Agenda | Oct 12,2019

For decades, the Birr stood as a symbol of national economic policy sovereignty. However, its foundations have pulverised under a persistent axis of pressures: inflation, forex crunch and a widening budget and trade deficits. In a Parliament address a few months ago, Prime Minister Abiy Ahmed (PhD) warned of a painful remedy for the macroeconomic imbalance, likening the economic woes to a throbbing tooth.

Last week, with a single stroke, he announced its extraction.

His Governor for the National Bank of Ethiopia (NBE), Mamo Mehiretu, has opened the currency floodgates. A radical overhaul of foreign exchange regulations, effective July 29, 2024, marked a seismic shift from Ethiopia's tightly controlled economic model. "Historical" was how he characterised the monetary policy reforms during his public address in the wee hours a day after the Prime Minister issued a four-page macroeconomic policy statement.

Prime Minister Abiy justified his decision as necessary to address deep-seated economic structural issues, including distortions and macroeconomic imbalances. He stated that liberalising the foreign exchange regime is expected to enhance the financial sector's competitiveness and inclusiveness, ultimately promoting a sustainable economic environment. His administration is banking on these reforms to control inflation, improve public investment efficiency, and strengthen the banking industry’s health.

The night before, the Governor stayed up until midnight in his office on Sudan St., briefing the chief executives of all banks. The centrepiece of his new directive, issued the same night, is adopting a fully floating exchange rate. Long anticipated by some economists, while utterly shocking to others, it hands over the trade of the Birr's against a basket of major currencies to the executives and other market forces anticipated to join the industry legally, effectively ending a 50-year firm grip dictated by the state.

Governor Mamo announced early in the morning that the central bank had dismantled a host of restrictions.

Exporters can retain half their foreign earnings, surrendering the rest to banks at negotiated rates. Businesses can access foreign currency on demand, as the priority list system for foreign currency allocation is abolished. Authorities have issued a directive demanding that all idle foreign currency earnings be surrendered to commercial banks within a month, hoping to inject much-needed liquidity into the interbank market. Anticipating a broadened market participation, they invited non-bank foreign exchange bureaus into the fold.

The radical shake-up promises to transform the economy, and the financial sector, enhancing service delivery and expanding consumer access.

For decades, Ethiopia's economy struggled under the weight of foreign exchange crunches that stifled growth and nurtured inefficiencies. Abiy's administration targeted to resurrect these "inherited" problems.

"It should have been done decades ago," the Prime Minister said.

His decision to let the state grip loosen came after his Administration concluded protracted negotiations with the International Monetary Fund (IMF) for a bailout program and external creditors for debt restructuring. These talks secured financial aid from the IMF and World Bank to support his economic reform agenda, dubbed the Home-grown Economic Reform Program.

The IMF board of directors met a day after the government floated the Birr and approved a 3.4 billion dollar loan under the extended credit facility. The IMF said it wants to see Ethiopia address the balance-of-payments issues and consolidate public spending. The World Bank followed suit, pledging a 1.5 billion dollar package to support macroeconomic stability, trade, and social safety nets.

These Britton Woods institutions praised Ethiopia's commitment to market-oriented reforms, including currency market liberalisation and monetary policy adjustments.

Last week, Parliament approved a billion dollars in concessional loans and half a billion dollars the World Bank granted to support these reforms.

"We needed the reform," said Ahmed Shide, minister of Finance, addressing members of the federal legislative house last week. "There was no other way."

Minister Ahmed, along with his deputy Eyob Tekalegn (PhD) and Governor Mamo, negotiated the terms with the IMF, the World Bank and external creditors over the past three years. He assured federal legislators that the loans would be used for the federal government's supplementary budget.

"Our budget this year is bound to be excessive," he said, acknowledging that implementing home-grown reforms over the past five years has been inhibited by internal problems such as the war in the northern region, natural disasters, and international pressures.

