Fortune News | Jun 23,2019

Jul 18 , 2020

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

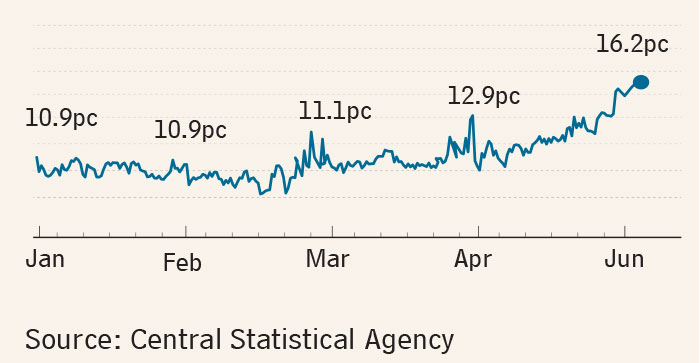

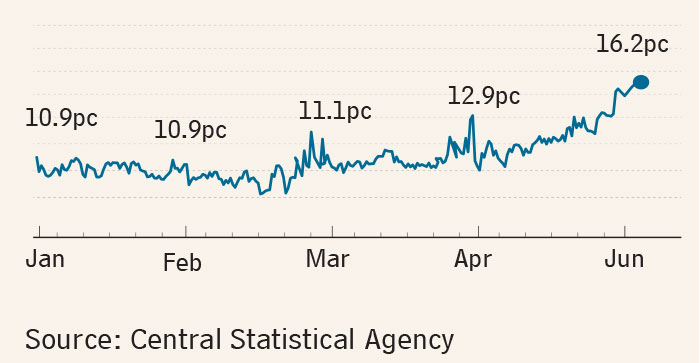

Headline inflation, an indicator of the cost of living, showed a two-percentage-point rise in June, reaching 21.6pc, according to the latest Consumer Price Index from the Central Statistical Agency (CSA).

The rate has been revolving around 21.8pc and 22.9pc in the last five months, registering the highest value in seven years next to the 22.9pc that was marked as an annual average for the 2012/13 fiscal year.

In June, the last month of the just ended fiscal year, food inflation registered a considerable three-percentage-point swell to 23.1pc, while non-food inflation recorded a slight increase of 0.7 percentage points to 19.7pc.

Most cereal and vegetable prices continued to rise during the last month and are the main drivers of food inflation, according to the report.

Vegetables, especially onions, garlic and tomatoes, registered a rapid increase in their price in the last month. Bread, maize, wheat and rice showed stable situations in some regions, according to the report.

“Whole black pepper has also continued to increase following the trend of previous months,” reads the report.

The rise in inflation in the non-food components was also steadily increasing mainly due to the rise in the prices of alcohol, tobacco, khat, house rent, housing repair and maintenance, energy, firewood, charcoal, transportation and medical care.

Alemayehu Geda (Prof.), a macroeconomist and a university lecturer at Addis Abeba University, is highly skeptical of the figures from the Agency, saying that there is no way that food inflation would go down in the months between April and August.

“The crop supply during this season only covers four percent of the total annual agricultural commodities supply of the country,” he said. “Non-food inflation would also be high due to import disruptions caused by COVID-19 and the depreciation of the Birr.”

Even though the figure is accurate, the rate is still very high, according to Alemayehu.

For the newly started fiscal year, the administration plans to lower the headline inflation rate to 9.8pc. During the just ended fiscal year, the annual average inflation rate stood at 19.9pc, one of the highest marks. The government also projected the economy would grow by 8.5pc in the new fiscal year.

The administration is on the wrong path in using exaggerated and unrealistic data, according to Alemayehu.

Two weeks ago Prime Minister Abiy Ahmed (PhD) announced that the country's nominal GDP stood at 3.4 trillion Br. However, the data from the National Bank of Ethiopia shows that the nominal GDP of the country stands at 2.2 trillion Br, according to the expert.

“It’ll make them believe that the economy has capacity for them to prepare an expansionary budget,” he said.

For the coming fiscal year, the government allocated 476 billion Br for the federal budget, intending to cover 64pc of it through domestic revenues including taxes. About 19.6pc of it will be covered through foreign assistance and loans, while domestic borrowing is expected to contribute 16.4pc of the budget.

After the government noticed that they could not cover the budget from tax revenues, it will start to look for loans and domestic borrowing to cover the budget deficit, which are both inflationary, according to him.

“The figure might double in the coming months,” he said. "There will be hyperinflation."

For the coming budget year, the government expects a budget deficit of 125 billion Br, which is planned to be mainly covered from the sale of treasury bills amounting to 50 billion Br.

This might not even be doable since the open market operations in Ethiopia operates with idle money, instead of sucking the money out of the economy, according to Alemayehu.

“Out of the total treasury bills availed by the government, 80pc of it is purchased by the pensioners’ agency, which is idle money,” he said.

Since the Public Servants Social Security Agency is not allowed to invest the money of pensioners, it only buys treasury bills from the central bank. In the 2018/19 fiscal year, the Agency had 137.4 billion Br worth of outstanding bills with the central bank.

Aggressive work on domestic production, such as wheat and teff, as well as making necessary consumer products available to the public at a reasonable price, like the Sheger Bread provided through consumer unions, could help the government to somehow control the inflationary pressure, according to Alemayehu.

“They should also cut capital expenditures,” he said. “At this moment, the country doesn't need to invest in mega projects such as parking lots, stadiums and parks.”

The government should also partially use loans it gets from donors to import basic consumer commodities, according to the expert.

"It'll help the government to avoid imported inflation and minimise the impact of the inflationary pressure that could be the result of the weak power of the Birr against the dollar following the latest exchange rate creep," he said.

Alemayehu also believes the Agency has to directly report to the parliament, switching from the existing executive organ.

"This might make the Agency more transparent and accountable," he told Fortune.

PUBLISHED ON

Jul 18,2020 [ VOL

21 , NO

1055]

Fortune News | Jun 23,2019

Editorial | May 03,2025

Agenda | May 20,2023

Commentaries | Jun 15,2024

Agenda | Jun 25,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...