Chips are an essential part of Dawit Zemene's downtime. The 26-year-old, who drives for taxi-hailing service Ride to make money on the side, eats chips almost every day.

When SUN Chips, a locally-made brand, debuted in the market, it was great news for chip lovers like Dawit, who used to buy more expensive imported brands from the supermarket.

Dawit, who is studying Computer Science at Admas University, has stopped browsing the aisles for chips ever since. There is only one brand he is interested in. His favourite is the latest flavour variety -- Habesha Spice -- which uses Ethiopian spices like berbere to add a spicy kick to the popular snack food.

The smiling sun logo on the package can be seen propped on the shelves of many kiosks and supermarkets across the country.

"The other chip brands they package here are hit or miss," he said. "You could get a bad batch. There's no guarantee."

But it is safe to say that Dawit is not the only fan. Senselet Food Processing Plc, the company behind SUN Chips, has enjoyed significant growth since it first started producing the chips in January 2018. Until recently, Senselet was wholly-owned by Netherlands-based investment company Veris Investments, but its burgeoning success made it attractive to larger firms.

So much so that in December 2019, international food and beverage giant PepsiCo acquired a majority share in the company. The producer of Pepsi-Cola registered a whopping 67 billion dollars in worldwide net revenues over the past year.

Founded by Veris in 2015, Senselet has steadily sold a million bags of chips a month since it commenced production in 2018. This number is expected to triple by the end of this year, according to Chris Wijnterp, general manager of Senselet Food.

The company has also grown alongside the demand for its chips. The number of employees has grown from 60 to 230, and its initial small agriculture team is also expanding.

"We started out with just one production shift," said Chris.

The company works with smallholder potato farmers in the country and provides them with support to increase the quality of the locally-sourced potatoes. The company has seen success despite the common challenges that investors face in the country.

One problem was getting the necessary materials and machinery into the country, according to Chris.

The lack of foreign exchange in the country was another - a common issue that many investors in Ethiopia struggle with as forex availability dwindles over time. Last year the nation's forex reserve covered 2.4 months worth of imports. Currently, it covers a little over a month and a half's worth.

There are currently 20 state-owned and private industrial parks in the country, creating employment opportunities for over 100,000 individuals.

"Following regulations are important," said Chris, "and patience is necessary."

On a positive note, the company has also been fully supported by the Ethiopian Investment Commission (EIC), according to Chris.

Two years after Senselet entered the market in 2015 the country recorded its biggest ever level of foreign direct investment (FDI) at 4.1 billion dollars. Since then the flow has been on a steady decline, scoring its lowest in five years at 2.5 billion dollars in 2019.

Many factors are attributed to the substantial flow of FDI into the country in the years preceding 2017. Over a decade ago, the construction of the first private industrial park in the country, the Eastern Industrial Zone (EIZ) built by China's Yonggang Group, brought attention to the development of industrial parks elsewhere in the nation.

The industrial park phenomenon that followed in subsequent years and the government's shift to an industrial-led economy were major factors for high FDI inflow, according to Temesgen Tilahun, deputy commissioner at the EIC.

The opening of the nation's first government-owned industrial park, Bole-Lemi Industrial Park, followed soon after in 2014, and the number of parks in the country has grown to 20 since then. The latest addition is Bahir Dar Industrial Park, which joined the swelling ranks earlier this month.

"There was a shift in focus to manufacturing as well," said the deputy commissioner. Currently, an average of 60pc of the country's investments come in that sector.

Investment from Turkey, China and India also began flowing in during the industrial park boom, according to the Commission's report. Investing in the parks comes with a series of perqs and benefits including customs duty and income tax exemptions among other things. The country also draws investors in with its huge labour force. This is seen as an advantage for the investor and a plus for the local communities bolstered by the creation of jobs.

Over 90,000 permanent and temporary employees have been hired across the parks in the country as of July 2019. In the first quarter of this year alone, an additional 10,864 people joined the workforce, according to a report by the Commission.

Contrary to what seems to be a pool of opportunity, however, is the high turnover rates at the parks.

One reason could be the high cost of living and the wages in the parks, according to Fekadu Negussie, a labour specialist at the Commission.

"Companies provide meals in the Parks, but housing and other living costs may be a reason for the high turnover," he said. "Since there isn't a lot of skilled labour, the pay is dependent on productivity and may not fully cover employees' living costs."

In a country where there is no set minimum wage, this may have created a gap in what operating companies also consider liveable wages, according to the labour specialist.

"Limited skills and gaps in human resource management could also be factors," said Fekadu, adding that the Commission is conducting a study to better pinpoint these factors.

"While managers at the companies have extensive experience in other places, Ethiopia is a different country," he said. "This may be compounded with a lack of soft and hard skills of employees."

Cultural divides and communication barriers between employees at the parks, who hail from all parts of the country, and the management are being moderated using various methods to ease relations and promote the industry.

An example is a grievance redressing mechanism involving regional labour bureaus, a park peace directorate, and the One-Stop-Service programmes at parks. The One-Stop-Service, a practice implemented to ease the investment process, also has a labour representative that oversees human resource issues like this. Beyond that, the Service has representatives from banking, electricity, telecom, water and customs offices whose job is to bring these services to the investors.

Over the past three years, instability in the country has led to many investors rescinding plans and returning sheds in industrial parks. Others have had their investment processes delayed or interrupted at various stages for the same reason.

"When there's no peace," said the Deputy Commissioner, "there can be no investment."