He argued inflation would continue to subside, the debt burden would decline, and the balance of payments would improve following exchange rate reforms. He attributed the debt to massive public investment over the past 15 years, which would be mended through macroeconomic reform.

"This reform will substantially reduce our debt burden," he said.

However, experts have debated the notion that every dentist can successfully treat a tooth, and so too has the efficacy of floating the Birr as a panacea for Ethiopia's economic ills. Some warn that the government will need to tread carefully as it steers this uncharted water.

Political economy strategists like Dalaya Esayiyas have voiced their complete disregard for the reform on their virtual platforms. Dalaya equated the leaders of Ethiopia’s reform with economists who championed similar reforms in the late 1970s, where the blueprints led to disastrous consequences in Chile. She recalled that the policies of the "Chicago Boys," liberal economists at the time from the University of Chicago, thought by the monetary economist Milton Friedman, initially led to economic growth in Chile but also resulted in gross social inequality and economic instability.

The legacy of the Chicago Boys has shaped economic policies in many countries, contributing to the rise of what its critics claim is "neoliberalism", associated with economic growth but often blamed for benefiting the wealthy at the expense of the poor. Dalaya boldly claimed that the frontiers of Ethiopia’s reform are “serving as footsoldiers in dismantling its [policy] sovereignty,” while those in the lower economic curve are left to suffer from governance dysfunction.

A subtle inquiry into this was asked by members of Parliament called late last week from a recess as the concessional loan was put before them. They wondered how a country wrestling with war, drought, and inflation could handle the “short-term” effects. Federal government officials pledged measures to protect the most vulnerable members of society during this “shock period.” Social safety net programs and wage subsidies for low-income public service employees are part of the broader strategy to cushion the potential short-term impacts of the liberalisation program.

Prime Minister Abiy disclosed that over 90 billion Br is allocated for a salary adjustment in the supplementary budget bill, which will soon be cashed out after Parliament ratifies it.

“This was never seen in the history of Ethiopia,” he said.

A country usually engrossed in political turmoil was abruptly consumed by the blunt reality of economic survival. Investment consultants such as Million Kibret, the managing partner of BDO Ethiopia, believe it is only natural for change to trigger widespread fear.

"Remain calm and react rationally," said Million, advising the public on how to bear during such times.

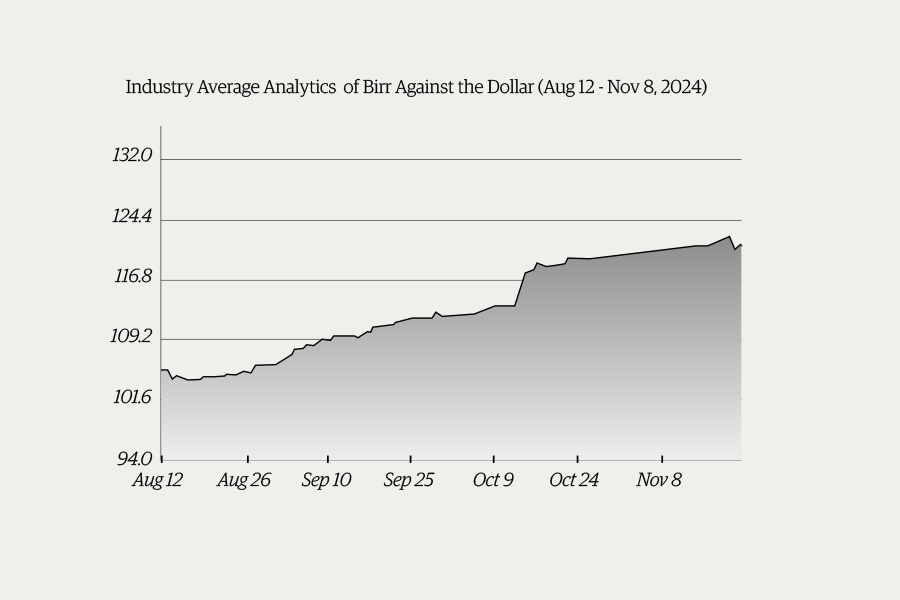

He expects Birr's exchange rate to the US dollar to potentially jump to more than 100 at the official markets; a projection materialised a day after sharing his thoughts. On Saturday, August 3, 2024, the Birr passed a historical mark of 101.43 against the Dollar for cash and transaction, offered by the state-owned Commercial Bank of Ethiopia (CBE).

