Radar | Jan 03,2021

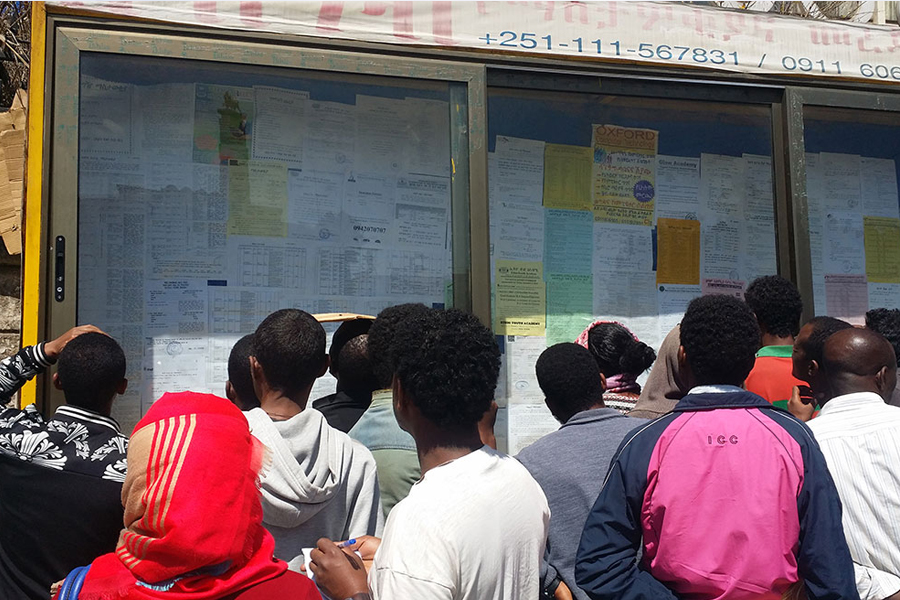

Last week saw thousands of young individuals queueing at three branches of the Development Bank of Ethiopia (DBE) in the capital to register for the fourth round of a five-day "business training". Many were lured by the hope of gaining sizeable loans without collateral, contingent upon undertaking the training and coming up with a plausible business proposal.

The thirst in the young entrepreneurial community to kick start their business careers was evident as turns in the queue were sold for money as high as 1,000 Br.

On a mid-day one of the weekdays, Roman Mohammed joined the ambitious people waiting in a long line at the Kazanchis branch of the Bank. He had been waiting to register for nearly five hours, taking a leave of absence from work where he earns a 5,000 Br gross salary. Completely in the dark about the program, Roman believes he is getting an interest-free loan, which serves its best interest. Hearing his colleagues fussing about the opportunity to start a business, he came to take the training without giving much thought to what he planned to do.

"I'll figure it out after the training," he said.

The registration method demanding applicants' presence raised questions by many, witnessing the long chaotic queue. For Yeabsira Nigussie, a spokesperson for the Bank, the absence of electronic registration is designed to measure the degree of commitment. He believes millions would register online without an actual interest in engaging in the training otherwise.

Following the gathering of a large "committed" crowd for registration, the Bank has extended the deadline for another four days.

Meanwhile, informed applicants, such as Yahya Abdusemed, are returning home, leaving the scene frustrated by the long line. The young man in his mid-20s is ambitious about joining the agricultural sector. His older brother had already taken the training before this and adequately briefed him on what to expect. After learning about the fourth training from the Bank's social media platform, he decided to try his chances. He plans to return and see if the situation improves in the last few days.

According to Yeabsira, close to 300,000 people have registered in the four rounds. He said the five-day training would help applicants develop the necessary skill to create business plans and submit qualified proposals.

Lease financing issued by DBE will entail the purchase and renting of capital goods (machinery) at a yearly service charge of nine percent. The financing modality is open for new and running businesses within the priority sectors such as agriculture, agro-processing, tour operation, mining and construction.

The projects need a capital range between half a million Birr and 7.5 million Br while contributions by the Bank will not exceed more than 80pc of the total equity as the recipient will need to cover running costs such as salaries. Grace periods for payments of service fees will not exceed six months.

This differs from the modality mentioned by the Bank President, Yohannes Ayalew (PhD), a month ago to a maximum of 1,000 businesses. At a panel discussion held at the Science Museum, he revealed to an audience of prospective entrepreneurs that the bank had prepared about 80 million dollars for "idea financing". He also said a televised national process of ideas being pitched to a panel of judges would ultimately provide seed money.

The support for startup business ideas is better late than never, as a new report by Sub Stack indicates that Ethiopia mobilised one billion dollars less than its neighbour Kenya funding startups in the past year.

