My Opinion | Mar 04,2023

The Toronto-based mining multinational Allied Gold Corporation has received board approval for a two-phase advancement of its expanded Kurmuk Project, slated to become the largest gold mining project in the country.

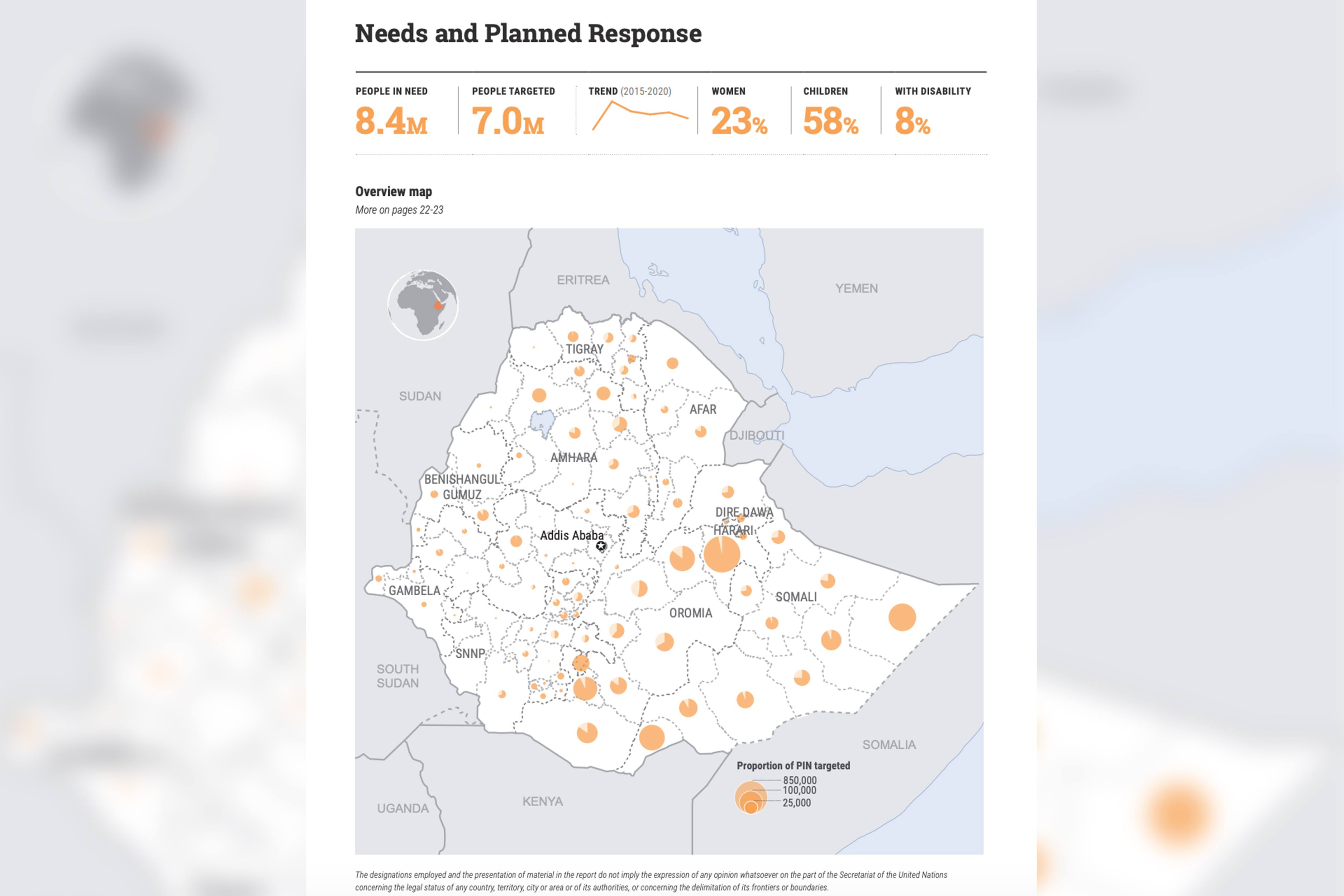

Based in Benishangul Gumuz Regional State, 763Km from Addis Abeba, the project requires over 500 million dollars in development capital. The company has committed 185 million dollars to be spent over the next year and a half for the project's first phase development plan during its inaugural board meeting in September.

The mineral producer has ongoing projects across African countries such as Mali, Egypt and Côte d'Ivoire at different stages. Its total operation costs over the 12-year life cycle of the mine are estimated to reach around 1.8 billion dollars, according to the annual report presented to the Toronto Stock Exchange (TSX).

