Commentaries | Aug 19,2023

A trio of economists from the International Monetary Fund (IMF) presented the World Economic Outlook for the first time in Africa last week.

The report displayed to an audience that included Central Bank Governor Mamo Mihretu projected a 6.1 GDP growth rate for Ethiopia this year amidst a 0.7pc regional decline.

Dubbed Navigating Global Divergences, the presentation opened with remarks from the Governor, who expressed his desire to learn about regional and global trends that could define Ethiopia's trade relations in the near future.

"The global economy is filled with anxiety rather than uncertainty these days," he underscored.

While the region is going through an 'acute funding squeeze', growth prospects in Ethiopia were only preceded by the Democratic Republic of Congo within the sub-Saharan region, which is projected to grow by 6.7pc mainly boosted by rising mineral exports.

The report released the prior week highlights a global economic trajectory marked by growing geopolitical tensions, a slowdown in China primarily due to the unfolding real estate crisis, and increased trade barriers, which are expected to "limp along" until 2028.

The IMF presenters echoed it.

Jean-Marc-Natal, deputy division chief of the World Economic Outlook department at the IMF, reflected on the difficulty faced, particularly by Low-Income Developing Countries (LIDC) in rebounding to pre-pandemic levels stating: "the global economy is still healing."

The former banker at the Swiss National Bank cited biting monetary policy, unsatisfactory declines in inflation rates and high debt as headwinds of the global economy going forward.

Pointing out the "stellar" growth of the Ethiopian economy in the Sub-Saharan context and the pressure of fuel imports on foreign currency reserves, Mamo asked the representatives about the policy implications of the global economic trajectory marked by growing fragmentation worsened by the rise in conflict in the Middle East recently, in countries like Ethiopia attempting to keep inflation at bay.

Jean responded that realising price stability was a priority by building buffers to absorb shocks through fiscal consolidation and financial supervision depending on whether the financial architecture requires a significant role played by the Central Bank.

He referred to progress made by Zambia, Chad and Ghana while acknowledging the road will not be rosy. He suggested: "Debt structuring when possible by using multilateral frameworks."

Ethiopia requested a debt restructuring treatment in February of 2021 through the Group of 20's Common Framework, an initiative for restructuring government debt aimed at low-income countries with little progress.

The economist told Fortune that "there are structural reforms that are not too costly even in tight fiscal spaces" on the country's possible ways of domestic debt management.

He recommended 'first generation reforms' reflecting on a paper presented at Marrakesh, Morocco, the previous week during the annual meeting, which entails good governance and improved business regulation to incentivise investments from the private sector.

"With higher growth, it's easier to consolidate finances," he noted.

Jean also referred to improving revenue collection by upgrading the system through digitisation and cutting expenses without affecting the most vulnerable segments of society.

The regional economic outlook on Sub-Saharan Africa labelled "Light on the Horizon", presented by Tobias Rasmussen, resident representative of the IMF in Ethiopia.

It cast four dark clouds in the region marked by high core inflation, significant exchange rate pressure, funding squeeze and low per capita income distribution in resource-rich countries.

Tobias Rasmussen, the resident representative of the IMF in Ethiopia, revealed projections of around six per cent economic growth while underscoring that the entire Sub-Saharan region was undergoing an "acute funding squeeze" and ballooning debt service obligations.

He noted the rising interest rates in advanced economies had put particular exchange rate pressure on the region.

Tobias acknowledged that Ethiopia had moved significantly from having less than a month's worth of foreign currency last year; while he did not disclose the amount. He revealed the central role played by decreased external borrowing by the government.

The third presenter Martin Stuermer who is in charge of research in the Commodities unit of the IMF, noted growing fragmentation in the global commodities market having uneven economic impacts worldwide with the brunt of the blow felt by low-income countries like Ethiopia.

A policy cocktail characterised by prudent borrowing, pausing interest rate raises, a strategic approach to spending and anchoring fiscal policy through a credible medium-term framework is forwarded by the report.

Concerning debt, the report recommends restructuring for a few countries as ample financial support will be required to meet development needs in limited fiscal space.

PUBLISHED ON

Oct 21,2023 [ VOL

24 , NO

1225]

Commentaries | Aug 19,2023

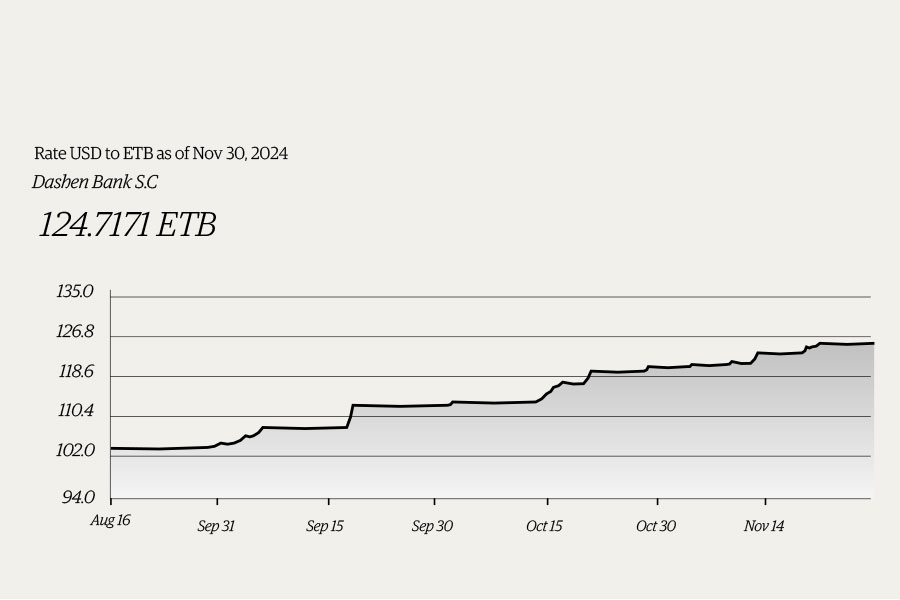

Money Market Watch | Dec 01,2024

Commentaries | Jan 13,2024

Commentaries | May 11,2024

Radar | Oct 12,2025

Agenda | Mar 11,2023

Fineline | Mar 30,2019

Radar | Nov 09,2024

Fortune News | Jan 14,2023

Radar | Jan 09,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...