Featured | Apr 26,2019

A debilitating foreign currency crunch pushes pharmaceutical manufacturers to the precipice when public and private health institutions face acute shortages of drugs and medical supplies. At least three foreign-owned pharmaceuticals are on the verge of ceasing operations.

Forex unavailability and global supply chain disruptions have undone progress made in the pharmaceutical industry over the past decade. Foreign investment was heavy in the industry, accounting for as much as 40pc of total pharmaceutical investments three years ago. It has since dropped to around eight percent, according to the lobby group representing manufacturers. There are 22 pharmaceuticals and medical device producers; 622 firms manufacture healthcare products such as soap and hand sanitiser, data obtained from the Food & Drug Authority, under the supervision of the Ministry of Health, indicated.

Three years ago, domestic manufacturers had covered a significant portion of the drugs procured by the Ethiopian Pharmaceuticals Supply Agency, established in 1947. It is the sole buyer of local pharmaceutical firms, distributing over 1,000 types of medicines and medical equipment to more than 5,000 public health institutions. The Agency pays a 30pc advance to domestic manufacturers when making procurements. It also spends an estimated one billion dollars annually importing medicines and health supplies from overseas.

According to Haftu Berhe, director of procurement and marketing research, the share of domestic pharmaceuticals has declined significantly.

Several manufacturers are close to calling it quits.

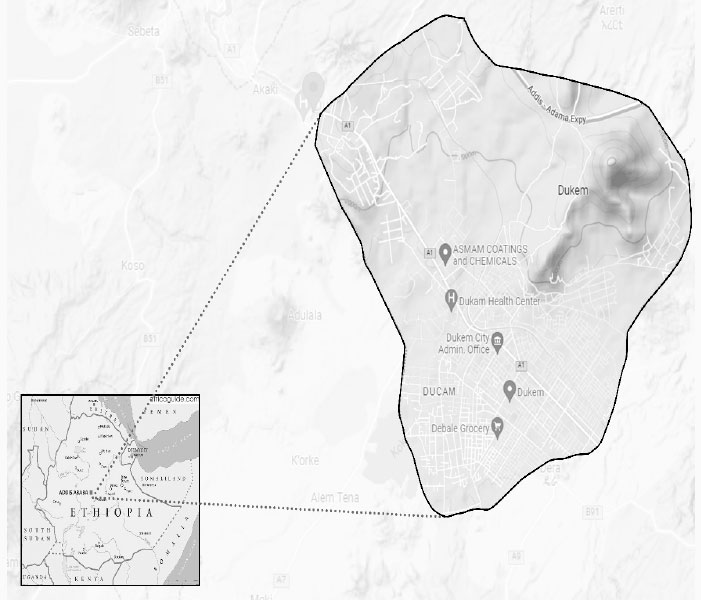

Owned by Chinese investors, Sansheng Pharmaceutical Plc began operations four years ago in Dukem Eastern Industrial Zone after erecting a plant on a 160,000sqm plot. It employed 350 workers until recently. The workers, barring management members, are on leave, according to Yared Hirpo, deputy general manager.

"The company still pays salaries," he told Fortune.

Sansheng imports raw materials primarily from China and India to produce up to five billion tablets and capsules and 10 million doses of infusion drugs every year. It requires up to seven million dollars a year to maintain production.

Manufacturers such as Sansheng have trouble accessing forex from commercial banks despite holding priority status from the National Bank of Ethiopia (NBE). A directive issued by the central bank last December included inputs for pharmaceutical manufacturing and laboratory reagents in the highest priority group for foreign currency allocation. However, a senior manager at one of the oldest private banks said it is not unusual to see manufacturers with priority access to forex waiting for more than two years to open letters of credit (LC).

“Even after the approval of LC, they're forced to wait as long as five months,” he told Fortune.

The pharmaceutical manufacturers association has been lodging its complaints to officials but to no avail, according to Daniel Waktole, president of the pharmaceuticals lobby group.

Cadila Pharmaceuticals Ethiopia Plc has been struggling with the forex shortage like many of the firms in the industry. It was incorporated in 2003 as a joint venture between India-based Cadila Pharmaceutical Limited and Almeta Implex Plc, a domestic firm. It can produce 1.2 billion tablets, half a billion capsules, and over four million bottles of syrups every year with a staff of 347.

In its initial years of operation, Cadila used close to half of its capacity, producing 59 types of medications. However, performance started to decline gradually, forcing its management to let half its temporary workers go while putting most of its management staff on leave. It has been two years since the company has accessed forex from banks, according to Kebede Hunde, director of product quality control and assurance.

“We're producing at less than a tenth of our capacity,” Kebede told Fortune.

Among those who have been put on leave is Wondwessen Yilma, 48. A father of two, he worked as a production controller at Cadila for nearly two decades, earning a salary of 13,000 Br. He stopped going to work last month.

“I don’t know how much longer the company can keep paying my salary,” he told Fortune.

His colleagues are also desperate.

Daniel, the president, blames officials for not giving attention to manufacturers in import substitution industries such as pharmaceuticals. He raised the imports of IV fluids, which comprise 95pc water and minerals like sodium and potassium.

“Instead of availing foreign currency for local manufacturers to import the chemicals, the government prefers to import IV fluids at a higher cost,” said Daniel.

The Agency spent 17 billion Br on imported pharmaceutical goods from abroad last year, an amount already spent in the first two quarters of the current fiscal year. However, the Agency has been buying IV fluids from domestic manufacturers.

"The Agency is forced to look outside the country because they can't supply the required volume," Haftu, the director, told Fortune.

Medical professionals, however, observe that domestic manufacturers are a vital cog in the healthcare system.

"They played a big role, satisfying laboratory supplies, sanitary products and antibiotics during the pandemic," said Berhane Tsehay (MD), ward manager at St Paul's Millennium Medical College.

PUBLISHED ON

Jun 18,2022 [ VOL

23 , NO

1155]

Featured | Apr 26,2019

Radar | May 13,2023

Fortune News | Apr 16,2022

Sunday with Eden | Mar 27,2021

Fortune News | Oct 30,2022

Radar | Apr 21,2024

Fortune News | Sep 23,2023

Commentaries | Mar 25,2023

Fortune News | Jan 25,2020

Fortune News | Feb 25,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...