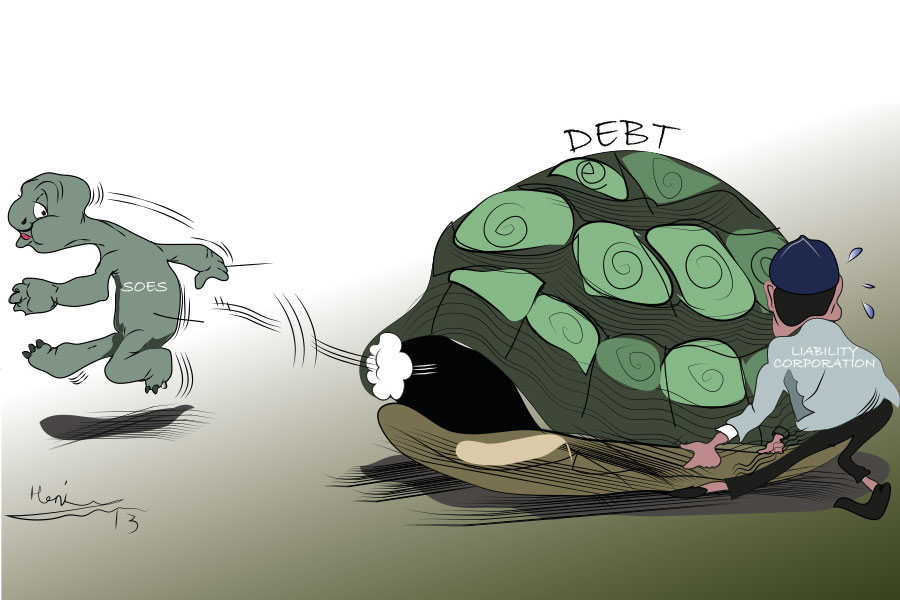

Last year, the Commission stated that the security situation in the country had cost it 300 million dollars in FDI. The ever-increasing issue of forex has also forced businesses to operate below capacity, according to the deputy commissioner. Companies were reportedly operating at an average 30pc capacity through the past year when the crunch got especially bad.

Another issue is the provision of electricity - a shortage of power substations in areas where the main industrial hubs are located. Transportation, too, is cause for concern. The level of support and efficiency at regional levels is also not commensurate with the efforts that the Commission is putting forth to attract investors.

China's investment, which accounted for more than 60pc of investment in the country, has also stabilised, according to the World Investment Report by the United Nations Conference on Trade & Development (UNCTAD).

The lack of investment flow is expected to be further exasperated by the effects of the Novel Coronavirus (COVID-19), according to the same report, which estimates a 25pc to 40pc drop for the continent at large. In 2019 alone, there was a decrease of 45 billion dollars in FDI on the continent.

In line with this, the Commission has had to revise its initial five-billion-dollar target for 2020 to 4.1 billion dollars, a figure that is still pending approval. In the first quarter of the country's fiscal year, only half of the targeted one billion dollars was realised. Despite this, the Commission still finds reasons to be hopeful.

"There have been a lot of changes in the legal framework," said Temesgen. "The revised investment law has opened more sectors to foreign investment. We're now welcoming investors instead of sending back interested parties due to strict laws."

A new directive is underway by the Ministry of Innovation & Technology to fully digitise all government offices on an online platform. This digitisation is expected to smooth out rough patches in the investment process.

The privatisation of Ethio telecom, the country's sole telecom operator, is a major event anticipated to bring in a substantial amount of FDI in the near future. In addition to this, the four agro-industrial parks located at Bure, Yirgalem, Bulbula and Meqelle will become operational this year.

"Most investments take place in the third quarter," said Temesgen. "We expect to see a rise in the coming months."

The report by UNCTAD also forecasts some auspicious circumstances. Trading facilitated by the African Continental Free Trade Area Agreement, effective as of 2019, is also expected to cushion the blow.

Additionally, despite global trends, Ethiopia remained the largest FDI benefactor in East Africa even when flows to the region decreased by nine percent in 2019.

The commitment of the government in attracting foreign investors and opening sectors is very important in this regard, according to Tsegaye Gebrekidan (PhD), an economist at the Policy Studies Institute. Successful privatisation efforts would also provide momentary relief for the current forex crunch in the country, explained the economist.

But privatisation needs to be followed by policy reform and revision of the allocation of foreign currency for it to have a longer-lasting impact on forex reserves, he warned.

"If the forex allocation remains the same," he said, "then we go back to the same problem."

Liberalisation and privatisation of sectors like telecommunications are also likely to invite investment in other sectors, according to Tsegaye.

"This signals an opening up of the country," he said. "If the privatised sectors are also efficient, then this will have spillover effects in other industries."

The country's stability is another major factor.

"This is what had brought in investors, along with a young labour force and a strong commitment by the government," he said. "So it's importance is very clear."

In countries where there are huge amounts of resources like minerals, investors enter markets even in the midst of war but not so where investment is focused on manufacturing, according to Tsegaye.

The expert stressed the importance of government commitment when it comes to the implementation of planned reform as another critical factor.

PUBLISHED ON

Oct 24,2020 [ VOL

21 , NO

1069]

Commentaries | Dec 11,2020

Verbatim | Apr 03,2021

Verbatim | Oct 10,2020

Fortune News | Aug 01,2020

Sunday with Eden | Aug 08,2020

Fortune News | Apr 03,2021

Editorial | Apr 03,2021

Radar | Oct 17,2020

Addis Fortune | Jul 03,2025

Verbatim | Apr 13, 2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...