Editorial | Feb 05,2022

Lights beamed down the hall, changing colors every few minutes and glittering against the stage where several business people sat on a panel to fire up a dimly lit crowd. Emmanuel Birba was one of these panelists gathered at the closing of the second edition of a forum organised to mobilise resources to fill Africa's enormous gap in infrastructure financing.

A native of the Caribbean, the tall and young Birba told his audience, dealing with Africa should not be seen as “a one-night stand.” The crowd murmured, some with hysterical laughter. From a panelist who sat next to him: “You can't dream big and invest small in Africa.” Another won applause from the gathering when declaring, “If you aren't in Africa, you aren't in business.”

The message appeared to have hit home, judging by the over 2,200 people from over 25 countries assembled inside the Sandton Convention Centre of Johannesburg, South Africa, for the Africa Investment Forum, who appeared to have taken this statement literally. Two weeks ago, they were there shopping for viable projects in Africa, whether in energy, infrastructure, transport or logistics. Equally, there were as many representing African countries but determined to pitch their respective projects, chasing capital moving around the world.

The absence of Ethiopians was glaring though.

Not one individual from either the public or private sector was in attendance - spare a diplomat from Ethiopia's embassy in Pretoria - missing out on the 52 transactions made in 72 hours that were estimated to value 40.1 billion dollars. A project to build a 2.6-billion-dollar sky train in Ghana's capital of Accra raised 600 million dollars in equity; the largest was a liquid natural gas pipeline from Mozambique to Japan projected to cost 25 billion dollars.

Mozambique's Prime Minister signed a deal during the Forum for one billion dollars in financing with its creditors. When completed, the project will position this impoverished southern African country to claim four percent of the global market share for LNG exports.

Ethiopia would have remained obscure at the sole market for capital on the continent if it was not for a lone project pitched by Birba, a chief financial officer for Tulu Moye Geothermal Operations Plc. A subsidiary company of the French Meridiam Infrastructure Africa Fund, managed by Thierry Deau, the company raised the initial investment of 58 million dollars, alongside Reykjavik Geothermal, an Icelandic company that owns 49pc of Tulu Moye.

The geothermal power project in Tulu Moye, a couple of kilometres from the town of Itteya, is one of the two such plants ongoing in Ethiopia. Ethiopian Electric Power has already commissioned a Chinese company to drill wells for a similar project in Aluto Langano, in the Rift Valley.

The project, initiated almost three years ago, aspires to generate 520MW of electric power from a geothermal source when the four phases are completed at a location bearing the company's name, 100Km southeast of Addis Abeba in Oromia Regional State. The company hired a Kenyan company last month to begin drilling for the construction of the plant, whose first phase is hoped to generate 50MW of power to be sold to Ethiopian Electric Power through a power purchase agreement signed in 2017.

This first phase alone will cost the company 250 million dollars, two-thirds of which its managers hope will come from debt and equity. Birba was busy in Johannesburg two weeks ago, meeting potential investors in one of the six boardrooms where deals were actively pursued. He met no less than six prospective investors, including those from the European Investment Bank and the African Development Bank (AfDB), the latter the organizer of the Forum.

“Africa is bankable,” declared Akinwumi Adesina, president of the AfDB. “It's impatient for development. It's like a bride.”

Finding a groom for this bride is found to be tasking; and bridging the financing gap to pay for mega projects in Africa, such as Tulu Moye, no less daunting. It is estimated to reach as high as 130 billion dollars, although few experts put this number much further than 40 billion dollars. Yet a staggering 1.8 trillion dollars held by global institutional investors searches for bankable projects across the world.

Africa, with over half a billion young people, is perceived as a high-risk destination for investment and viewed as a continent in perpetual need of development aid. Changing this narrative remains the Achilles' heel of those who have taken the burden of promoting Africa as the “new and confident continent” ascribed by Adesina.

Africa should not be a place for “a billion dollars in development assistance” but a market for “trillions of dollars in investment,” according to Neven Mimica, the outgoing EU Commissioner for International Cooperation & Development.

“It's an exciting time for Africa,” said Mimica, whose institution has allocated 60 billion dollars in funding to provide loan guarantees for businesses in the continent hoping to create more than 10 million jobs in five years. “We have to do more and faster.”

The bullishness of these leaders within and outside of the continent was evident during the Forum where “doing more but not enough” sinks deep in their conscience. Only in its second year, the Forum managed to see a 44pc increase in deal value from the 32 billion dollars signed last year. Close to 100 million dollars of that amount was signed between Ethiopian authorities and AfDB, in the presence of President Sahle-worq Zewdie, to finance rural electrification.

Nonetheless, there is a noticeable departure in how projects should be financed in Africa, from public investment-driven like the rural electrification in Ethiopia to private-led projects such as Tulu Moye. The buzz phrase inside a series of panels and corridors or media briefings was the “private sector.” Investors were urging leaders in attendance, such as Rwanda's Paul Kagame and Ghana's Nana Akufo-Addo, to open their eyes to private sector investment in public infrastructure.

