Editorial | Feb 10,2024

Jan 9 , 2021

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

The prices consumers paid for widely used goods and services in December clocked in at 18.2pc higher than a year ago, marking this fiscal year's lowest rate. The inflation rate registered a 0.8 percentage-point dip compared to the previous month, according to the latest consumer price index (CPI) from the Central Statistical Agency (CSA).

The survey, which measures the average changes in the price for a basket of goods and services, indicated that food inflation stands at 21.3pc, a 1.1-percentage-point slide from the previous month. Non-food inflation came in at 14.3pc, a slight 0.8-percentage-point decrease from the rate registered in November. Though the Agency reported that inflation has eased, the cost of living showed no improvement.

Vegetables and some pulse types registered a decrease in their prices, while the costs of sugar, edible oil, potatoes and coffee surged, according to the Agency.

The rise in non-food inflation is mainly attributed to the price spike in alcohol and tobacco; khat; housing repair and maintenance; energy; medical care; and jewellery, especially gold, the report indicates.

December’s month-on-month general CPI, a measure of the difference in prices from the preceding two months, has shown a decline of 0.1pc compared to the value recorded in November.

December's rate also stood lower than last fiscal year's average inflation rate, which registered at 19.9pc. For the current fiscal year, the government targets to confine the rate to the single-digits at 9.5pc. However, since July, the rate has been swinging between 18pc and 22pc.

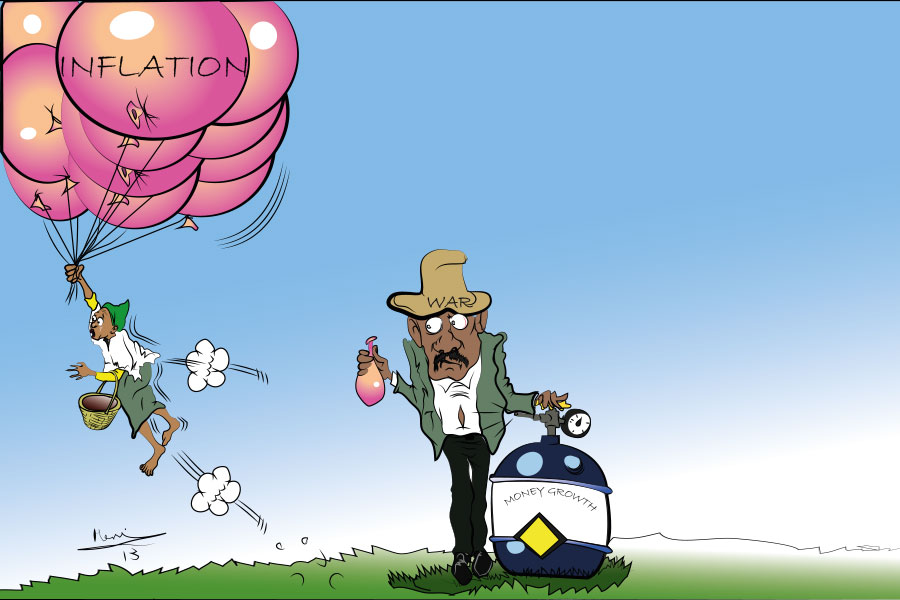

Along with a severe foreign currency shortage and a high unemployment rate, mounting inflation has been the major challenge that is battering the country's economy. Over the past decade, the nation's headline inflation rate averaged 14.4pc, driven by 15.2pc food and 13.7pc non-food inflation rates, respectively.

The 10-Year Perspective Plan, which was recently approved by the Council of Ministers, targets to limit the inflation rate to a single-digit figure. The Plan details that the government will use fiscal and monetary policies as instruments to keep the rate within the planned range.

One of the mechanisms suggested in the Plan is balancing demand and supply. It also states that the government would cover the budget deficit from the sale of treasury bills (T-Bill) both in the primary and secondary markets. Limiting the broad money supply and base money supply to an annual growth rate of 21pc and 19pc, respectively, are also among the tools that the government plans to apply to manage the inflationary pressure in the coming decade.

The figure from the Agency just shows the incremental change, and the real figures are higher, according to Wasihun Belay, an independent consultant with a decade of experience.

"And the report from the Agency just gives an inception concept, not the full picture," said Wasihun. "It should be detailed and give full information."

Wasihun argues that the Novel Coronavirus (COVID-19) has brought many changes in the market, such as leading consumers to cut the consumption of some items in the basket of goods and services in the CPI. He adds that the holiday season and the opening of schools bring demand for some items such as furniture products and back-to-school kits.

"Giving a detailed report will help us to understand the circumstances beyond the numbers," he told Fortune.

Beyond comparing the prices with the same month of last year based on a base year, the Agency should also compare prices between two consecutive months, according to Wasihun. He added that, while analysing market data, the Agency should also benchmark a year when the economy was under favourable conditions.

"This can help the policymakers to understand the economic impact and configure policy instruments," he said.

PUBLISHED ON

Jan 09,2021 [ VOL

21 , NO

1080]

Editorial | Feb 10,2024

Fortune News | Feb 11,2023

Fortune News | May 20,2023

Fortune News | Aug 10,2019

Editorial | Aug 28,2021

Radar | Jun 01,2024

Viewpoints | Jan 09,2021

Fortune News | Jan 28,2023

Fortune News | Jul 08,2023

Fortune News | Nov 07,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...