Radar | Apr 29,2023

A global logistics crisis caused by the COVID-19 pandemic has pushed the state shipping service provider to acquire 3,000 shipping containers less than a month after conducting a similar procurement.

The Ethiopian Shipping & Logistics Services Enterprise (ESLSE), which has increased tariffs by over four-fold due to the shortage of containers almost two months ago, is expected to spend an estimated 765 million Br to buy these containers. The Shipping Enterprise executives hope the procurement will help them cope with a global shortage of containers brought about by imbalances created during COVID-19 lockdowns. It is among a series of actions implemented by the Enterprise to collect shipments docking at various ports worldwide, largely in China, where 13,000 containers were stranded last month.

The international bid floated by the Enterprise for the procurement of 1,101 40ft containers and 1,857 20ft containers in early May had attracted the interest of 19 bidders.

However, only six suppliers participated in the bid, and just four of them have made it to the financial evaluation stage. Three Chinese firms, Guangdong Pi Power Co. Ltd, CCCC Tianjin Dredging Co. Ltd, the CXIC Group Container Co. Ltd, and the Emirati Almeriyan International FZE, are set to undergo a financial evaluation.

Two Chinese companies, Dalian CRRC Container Co. Ltd and Shanghai CIMC Baowell Industries Co. Ltd, were disqualified during technical evaluations, a stage where the Enterprise reviewed the track record of suppliers and the attachment of necessary documents.

The financial evaluations are set to take place over the coming week.

The latest procurement marks the second attempt by the Enterprise to acquire additional shipping containers in recent months. It bought 3,000 units earlier this year through the CXIC Group Container Co. Ltd, which is bidding in the latest round, at the cost of 17 million dollars. It had first floated a bid for the supply of the containers in March last year and initially signed a contract with SMC, another Chinese firm.

However, the process saw significant delays, and the deal was scrapped in early 2021. SMC forfeited a performance bond of 38 million Br as a result. In May this year, the Enterprise was forced to re-float the bid, which CXIC Group won, and around 2,500 of the 3,000 containers were handed over to the Enterprise in June this year. The containers were delivered to its agents in China, the source of over a quarter of Ethiopia's imports and where the shortage is most acutely felt.

The Enterprise, managed by Roba Megersa, CEO, expects the remaining 500 containers from CXIC in the coming week.

The latest procurement will bring the total number of containers at ESLSE's disposal to around 7,000. However, this remains insufficient to cover demand; hence the Enterprise will be looking to buy additional shipping containers soon, according to Wondimu Denbu, deputy director for corporate services.

"The Enterprise plans to ease the shortage, buying containers, but it probably won't be enough," said Wondimu.

Industry insiders have mixed views on the bids.

Abdulhadi Jemal, a representative of Bezhan Trading Plc, an importer of glass using 100 containers a year, cautions the Enterprise to carefully study the local demand for containers before deciding on the units to buy.

According to Gizeshwork Tessema, CEO of GIZE Logistics & Shipping Company, container procurement is insufficient to solve the problems facing importers and the logistics industry.

"The industry is under a government monopoly," said Gizeshwork.

There is little progress to be expected if things remain unopened up to the private competition. Wondimu agrees but stopped short of endorsing the liberalisation of the industry.

Senior executives of the Enterprise blamed the shortage of shipping containers for their drastic markups on cargo tariffs, which comprised quadruple the prices charged a year ago. Importers now have to pay as high as 4,838 dollars for 20ft and 9,223 dollars for 40ft containers. Despite the high cost, goods have been stranded at ports for months now, with no solution in sight. Some have been subjected to fines from banks for missing deadlines on letters of credit (LCs) issued.

The Enterprise has begun issuing waivers to importers, allowing them to use other shipping companies to transport goods from China.

PUBLISHED ON

Aug 14,2021 [ VOL

22 , NO

1111]

Radar | Apr 29,2023

Fortune News | May 04,2019

Radar |

Radar | Feb 09,2019

Fortune News | Aug 10,2019

Fortune News | Mar 14,2020

Radar | Jan 12,2019

Radar | Mar 27,2021

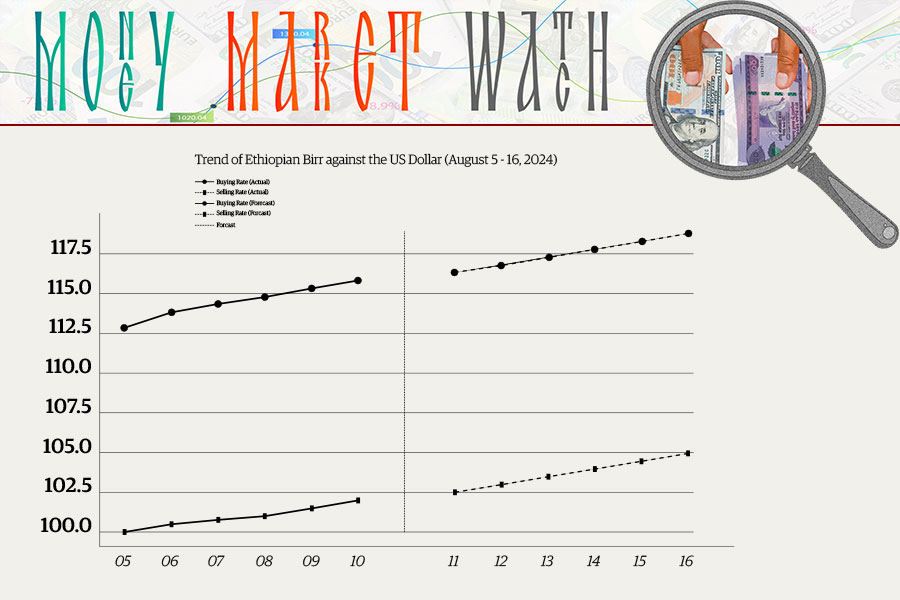

Money Market Watch | Aug 11,2024

Radar | Feb 16,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...