Fortune News | Dec 05,2018

One of the younger insurance firms, Lucy Insurance Company, has reported a 26 million Br net profit in the last fiscal year, which makes for a 60pc increase.

Named after Lucy, the 3.2 million-year-old hominid, the insurance company has been reporting profit growth for the past three years.

Increase in interest income and underwriting surplus are the major sources of profit growth, according to Abdulmenan Mohammed, a financial professional at Portobello Group in London.

The six-year-old insurer underwrote 43 million Br in the fiscal year, a 40.8pc increase from 2016/17. Interest from time deposits soared to 16.5 million Br, a 37pc increase.

The CEO of the insurance company agrees with Abdulmenan's view.

“We have increased our premium production efforts and managed the claims,” said Tefera Wondimu, the CEO of Lucy.

The dividend paid to shareholders reached 244 Br/share, a 33pc increase from the previous year's performance report.

The dividend has risen as net profit surges are coupled with a modest increase in paid-up capital, according to Abdulmenan.

The positive outcome was recorded after challenges, according to vice chairperson of the insurance firm, Abayneh Kebede.

“Lucy finds itself amidst a stiff and cutthroat competition,” the vice chairperson stated in his message to shareholders in the annual report. “However, the company is managing to withstand the competition.”

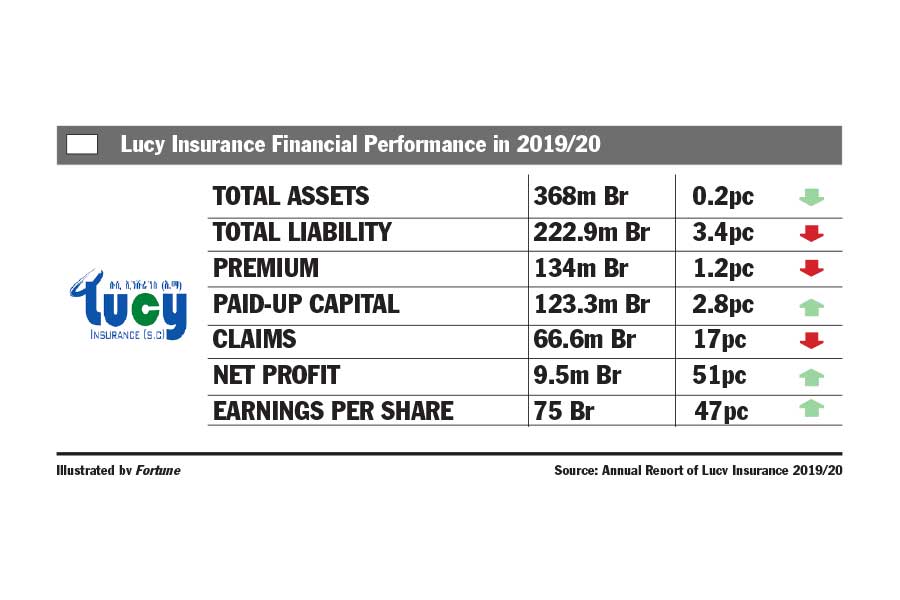

The total assets of the company also jumped by 34pc and reached 330.2 million Br. Half of it was held in interest-earning deposit accounts while 34.7 million Br held in shares at different companies. Its investment in interest-earning takes 59pc of the total assets.

Last year the firm underwrote 128 million Br in premiums and covered 29.7 billion Br in risk. From its total coverage, motor insurance contributes 57.8pc of the portfolio followed by liability and financial insurance.

The surge in premiums was paralleled with an increase in claims. The company paid out 60.7 million Br in claims, posting a 23.4pc increase.

“Compared with its previous year’s growth, the current increase is reasonable,” Abdulmenan pointed out.

Lucy's earning from reinsurers' commission has declined by 9.7pc to 7.1 million Br.

“It declined as we have retained more risk,” Tefera argues. “With the increase in capital, we are now able to handle more risk.”

The report also affirms that the retention ratio of Lucy has declined by 1.6 percentage points.

“The result on retention is very impressive,” Abdulemnan told Fortune.

The expansion in business was accompanied by a surge in operational and commission expenses.

Expenses for its 157 employees' salaries and benefits soared by 82.8pc, reaching 28 million Br. The firm also opened an additional four branches.

The company made a salary adjustment last year. “To compete with the market, we have made salary and scale adjustments in the period,” Tefera told Fortune.

“Lucy should monitor the growth of expenses, so that they are held at an acceptable level,” Abdulmenan suggested.

Looking at the liquidity analysis, Lucy has improved its liquidity level in value terms. The cash and bank balance soured by 13pc to 27.5 million Br.

The firm’s capital increased by five percent to 104 million Br. The wealth and the none-distributable income reached 34pc of total assets.

“Lucy is a well-capitalized insurance company,” Abdulmenan said. “It should use its strong capital efficiently, instead of expanding its capital further.”

Lucy's performance has received a positive affirmation from its shareholders. One of its shareholders, Addisu Habba, who had been with the company for four years, says the firm’s result is satisfying.

“This year's performance is praiseworthy,” he told Fortune.

PUBLISHED ON

Dec 05,2018 [ VOL

19 , NO

971]

Fortune News | Dec 05,2018

Fortune News | Dec 27,2018

Agenda | Oct 13,2025

Fortune News | Jan 26,2019

Viewpoints | Dec 25,2021

View From Arada | Sep 08,2024

Radar | Oct 05,2025

My Opinion | Jan 07,2022

Fortune News | Feb 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...