However, this was no surprise to Million, as the parallel market, which has been extensively used to import commodities, has been way above these figures for the past years.

“The substantial amount of assistance received from development partners will cushion the negative effect that could potentially harm our economy,” he said.

Governor Mamo's briefing to the senior executives of the banks focused on the urgency and importance of preparing the financial sector for the upcoming changes.

"We're dedicated to continuously reviewing and evaluating the impact of these reforms," he asserted.

Banks are required to report their daily transactions to the central bank by the end of the day. The NBE would compile the exchange rates used by all banks and authorised foreign exchange dealers in their daily transactions and publicly communicate an indicative daily exchange rate, calculated based on these reports, to the market by the start of the following business day. The directive states that it may serve as a reference price but not a mandatory transaction price.

However, the road ahead is fraught with uncertainty. Overnight, the Birr lost nearly a third of its value, which ballooned to over half within a week, eviscerating purchasing power. While the reforms promise to unlock Ethiopia’s economic potential, experts fear they also risk fueling inflation, destabilising the financial system, and increasing the cost of imports.

According to Abdulmenan Mohammed (PhD), a financial analyst based in London, the disparity between official and parallel market rates suggests that convergence is far from imminent. He observed many overlook the distinct dynamics of these markets, arguing that the demand for foreign currency in the parallel market depends on its availability through official channels and the pricing of imported goods in the domestic market.

The uncertainty brought about by the new exchange regime, coupled with soaring bank exchange rates, is pushing the prices of goods and services higher in domestic markets. If this trend continues and banks cannot provide sufficient foreign currency, Abdulmenan warns importers will likely feel compelled to offer even steeper rates in the parallel markets. He argued that past prices and the existing demand and supply dynamics influence rates.

“Prices have memories,” he told Fortune.

Over the week, the supply and demand of foreign currency have nearly frozen due to uncertainty. But Abdulmenan anticipates these rates will rise once stability returns, as the cost of imported goods will demand it, all while banks struggle to keep pace with foreign currency shortages.

“Our country's foreign currency reserves appear inadequate to stabilise bank exchange rates,” he said.

Banks have been ramping up their rates to attract more foreign currency. Last week, the US dollar soared by over 35 Br at some commercial banks. The rate witnessed last week followed the Birr's high volatility in the official market, where commercial banks kept scrambling to determine the real value of the Brewed Buck. The Birr's value against the dollar surged within a week by 106.85pc, from 58.6 Br on July 27.

The parallel market, double the official exchange rate a few weeks ago, only saw an increase of around five Birr, exchanged last week at 124 Br against the dollar. However, Abdulmenan warns this could backfire, prompting sellers to withhold their foreign currency from official and parallel markets, leading to a continuous rise in exchange rates. He forecasts that the higher the official rates climb, the more import prices will soar, triggering inflation and increasing the country's debt in foreign currency.

“If this pattern persists, we could be heading towards economic turmoil,” he told Fortune.

PUBLISHED ON

Aug 04,2024 [ VOL

25 , NO

1266]

Agenda | Oct 12,2019

Verbatim | Jun 15,2024

Money Market Watch | Nov 24,2024

Money Market Watch | Sep 27,2025

Fortune News | Apr 29,2023

Commentaries | Jul 10,2021

Fortune News | Feb 24,2024

Fortune News | Jul 07,2024

Addis Fortune Press Release | Oct 04,2024

My Opinion | Apr 02,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...