Allied's listing on the Toronto Stock Exchange four weeks ago resulted in it raising 267 million dollars in Canada's largest mining initial public offering since 2010; with a market capitalisation of 970 million dollars on the first day.

The Kurmuk Project entails a 4.4tn a-year processing plant that will produce close to 2.4 million ounces over a 12-year mine life based on a definitive feasibility study completed in 2022 on the Dish Mountain and Ashashire deposits in Benishangul Gumuz.

Its top brass, including CEO Peter Marone, are mostly former Yamana Gold shareholders, which was sold for 4.8 billion dollars to Pan American Silver last year.

They expect to start early works by the end of the year and target to reach commercial production in a couple of years despite setbacks due to the presence of artisanal miners, which had posed a security threat to exploration efforts.

Allied acquired the exploration license for Dish Mountain from ASCOM Mining Ethiopia Plc in 2017, while the Ashashire licence followed a year later from Aurigin Resources Inc.

A large-scale mining license was granted to the Kurmuk in 2021 for the 100sqkm site located five kilometres from the Sudan border. It was accompanied by a two-decade-long development agreement that entails a 25pc corporate tax and five per cent royalty fees with the Ethiopian government.

Allied, which holds three other exploration licenses around the mining site, completed the accretive acquisition of the minority interest previously held by APM Investment Holdings Ltd (APM) in September, consolidating 93pc ownership with the remaining held by the state.

The acquisition included the issuance of over 11 million common shares at a price of 4.45 dollars for an aggregate value of 52 million dollars.

Ethiopia's largely untapped gold resources have attracted the attention of several international investors over the years, who have filed for exploration and mining licenses with mixed success.

The country only has one active large-scale gold producer for the past quarter of a century, run by MIDROC Goldmine Plc, in Lega Dembi, Oromia Regional State. The site has been a source of public outrage due to its environmental damage.

With hopes of incentivising targeted investors, a wave of reforms was put forth by the National Bank of Ethiopia (NBE) last month, which effectively removed foreign exchange controls for large mining projects.

The decision has been welcomed by prospective investors and industry insiders.

"It will help us become a preferred attraction for investments," said State Minister for Mines Million Matheos. He indicated that the investors will be confident to engage in projects such as foreign currency convertibility guarantees that entail dividend repatriations and loan repayment assurances.

While lauding the series of reforms, Million acknowledged the significance of the Kurmuk project both in its scope and proven reserves. He confirmed that decades of exploration had taken place in the project area, marking it as a promising undertaking.

"It will most likely become the largest gold producer in the country," he told Fortune.

Ethiopia’s gold reserves are estimated at 200tn, according to the Extractive Industries Transparency Initiative (EITI), a global standard for monitoring oil, gas, and mineral resources in over 57 countries.

The reserves have attracted several foreign investors throughout the last two decades despite few managing to grow into the production stage.

London-based KEFI Gold & Copper Plc is the only other large-scale gold mining company with promising prospects for its 390 million dollar Tulu Kapi project at Wellega Zone of the Oromia Regional State. Despite setbacks due to security issues, it had recently received extensions on its license from the Ministry of Mines.

Within the next five years, officials contemplate hosting two large-scale gold mines which help reel back on exports that showed a 64pc decline. It has been nearly two years since the Kurmuk project received its mining license from the Ministry for the project slated to begin production by 2026.

Tsehay Mulugeta, head of legal affairs at the Ministry, indicated that expectations of when a company should begin production differ depending on the nature of the mineral and the location of the deposit despite a maximum of five years.

Tsehay referred to the recent allowance of offshore accounts as responsive to investor interests and indicative of an accommodating regulatory environment.

"We don't expect someone who is moving mountains to immediately start producing," he told Fortune.

Experts have consistently maintained the importance of effective implementation of the country's laws for sustained growth of the sector.

Wondemagegnehu G. Silassie, a seasoned expert in Ethiopia's mining industry, stresses the necessity for stable mining laws to attract more investment in the sector. While he considers the recent move by the central bank to be a positive step, he underscored the importance of predictability in regulatory oversight to attract investments.

"Effective implementation of laws is necessary," Wondemangehu told Fortune in reference to issues that arise with artisanal mining. He indicated that mining licenses are exclusive by their nature, entailing restricted access according to the law despite their challenges in implementation.

PUBLISHED ON

Sep 30,2023 [ VOL

24 , NO

1222]

My Opinion | Mar 04,2023

Radar | Mar 20,2021

Radar | Jul 13,2025

Fortune News | Jun 05,2021

Radar | Oct 31,2022

Fortune News | Feb 23,2019

Radar | Oct 26,2025

Fortune News | Jun 01,2019

Fortune News | Mar 13,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...