Commentaries | Aug 05,2023

May 4 , 2019

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

The report indicates that food inflation rate reached 14.5pc, a three percentage point increase, while non-food inflation remained at 11pc, marking a slight rise of 0.2 percentage points.

The report indicates that food inflation rate reached 14.5pc, a three percentage point increase, while non-food inflation remained at 11pc, marking a slight rise of 0.2 percentage points. Headline inflation, an indicator of the cost of living, soared to 12.9pc last month, marking the highest rate in eight months.

The index has shown a 1.8 percentage point increase from the preceding month, according to data from the Central Statistical Agency.

The report indicates that food inflation rate reached 14.5pc, a three percentage point increase, while non-food inflation remained at 11pc, marking a slight rise of 0.2 percentage points.

“The rapid increase of food items has contributed to the rise of general inflation,” reads the report.

Last month, price increases were observed in all cereals, vegetables and fruits, which contributed to the rise in food inflation, according to the report. The prices of foodstuffs whose demand increases during the holiday season, including meat, milk, cheese, eggs and butter, have also shown an increase.

The month of April is known for food price increases, since it is a fasting and holiday season, according to Getachew Asfaw, an economist who has published four books on the macroeconomic conditions of the country.

“Vegetables and fruits have higher prices during the fasting season, and the price of meat and eggs will sour on Easter,” Getachew said.

Easter saw a price increase in chicken ranging between 350 Br to 500 Br, while eggs were sold from four Birr to five Birr apiece. The price of a kilogram of butter has also climbed to between 350 Br to 400 Br.

Though the growth rate is marginal, non-food inflation also increased due to a rise in the price of khat, clothing and footwear, house rent, housing repair and maintenance, energy, health care and transport, especially automobiles.

Standing lower than last fiscal year’s average rate of 14.4pc, April’s inflation rate is the highest since August 2019, which saw a rate of 14.2pc.

Over the past eight months of the current fiscal year, the government was using different monetary policies, stringent fiscal policy and import and distribution of basic consumer commodities as a strategy to control the inflationary pressure, according to Yinager Dessie (PhD), governor of the National Bank of Ethiopia (NBE).

“However, the rate hit double digits due to the price increase of commodities in the global market and the imbalance of local demand and supply,” Yinager said last month at the parliament in his report of the macroeconomic situation of the country.

To decrease the rate to single digits, the Bank will continue to implement stringent fiscal and monetary policies along with administrative measures, Yinager advised.

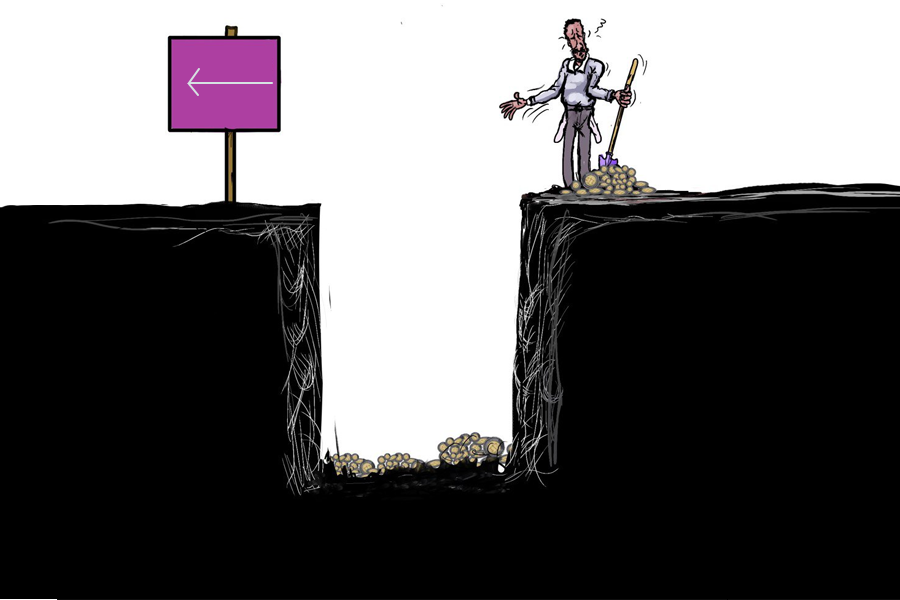

However, Getachew sees the cause of the rate of growth from a different perspective, saying that the retail market has a structural problem.

“Most of the time retailers don’t have an economic justification when they make price increases,” he says. “The price changes are not made following demand and supply analyses.”

The buyers also accept such price amendments without being responsive, according to him.

“We’re not observing long queues at butcheries when the price of a kilogram of meat was 100 Br,” Getachew said. “Now long queues are normal when the price of meat has grown by over three-fold.”

PUBLISHED ON

May 04,2019 [ VOL

20 , NO

992]

Commentaries | Aug 05,2023

Agenda | Sep 04,2021

Advertorials | Jul 31,2024

Radar | Nov 16,2024

Radar | Dec 21,2019

Fortune News | Jun 07,2020

Radar | Nov 20,2021

Editorial | Mar 18,2023

My Opinion | Jun 29,2024

Commentaries | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...