“Infrastructure should not be the preserve of governments,” Adesina cautioned them. “The Bank [AfDB] promotes the public-private partnership model.”

But there is a need to structure it very well, according to Ini J. Urua (PhD), senior vice president of the African Finance Corporation (AFC).

"Yes, it does pay," Urua told Fortune. "We finance infrastructure, and we haven’t lost money."

Public infrastructure financing in Africa surpassed the 100-billion-dollar mark, for the first time, an increase of 24pc from last year. States in the continent claim 33pc of this, while China`s commitment reached 65pc. Mainly made on energy, transport, as well as water and sanitation, the investments from the private sector were close to 12 billion dollars. And that is mostly made in South Africa, a host for the annual Forum, which had attracted no less than four governors from Nigeria, competing to get a slice of the massive amount of investment.

Many speak highly of the Forum as an effective venue for raising capital. They see it as an ideal investment ecosystem to get things done and close deals. For Sanjeev Gupta, executive director at the Africa Finance Corporation (AFC), the Forum represents “aggressiveness, adaptability and activeness.” His take was evidenced by Mebarek, an investor from Egypt, who has had 75 meetings in three days and raised half a billion dollars in equity. Making deals at the Forum requires “discipline, process and rigor,” Mebarek told an enthusiastic crowd.

Adesina echoed his views of the Forum, which is not a political but an investment platform, whereby a lot of preparation is required.

The preparations Birba made to pitch Tulu Moye as a project worthy of their investment was not the first when it was presented inside one of the boardrooms two weeks ago. Last year, his company's officials met the same prospective investors, selling the project idea and raising the necessary equity.

The geothermal power project in Tulu Moye, a couple of kilometres from the town of Itteya, is one of the two such plants ongoing in Ethiopia. Ethiopian Electric Power has already commissioned a Chinese company to drill wells for a similar project in Aluto Langano, in the Rift Valley.

Confident of his encounter with the prospective investors, Birba has high hopes that by next year there will be a financial closing to secure close to 80pc of the 800 million dollars needed to finance the plant that will generate 150MW of power in its first phase. Of this investment, 60 million dollars will go to pay for the drilling work by KenGen that comprises 12 wells, each 2,500m deep. Work is scheduled to begin in January 2020.

The successful implementation of the project will see the generation of 50MW of electricity begin in September 2022 and an additional 100MW two years later.

PUBLISHED ON

Nov 23,2019 [ VOL

20 , NO

1021]

Editorial | Feb 05,2022

Viewpoints | Jan 25,2020

Radar | Oct 26,2019

Commentaries | Mar 25,2023

Fortune News | Mar 09,2019

Viewpoints | Aug 16,2020

Fortune News | Dec 01,2024

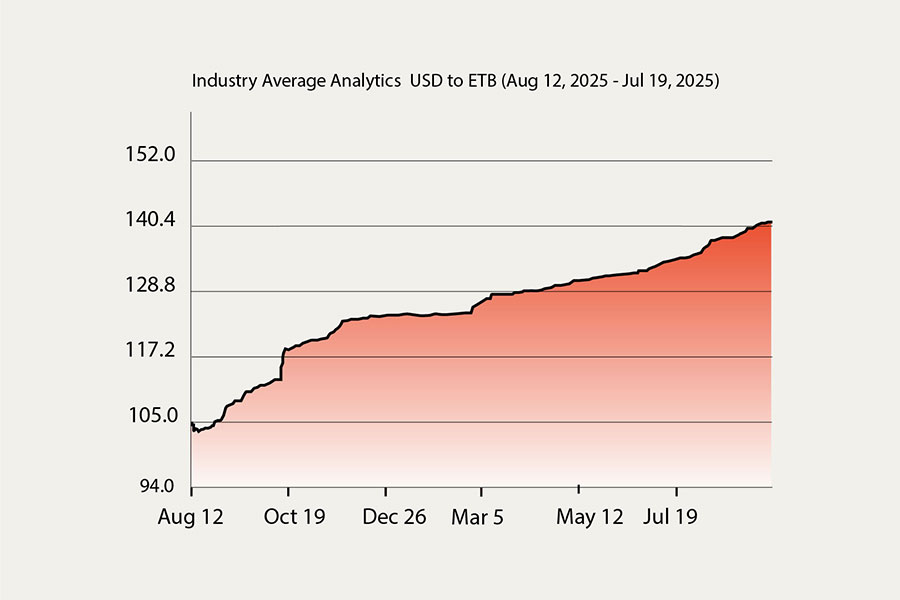

Money Market Watch | Sep 27,2025

Fortune News | Aug 10,2025

Editorial | Aug 18,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...