Fortune News | Feb 20,2021

Apr 22 , 2022

By HAWI DADHI

The insurance industry scrambles to acquire core insurance systems following a demand placed by the regulatory authorities that financial institutions fully automate their business operations.

The National Bank of Ethiopia (NBE) recently issued a compelling directive for banks, insurance firms and microfinance institutions (MFIs) to implement an automated financial management solution. Becoming enforceable this month, the directive outlines general information technology management requirements for financial institutions the national bank regulates.

The national bank has granted insurance firms two years to complete the transition. Acquiring a system requires buying the hardware and establishing a system environment, including a robust database.

Ethio-Life & General Insurance is about to complete the migration to automated services, signing a deal to acquire a financial system from an international supplier. The US-based Beyontec developed the firm's system for 30 million Br, selected from a pool of five global system providers. Infusion, 3i-Infotech, Informatics International Ltd, and ASSECO Poland were the other contenders.

Capitalised with 200 million Br, Ethio-Life is Beyontec’s first client in Ethiopia. It has been providing services manually since it began operations in 2008 as one of the second-generation insurance firms. Its executives plan to implement the system in 10 selected branches and grow to include all the 28 branches in four months, according to Dagimawi Hailu, the project consultant at Ethio-Life.

The automated system allows all the departments to link one another and process workflows in real-time.

“We'll be able to integrate all our branches, clients, authority [central bank], and re-insurers,” Dagmawi told Fortune.

Ethio-Life, owned by 1,300 shareholders, provides life and general insurance policies to 3,000 clients. The insurer has 1,300 shareholders.

Its executives expect the automated system to create ease for customers, allowing them simple access to information on premiums and policy renewal. Clients will also be able to make claim requests by logging into the system and following up on the process remotely, receiving updates through text messaging, according to Nebiyu Ephrem, IT department manager.

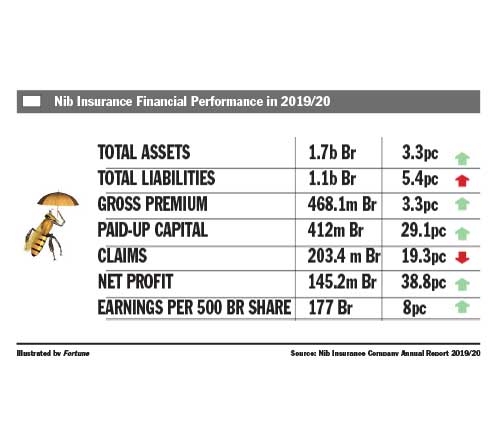

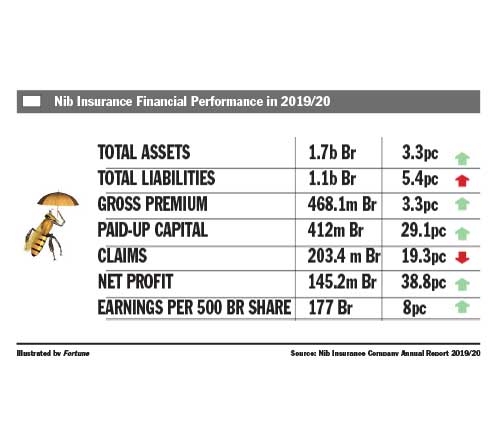

The banking industry has already transitioned into automated service provision, with all banks having adopted core banking technologies. A few insurers, such as Awash, United, Nib and Africa, have acquired core systems. United Insurance, an industry veteran incorporated in 1994, is the first to implement a core insurance system. It bought its first system, dubbed PREMIA, over a decade ago.

United is working on upgrading the existing system, according to Aliye Mohammed, IT manager.

"There's no question of its importance," said Aliye.

The upgraded system will incorporate end-user solutions such as mobile application functionality.

"It'll also include IFRS reporting tools," said Aliye.

These reporting solutions help in decision making and submissions of reports to the national bank. It is challenging to generate and submit frequent reports to the central bank using manual operations, says Aliye. Several companies find it challenging to implement these services due to the nature of the business and the high investment amount to acquire a system.

Awash Insurance, the most capitalised in the industry, on-boarded Infusion Software Development Plc, an Indian software supplier, in November 2014 to deploy its system. Bunna Insurance had started a bidding process to buy a core insurance system before the national bank issued the directive in early March. The bid is expected to close at the end of this month. Zemen Insurance, the youngest in the industry, called for an expression of interest earlier this month. It is scheduled to close next month.

Berhan Insurance is following suit, preparing to acquire a system. A bid will be floated soon, according to Yoftahe Mekonnen, manager of IT services. Last year, Berhan registered 45 million Br in gross profits from its operation with two dozen branches.

The absence of local technology providers is a significant setback. Access to foreign currency to buy, upgrade and cover maintenance fees keep troubling decision-makers in the financial sector.

Eskinder Mesfin, chief executive officer (CEO) of Asiibez Consulting, is an IT expert working in the sector for 13 years. He attributed the high investment to the sophisticatedness of banking system modules and the high-security risks. According to the expert, local IT firms with the capacity to provide specialised services are absent.

"Local capacity has to develop," said Eskinder. "But it'll take time."

The central bank has issued similar requirements for all 38 microfinance institutions. They have been granted a three-year transition period to comply. Recently, two dozen have adopted a shared core banking system deployed by the Association of Ethiopian Microfinance for three million dollars. The system has been in the making for three years, supported by the International Fund for Agricultural Development (IFAD), which covered more than half of the development cost while the institutions paid for the balance.

Dire Microfinance Institution and Dynamic Saving & Credit are among the project's beneficiaries.

Eskinder observed a gap in technology as a driver of business rather than orders by regulators.

"There's a means to recover the initial investment, even though it is high," he said.

PUBLISHED ON

Apr 22,2022 [ VOL

23 , NO

1147]

Fortune News | Feb 20,2021

Advertorials | Jan 02,2020

Exclusive Interviews | Jan 05,2020

Commentaries | Jun 19,2021

Agenda | Nov 20,2021

Fortune News | Oct 30,2021

Verbatim | Aug 30,2025

Viewpoints | Oct 14,2023

Radar | Aug 01,2020

Radar | Dec 02,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...