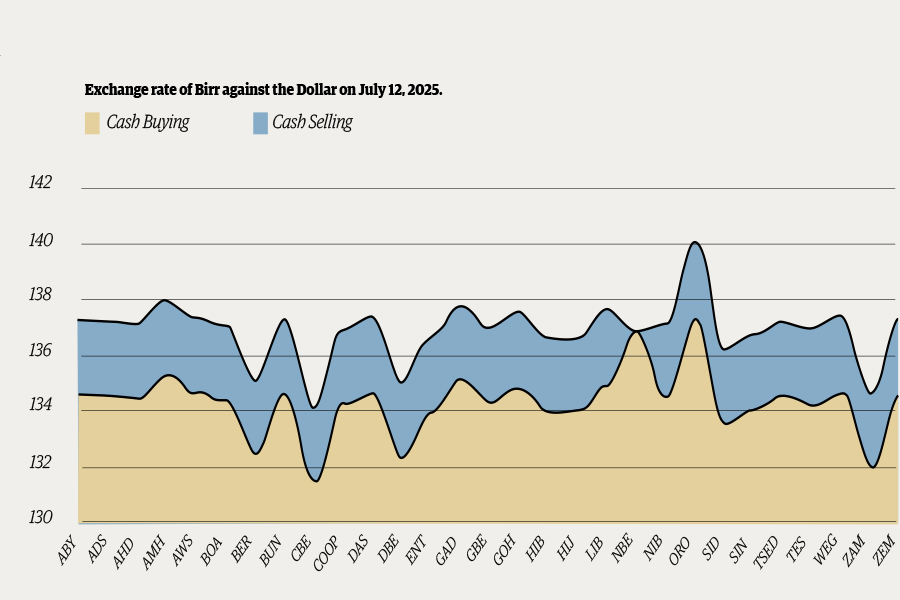

Money Market Watch | Jul 13,2025

Radar | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...