Headline inflation, an indicator of the cost of living, stagnated at 10.9pc last month, according to the latest report from the Central Statistical Agency (CSA).

Last month's Consumer Price Index (CPI), which quantifies the price of a basket of goods and services, states that the rate had shown the same growth as the preceding month, January.

The report indicates that the food inflation rate in the stated period reached 10.7pc, a 0.8 percentage point decline from the previous month.

"Prices of wheat, rice, barley and sorghum have shown slight declines," reads the report, "on the other hand the price of fruit, meat, milk, cheese, eggs, butter, spices, Teffand maize increased last month."

In February non-food inflation has shown a percentage point increase that reached 11.2pc. The rate was pushed by the price increases in narcotics and stimulants, especially khat, clothing, footwear, house rent, housing repair and maintenance, energy and automobiles.

A mini-market assessment conducted by Fortune revealed that the price of automobiles, especially Toyota Vitz models, has shown an average a 12pc price increase.

While the inflationary pressure in Ethiopia has remained in double digits, Kenya managed to keep the rate in the single digits at 4.14pc. Kenya's inflation rate in February has shown a 0.6 percentage point decline from the preceding month, according to tradingeconomics.com,a New York-based statistics and data provider.

Though the rate stayed in the double digits for the past three months, the government has only managed to bring the rate down to the single digits, 9.3pc, in November of last year, but it jumped into double-digit territory the following month. Yet the rate is still lower than last fiscal year's average rate of 14.4pc.

Getachew Asfaw, an economist who has published several books on the macroeconomic conditions of the country, attributes the lessening of inflationary pressures on the current economy to a fall in demand.

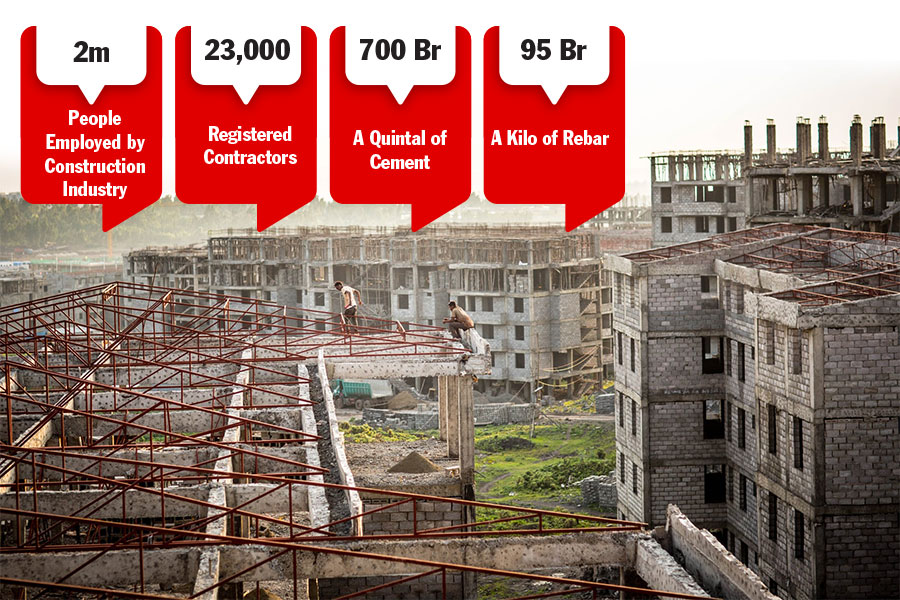

"The construction industry has gone slow in recent months," said Getachew, who served in the former Northern Ethiopia Regional Planning Office, the former Ministry of Planning & Economic Development and later the Ministry of Finance & Economic Development (MoFED).

Last month's address by the Prime Minister to the parliament affirms the expert's assertion.

"We have targeted to control the inflation rate by cutting government expenditures and investments in mega projects," Prime Minister Abiy Ahmed (PhD) told the members of parliament last month.

The expert fears that the government's policy on measures to control the inflation rate could negatively affect the unemployment rate as the two need opposite policy measures.

"When the government stops investing in mega projects and the construction industry," said Getachew, "the number of unemployed in the country increases."

Better control for the rate hike that Getachew recommends is that the government balance the two opposite policies.

"Controlling the inflationary pressure while keeping unemployment lower is the basic thing that needs to be achieved," he concluded.

Last month's report by the Agency is the third since it revised the base year for inflation rate measurements that quantify the price of a basket of goods and services. The revision was made eight years after the previous update.

PUBLISHED ON

Mar 09,2019 [ VOL

19 , NO

984]

Money Market Watch | Apr 27,2025

Agenda | Mar 11,2023

Viewpoints | Jul 13,2024

Viewpoints | Oct 08,2022

Fortune News | Jul 06,2019

Radar | Dec 11,2021

Fortune News | May 20,2023

View From Arada | Jul 09,2022

Fortune News | Feb 19,2022

Agenda | Jun 25,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...