The report, which compiled data on startup financing in Eastern Africa, demonstrates that Ethiopia managed to facilitate a mere six million dollars which translates to 0.5pc of the total fund for the region, while Kenya issued a staggering 1.16 billion dollars. Tanzania, Uganda and Sudan have managed to flow more funds to startups.

The Assistant Professor of Finance at Addis Abeba University, Sewale Abate (PhD), predicts startups will fall short of funding until the capital market becomes operational. He argues since the banks have a five percent nonperforming loan threshold, they cannot afford to give high-risk loans with long payback periods.

"Commercial banks have zero appetites for risk," he told Fortune. He said they would risk seizure by the central bank if they engaged in high-risk speculation with the deposit of customers.

According to the expert, the only policy bank in the country expecting to address the national demand for seed funding is not pragmatic. He said Venture Capital, Angel Investors, Hedge Funds, and Mutual Funds are the types of financial institutions that can afford to give out high-risk loans to startups and can exist only in an operational capital market.

Sewale describes the shortage of loanable funds due to the absence of capital markets as an unfortunate inevitability that renders Ethiopia falling behind in startup funding.

The frustration with the entrepreneurship ecosystem led to the establishment of the Ethiopian Youth Entrepreneurs Association (EYEA).

Karemenz Kassaye, the co-founder and vice president, said most of his friends left the country, fed up with the system. In his 30s, he had attempted to launch multiple products in his quest for financial freedom, with most crumbling due to a lack of access to capital.

He reasoned that the banks hardly show a willingness to provide capital without collaterals, which startup businesses do not have. Karemenz considers most banks to operate in an outdated and highly risk-averse model regarding credit facilitation, lacking competent management that can asses the value of innovative ideas.

"They neither understand what startups are nor what entrepreneurship entails," he said with a defeated tone. He hopes the Association will at least serve as a voice for the frustrated youth dragged along by the empty promises of politicians and grossly incompetent bureaucracies.

Ethiopia falling behind its neighbours in startup funding is not surprising to him as the mere registration and acquisition of business licenses and getting startup funds are hindrances for most new companies.

His peer Khalid Mohammed concurs. The founder of an e-commerce company called 'Jimla Tera' that folded last year was not the least bit surprised at the indications of the Substack report.

"Startup funding only exists in theory here," he told Fortune.

His company hoped to create a digital link between mass producers within regional states and sellers in the capital. All credit institutions require assets as collateral; an idea is an asset that the banks fail to recognise as one, said Khalid. He believes the lack of integration between government bureaus makes registering a new digital business impossible. The startup was cut short, shut down its offices in Seka Building around Merkato, and the young group of colleagues went their separate ways after being run down by the system or lack thereof.

Abenezer Engida is the CEO of Wuijo, a digital 'equb', a traditional saving mechanism much like a mutual fund which hands out the collected capital to members one after the other. Wuijo was founded two years ago with a paid-up capital of 250,000 Br. Optimistic that capital markets will open, he and his four friends pitched in their savings to launch and fund a company that aspires to mobilize 50 million Br through the entry of foreign banks and venture capital firms as the financial sector opens up.

Abenezer believes expecting finance from the banks is not a feasible strategy.

The Director of credit portfolio management at Birhan Bank, Bereket Teketel, believes the lack of valuable security by most startups and the absence of competition between banks in credit facilitation contribute to the issue. He admits that banks will always prefer low risk with high return. On the contrary, startups are usually small and risk-prone.

He underscores that banks have an extensive portfolio of customers with collateral to select from and the incentive to engage with customers with no assets and little experience in managing a business is just not there.

Recognising the problem, the Ministry of Innovation & Technology drafted a new start-up innovation fund directive awaiting ratification. Selamyihun Adefres, director general of innovation & development research, acknowledged classification in the business community between a start-up and a Small and Medium Enterprise had been an issue. He forecasts the opening up of capital markets and the ratification of the directive will fill some of the gaps. The directive will also address funding availability, allowing angel investments and venture capital to fuel start-ups.

"Their absence is why Ethiopia lags," Selamyihun told Fortune.

PUBLISHED ON

Jan 28,2023 [ VOL

23 , NO

1187]

Radar | Jan 03,2021

Fortune News | Feb 22,2020

Radar | Sep 28,2019

Fortune News | Oct 01,2022

Fortune News | Aug 17,2019

Commentaries | Feb 22,2020

Viewpoints | Jul 07,2024

Fortune News | Dec 19,2021

Radar | Sep 18,2023

Agenda | Jul 22,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...