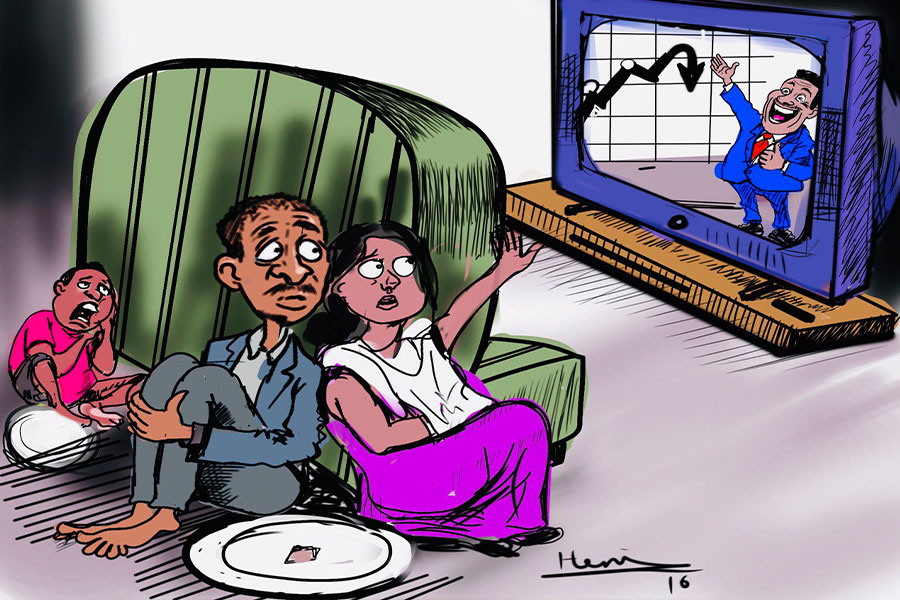

Public projects stalling due to financing issues have been a challenge to the government for almost as long as Ethiopia honed in on infrastructure development as the key to economic growth. The usual culprit could be conditionalities imposed by creditors, which could be affected by inefficiencies in project management and procurements. Lately, the offender is war, diplomatic fallout and debt stress that led to reviews of the country’s current and capital accounts. Official loans and grants have grown sluggish.

There has been no shortage of shocks over the past year. External loans fell by more than half in the past fiscal year to 1.4 billion dollars, while grants dropped by 64pc in the last quarter. The International Monetary Fund (IMF) has also frozen a 2.9 billion dollar programme after disbursing a little over a 10th of it, while the Chinese have suspended funding for several major projects. Their officials wanted to review Ethiopia’s debt standing.

"[The year] 2021 was a very difficult year," Eyob Tekaleign (PhD), state minister for Finance, tweeted on Saturday, Christmas Eve. "It all came to pass as we said it would. Let us hope and work for a much better year. For partners that have failed us, let's reset and move forward."

Moving forward, the federal government remains ambitious in its budgeting. It expects 116 billion Br in loans and grants to fill the gap in its spending. a.k.a budget deficit. Experts believe that it would instead likely have to offer more domestic bonds than it plans or ask the central bank to dial up the printing presses at significant risks to inflationary pressure. Yet, the cost of living is galloping.

"Among the options available, issuing more treasury bills is the better one," said one expert. "Still, this does not address the forex that could be obtained from grants."

Grants and loans are only one source of foreign currency. There is tourism, which the government is betting its "Great Ethiopian Homecoming Challenge" will refresh; exports, mainly held above water by commodities inching close to 1.5 billion dollars in the second quarter, and remittance. Revenues from privatisation and liberalisation efforts are there. But these are highly sensitive to the country's general political and security environment, as the recent suspension of a second telecom license to private operators might have made apparent.

You can read the full story here

PUBLISHED ON

Dec 25,2021 [ VOL

22 , NO

1130]

Fortune News | Aug 14,2021

Radar | Aug 07,2021

View From Arada | Dec 23,2023

My Opinion | Apr 13,2024

Radar | May 12,2024

My Opinion | Nov 04,2023

Viewpoints | Nov 02,2019

Radar | Dec 11,2021

Fortune News | Feb 05,2022

Radar | Dec 26,2020

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transportin...

Jul 13 , 2024 . By MUNIR SHEMSU

The cracks in Ethiopia's higher education system were laid bare during a synthesis re...

Jul 13 , 2024 . By AKSAH ITALO

Construction authorities have unveiled a price adjustment implementation manual for s...

Jul 13 , 2024

The banking industry is experiencing a transformative period under the oversight of N...

Jul 20 , 2024

In a volatile economic environment, sudden policy reversals leave businesses reeling...

Jul 13 , 2024

Policymakers are walking a tightrope, struggling to generate growth and create millio...

Jul 7 , 2024

The federal budget has crossed a symbolic threshold, approaching the one trillion Bir...

Jun 29 , 2024

In a spirited bid for autonomy, the National Bank of Ethiopia (NBE), under its younge...