Agenda | Oct 17,2021

Federal authorities increased prices on various fuel products last week, making a record-high jump never seen before in pumping stations.

As the news made its rounds that benzene and diesel would see price increases, drivers in Addis Abeba were seen rushing to gas stations on the evening of December 8, 2021. It was a last-ditch attempt to fill their tanks before retail prices increased the following morning. Several fuel stations had already closed by the time the announcement was made, inclined to sell off their stock the next day at the significantly higher prices of 31.74 Br a litre for benzene and 28.94 Br for diesel. The changes represent a 23pc and 25pc increase.

However, a few stations, such as one in the Addisu Gebeya neighbourhood run by Ephrem Tesfaye, a Petroleum Dealers' Association board member, were open.

“I could have gained a lot more had I closed the station early and sold my stock the next day,” he told Fortune.

Sales volumes were much higher than usual, up to 19,000lt during the last shift, more than double the figure on a regular day.

Last week's increase would not make the retail price of gas the highest in dollar terms. In 2014, a litre of benzene was sold for 0.89 dollars, compared to the current price of 0.64 dollars, a similar price seen in 2018.

However, the upsurge resulted in Ethiopia moving nine steps down to 23rd on the list of countries with the lowest retail prices for petroleum products. Though the scale of the change has come as a shock, fuel prices are on the rise across the globe, hitting non-oil producing countries hard. Two weeks ago, petrol prices in India, the world's third-largest consumer of crude oil, hit a record 1.43 dollars a litre, while in France, the price of a litre of diesel reached a new high of 1.55 euros.

Japan's retail prices also climbed by 20pc to 1.44 dollars a litre last week.

Consequently, increasing global demand and skyrocketing international market prices are the culprits.

The price of a barrel of Brent crude oil has doubled over the past year, now hovering near 80 dollars. The figure was closer to 60 dollars barely four months ago. The cost of crude oil is roughly half the price of refined petroleum products such as benzene.

The surging rates have been too heavy a burden for the public budget, which heavily subsidises petroleum. Officials of the Ministry of Trade adjusted retail gas prices in two rounds at the beginning of the year. A litre of benzene was at 25.83 Br by mid-February, up from 21.53 Br. Diesel also saw a similar jump.

Prices remained steady until last week.

The government found it difficult to keep up with the subsidies, reveals a 21-page letter the Ministry sent to oil companies last week. The expenditures are exacerbating the federal budget deficit, which stood at 126 billion Br at the beginning of the fiscal year. The state has spent 26 billion Br on subsidies in the five months beginning July 2021, with November accounting for over a third of the total. The Fuel Subsidisation Fund, a federal agency established to absorb shocks, has so far bled 82.2 billion Br in federal funds.

“Without the subsidies, the retail price would have reached 58 to 60 Br a litre,” said Hassen Muhammed, state minister for Trade, during a media briefing last week.

Ethiopia imported 3.8 million tonnes of petroleum products two years ago at a cost of 62 billion Br. The import bill rose by 15pc the following year, while the volume dropped three percent. In the first quarter of this year, 43 billion Br had been spent on importing fuel, more than four times the figure for the same period last year.

The federal government will continue to spend six billion Birr a month on subsidies, disclosed Ahmed Tusa, the Ethiopian Petroleum & Energy Authority acting director.

“Let the public bear with the 25pc increase while the government keeps subsidising the balance,” he told the media last week.

Experience has shown that a rise in fuel prices is correlated with inflation.

Ethiopia's historical high inflation rate of 64.2pc was reported when crude oil price shot up to 140 dollars a barrel in 2008. The price of kerosene went up 50.4pc while petrol and diesel prices increased by 5.6pc and 39.4pc, respectively.

Although less dramatic, recent price adjustments have also had an inflationary effect. At the beginning of the year, inflation jumped up by 10pc immediately after adjustments on gas retail prices were made. However, the shockwaves from the increase made last week have yet to be felt.

Fees on public transport and taxi fare are expected to increase, but transportation regulatory agencies have yet to announce the changes. Neither have food prices exhibited sudden changes in the days following the adjustment. Yet, things might not continue as they are.

Some forecasts suggest that international markets could continue to see prices climb, with the price of a barrel of crude oil possibly surpassing the 100 dollar mark in early 2022.

Getachew Asfaw, an economist who had previously served at the Planning & Development Commission and the Ministry of Finance, warns that not taking measures to cushion the effects of rising oil prices will have consequences. The trickle-down effect it has on other commodities might exacerbate the already severe cost of living. Headline inflation reached 34.2pc in October, while food inflation clocked in at a staggering 40.7pc.

“The fuel price jump would certainly be detrimental, especially to those with low income, without a follow up to ensure it won’t drive up other costs,” Getachew said.

PUBLISHED ON

Dec 11,2021 [ VOL

22 , NO

1128]

Agenda | Oct 17,2021

Agenda | Jan 07,2022

Radar | Nov 21,2018

Fortune News | Jul 24,2021

Agenda | Mar 16,2019

Agenda | Sep 14,2024

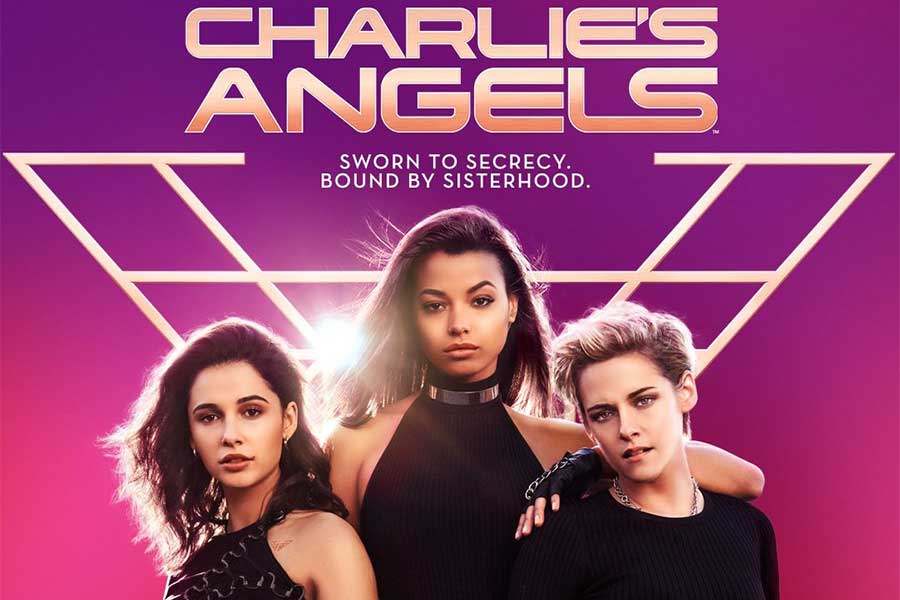

Films Review | Nov 23,2019

Sponsored Contents | Apr 04,2022

Commentaries | Nov 13,2021

Agenda | Mar 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...