Fortune News | Sep 06,2020

Dec 7 , 2019

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

The non-food inflation rate registered the highest swell with a three-percentage-point rise at 16.4pc. Food inflation has also marked a 1.3-percentage-point increase to reach 24.5pc.

The non-food inflation rate registered the highest swell with a three-percentage-point rise at 16.4pc. Food inflation has also marked a 1.3-percentage-point increase to reach 24.5pc. Headline inflation, the indicator of the cost of living, continued creeping up for the fifth consecutive month, hitting the highest rate in five years.

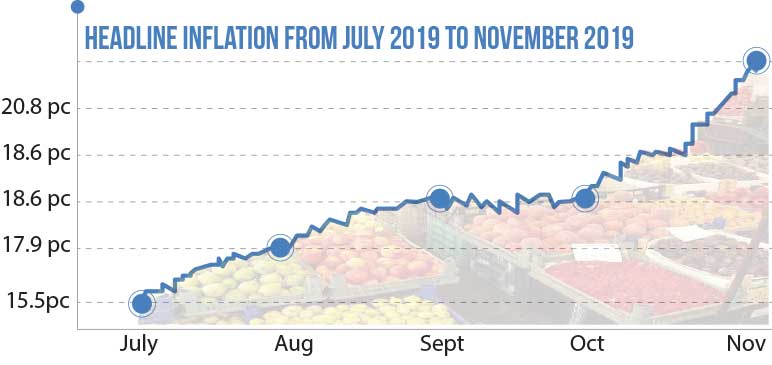

The rate jumped by two percentage points to reach an annualized rate of 20.8pc in November, according to the latest Consumer Price Index from the Central Statistical Agency (CSA).

The non-food inflation rate registered the highest swell with a three-percentage-point rise at 16.4pc. Food inflation has also marked a 1.3-percentage-point increase to reach 24.5pc.

The rate has been steadily increasing for the past five months and hit the highest figure in five years next to 22.2pc, which was registered in 2014.

Increases in the price of the major cereals, including teff, barley, sorghum and injera, has pushed the food inflation rate up. The price of beef also continued to grow in the last month, though the increases were not as exaggerated as in the previous months, according to the report.

Some of the food items such as wheat, bread, tomatoes, onions, garlic, potatoes, cabbage, carrots, lentils, butter, edible oils, milk, cheese and eggs showed a slight decline during the month, which helped the slowdown of the growth rate of monthly food inflation figures.

The rise in the prices of clothing and footwear, house rent, housing repair and maintenance, and energy household goods and furnishings, health care and automobiles caused the jump of the non-food inflation rate, according to CSA.

The growth of the headline inflation rate is accelerated by two major factors, according to Alemayehu Geda (Prof), a renowned macroeconomist and university lecturer.

Food supply is lagging behind demand, according to Alemayehu, and this might be worse after the upcoming harvest season, since agricultural productivity might fall due to the latest desert locust attack and untimely rain.

The second reason is the money supply in the economy, according to Alemayehu.

"Despite the promise of Prime Minister Abiy Ahmed (PhD)," said Alemayehu, "the government did not reduce the money supply in the economy, which is still growing by an annual rate of 30pc, similar to the former rate."

In terms of non-food inflation, the main reason that pushed the rate spike is the shortage of foreign currency, Alemayehu added.

"The forex crunch is making imported goods expensive," he toldFortune.

Concerned with the rise of the rate, the macroeconomic committee chaired by Prime Minister Abiy Ahmed (PhD) formed a task force a few months ago. The task force is mandated with assessing the causes of the rate spike and coming up with possible recommendations to drag down the rate. So far, it has forwarded a couple of policies to ease the pressure of food inflation.

Following the recommendations, the Ministry of Trade & Industry, the city's Trade Bureau and the Ministry of Finance have been trying to engage consumer unions in the distribution of food products. These 622 unions have 887 shops, butcheries, warehouses, schools and bakeries.

The government is also trying to involve the Ethiopian Trading Business Corporation and Ethiopian Fruit & Vegetable Marketing S.C. (ETFRUT) to buy food products from the market and sell to consumers at a reasonable price. The other major change introduced by the government lately is allowing importers to get involved in the import of major food items like oil, sugar and wheat, which have previously been reserved for the state and only a few private individuals.

The Ministry of Trade & Industry and the city's Trade Bureau are also working on establishing trading centres at the main gates of the city. The centres are aimed at enabling the farmers to directly sell their products to consumers. This policy is aimed at excluding the intermediaries in the market.

Cepheus Growth Capital, an equity firm operating in the country, is optimistic, saying that the rate cannot grow further.

The worst is over, and November's figure will mark the highest inflation rate for the rest of the fiscal year, according to the inflation outlook forecast from Cepheus.

Cepheus felt confident in making this forecast, "since month-on-month price changes have now turned negative for the first time in over a year and harvested crops are gradually beginning to enter national food markets," according to the report from Cepheus.

"We project inflation will remain in the mid- to low-teens up to the first quarter of 2020 but then show a marked decline thereafter," reads the report. "Our projection for June 2020 is a year-on-year inflation rate of 10.3pc."

Alemayehu differs on this, and he fears that in the coming two months there are two dangerous sources of high inflation.

The informal creeping devaluation of Birr against the basket of major currencies in the past couple of weeks and the lifting of the 27pc mandatory NBE Bill purchase for the private banks would potentially aggravate the inflation rate to grow, according to Alemayehu.

"The banks will use the money for credit expansion that will bring inflation,'' he said.

Alemayehu recommends the government employ a monetary policy to offset the increased inflationary pressure and make the banks lend the money for longer projects.

PUBLISHED ON

Dec 07,2019 [ VOL

20 , NO

1023]

Fortune News | Sep 06,2020

Fortune News | Oct 05,2019

Featured | Aug 29,2020

Fortune News | Aug 08,2020

Agenda | Sep 04,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...