Delicate Number | Sep 28,2024

Sep 3 , 2022

By Abu Girma Moges

Fiscal policy and spending management are critical for healthy and sustainable economic performance. When fiscal resource allocation significantly deviates from prudent and efficient public resource allocation, it generates significant cost to the economy and involves misallocation of public resources. Prudent and realistic fiscal policy reform is needed to effectively use the economic resources at the disposal of the government for efficient, equitable and sustainable economic growth, writes Abu Girma Moges (PhD), a professor of economics at the University of Tsukuba in Japan.

The fiscal policy and management of a government express the way public resources are mobilised and allocated in an economy. The prudence and efficiency of allocation of such vital resources play a critical role in shaping the overall economic performance and priorities towards sustainable and equitable growth. In this context, the fiscal budget signifies the government's overall health and vibrancy of resource management with widespread implications for the rest of the economy. It is also an area that requires policy attention and timely reform to improve the efficiency and efficacy of public resource management and avoid the costly problem of resource mismanagement and abuse.

The government has budgeted and got approval to spend 787 billion Br this fiscal year, roughly 11pc percent of the GDP. It is also a 40pc jump from last year, while the revenue generation has been stagnant over the past fiscal years. While the government plans to cover about 439 billion Br from its revenue collection, which amounts to only 55.8pc of its spending, the rest of the budget is highly dependent on borrowing.

A fiscal system that manages to collect only five to six percent of its GDP is somewhat in fiscal crisis territory. This is the first sign of the problem with the budget. The government spends far beyond its economic means and fails to mobilise the necessary revenue resources within the fiscal network due to loopholes, recurrent crisis, economic distress, and tax evasion. Moreover, how the government attempts to bridge the gap portends burdensome economic costs to the national economy. A healthy fiscal system does not spend as much as 80pc beyond its means and expect to function without creating huge distortion and misallocation of economic resources.

When faced with such a glaring primary deficit, it is time to jointly address the spending stance and revenue mobilisation effort. Scrutinising the expenditure components and making the necessary adjustments to bring spending somewhat in line with the revenue while simultaneously exploring the ways and means of generating more revenue in an equitable and sustainable manner is imperative. It is impossible to spend far beyond the revenue without prohibitively harming the economy.

Living within one’s means and budget prudence are virtues that apply to individual economic agents and the public sector. What is perhaps unique about the government sector is that it generally does not generate its own income but derives revenue by imposing taxes on the rest of the population. It has an inherent inclination to expand its expenditure without the necessary effort to earn income in exchange for providing goods and services in a market setting, like the private sector. Still, this does not make it less costly to society at large because, in one way or another, the spending behaviour of the government sector must be borne by the tax-paying general public and the economy at large.

To minimise the impact of fiscal misbehaviour, it is time to consider perhaps putting a ceiling cap on the range of spending that the government is allowed, relative to the size of the national economy and its growth over previous fiscal years. At the same time, each line of government spending must be closely scrutinised and justified in terms of its relevance and priority to the general welfare of the society.

A fiscal system that does not operate within a sound and realistic budget constraint ultimately generates burdensome costs and misallocation of limited economic resources. In this regard, the budget approval process needs reconsideration at the federal and regional levels so that fiscal resources are carefully and prudently used for sustainable, shared, and equitable objectives within the prevailing budget constraints. Failure to uphold such basic fiscal principles and processes might exacerbate already challenging macroeconomic imbalances and instability in the economy.

Looking into how the government has been financing its fiscal deficit for the past several years indicates that more and more dependence is on borrowing from domestic and foreign creditors instead of restraining its spending appetite or improving the efficiency of budget resource use. The government has accumulated outstanding debt of about 50pc of GDP and its maturing debt service obligations are currently absorbing as much as 22pc of its budget.

On the domestic borrowing side alone, despite its deliberately set cheap cost of borrowing, the outstanding debt requires debt service payments to the tune of tens of billions of Birr, which constitute nearly a third of the total payment settlements. The fact that the holders of such stock of debt, namely commercial banks and pension funds, avail the financial resources of the public at negative real interest rates to the government adds fuel to the inflationary financing habits of the fiscal-dominated monetary policy environment.

Given the unmet borrowing appetite of the government and the necessary upward adjustment in the cost of borrowing in the treasury bills market, it is expected that the cost of borrowing and domestic debt service obligations are bound to increase further in the foreseeable future.

Despite the formal or informal pressure on financial institutions to hold part of their portfolio in the form of government bonds, artificially cheap loans always give rise to a breach of financial discipline on the borrower, especially when such funds are not efficiently used to improve investment and economic growth. Since these financial institutions are managing the general public's assets, the burden's final incidence is ultimately the wider public, who had no choice but to hold part of their assets in financial form. Since the average saving in commercial banks is currently about 20,820 Birr per accountholder and taking into consideration the purchasing power of such a nominal saving balance, it is quite clear how heavy the burden of negative real interests has depleted the financial resource of the public.

The fiscal behaviour of the government and the way it is managing its resources has wider implications and adverse impacts on the economic welfare of the public. The way both fiscal and monetary policy is conducted has been such that critical economic resources are allocated away from priority areas of the economy. Artificially repressed cost of loanable funds allow a significant breach of fiscal discipline, credit rationing away from productive and employment generating sectors breeds both unbalanced growth performance and unemployment, and accommodative monetary policy adds fuel to an already rapid inflationary pressure. These issues are critical areas that need policy attention, yet the fiscal budget largely fails to address them.

Ethiopia's fiscal and monetary policy have fundamental structural problems that require a drastic shift in paradigm to better the aspirations of Ethiopians to build a better life for themselves and the generations to come.

PUBLISHED ON

Sep 03,2022 [ VOL

23 , NO

1166]

Delicate Number | Sep 28,2024

Commentaries | Jul 13,2025

Radar | Jul 17,2022

Editorial | Sep 03,2022

Sponsored Contents | Mar 03,2022

Commentaries | May 31,2025

Radar | Oct 27,2024

Fortune News | Jul 12,2021

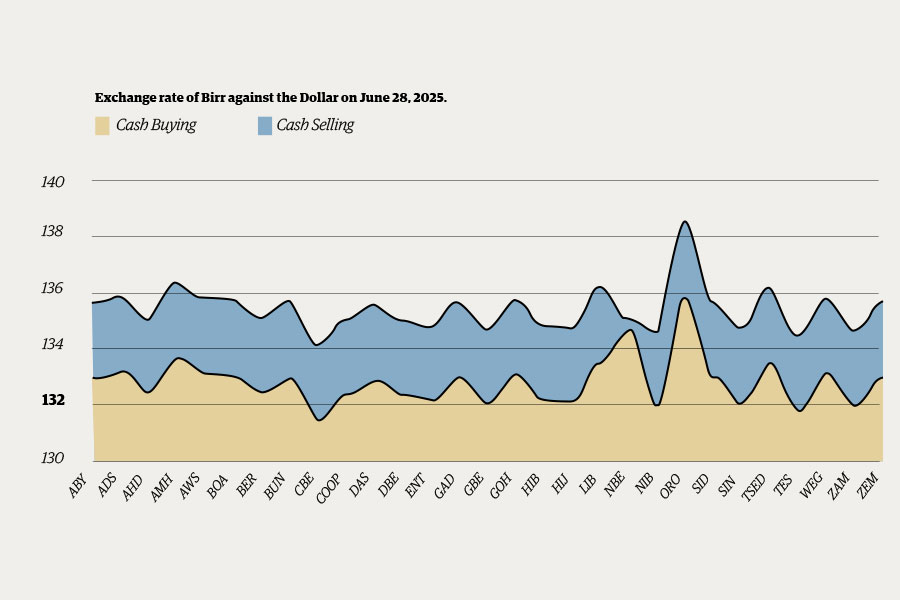

Money Market Watch | Jun 29,2025

Delicate Number | Jul 13,2024

Photo Gallery | 180707 Views | May 06,2019

Photo Gallery | 170901 Views | Apr 26,2019

Photo Gallery | 161992 Views | Oct 06,2021

My Opinion | 137305 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Nov 2 , 2025

The National Bank of Ethiopia (NBE) has scrapped the credit-growth ceiling that had s...

Nov 2 , 2025 . By SURAFEL MULUGETA

The burgeoning data mining industry is struggling with mounting concerns following th...

Nov 2 , 2025 . By YITBAREK GETACHEW

Berhan Bank has chosen a different route in its pursuit of a new headquarters, opting for a transitional building instea...

Nov 2 , 2025 . By BEZAWIT HULUAGER

Nib International Bank S.C. has found itself at the epicentre of a severe governance...