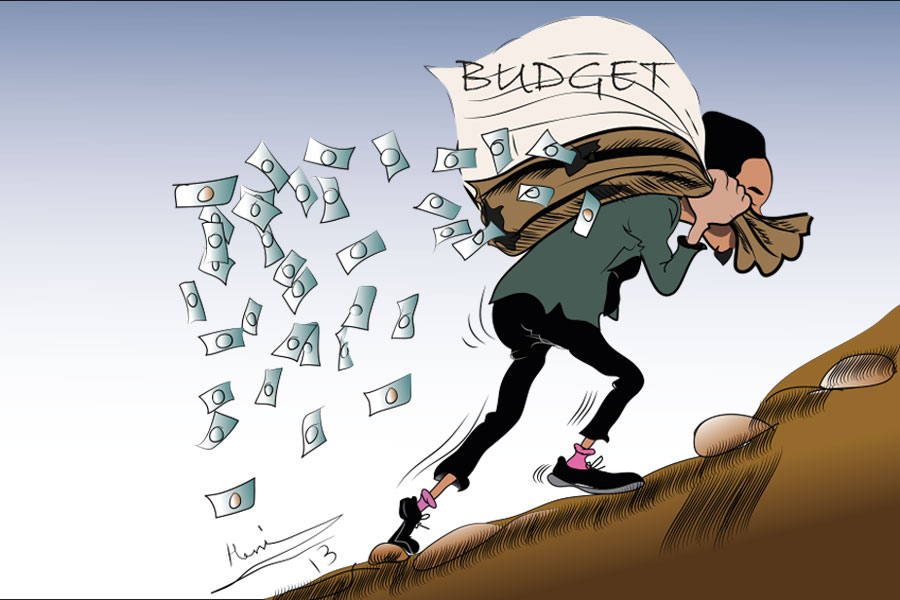

With the ratification of a towering 801 billion Br federal budget last week, a country once heralded as a developmental state model primarily built on extensive public infrastructure investments appears to be on the brink of a potential policy shift.

The freshly sanctioned budget earmarks 203 billion Br for capital expenditures while allocating 159 billion Br towards debt repayments. While these figures might seem substantial on the surface, they represent a stark departure from the country’s past spending patterns. The capital budget experienced a 1.9pc increase from the previous year, a growth that, albeit small, takes on a different hue considering the 33pc inflation rate.

In real terms, this represents a significant decline in capital expenditures by 15 billion from the previous year. It marks a continuation of an emerging trend over the past six years. The consequence of the reduced capital expenditure is that no new capital projects are on the horizon, with allocations strictly dedicated to ensuring that ongoing projects are not halted.

It is a far cry from what Parliament has approved for the 2022/23 fiscal year at 786.6 billion Br, a 40pc increase from the previous year. The federal government had proposed to cover 61pc of the budget from domestic tax revenues. The sources of funds for the current budget would be no different, with tax revenues expected to account for a massive 60pc. Domestic borrowing is directed to cover 30pc, leaving the rest to foreign assistance and non-tax revenues.

Arega Shumete (PhD), an economist and member of the Ethiopian Economics Association, argues that the reduced capital expenditure budget is an uncertain sign of austerity rather than an economic policy shift towards the liberalisation of infrastructure development. Developed nations, he reasons, tend to have smaller capital expenditure budgets since they have already established most of their critical infrastructure, a scenario far from Ethiopia’s situation.

“The need for capital projects is self-evident,” Arega told Fortune.

He believes that the previous regime’s five-year plans for growth and transformation led to a considerable wastage of funds due to corruption within the bureaucratic machinery. According to him, this underscores the necessity for a more careful balancing act between budget planning and execution.

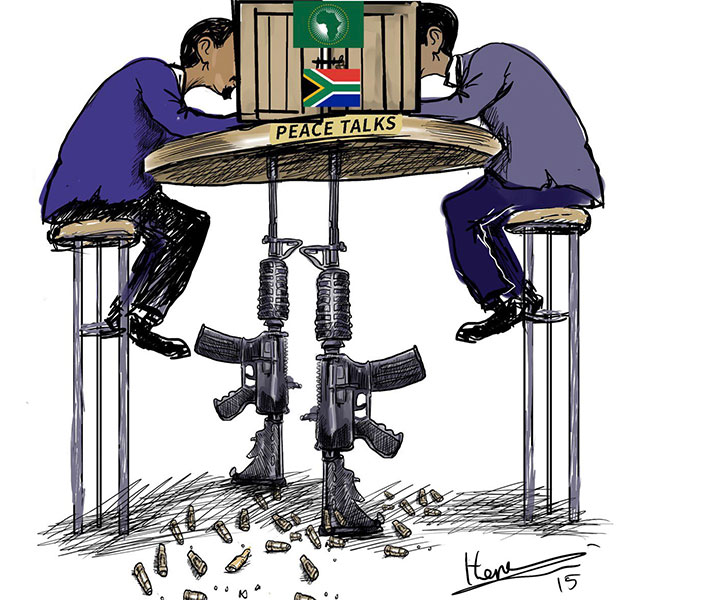

As the budget bill underwent scrutiny in the Plan, Budget & Finance Affairs Standing Committee, chaired by Desalegn Wodajo, it faced criticism for its meagre allocation for infrastructure projects, mainly roads. This dissatisfaction was particularly acute among regional states struggling from the fallout of a two-year war.

Residents from Seqota, an area in the war-ravaged Amhara Regional State, travelled 700Km to express their deep concerns over the reduced capital budget allocations. Alemu Damtew, an MP from the regional state, voiced his surprise at the substantial 92.6pc budget cut for the 69Km Mila-Mile Road, between the Oromia and Amhara regional states. He noted that the cost plummeted from 94 million Br to a mere seven million Birr, lamenting, “It barely covers a single kilometre.”

In an attempt to soothe the rising discontent, Prime Minister Abiy Ahmed (PhD) stressed that the stringent budget was aimed at slashing the budget deficit, restoring macroeconomic balance and serving external and public debt. This response, however, was met with scepticism.

Abebaw Desalegn, an opposition MP, emphasised during the budget hearing that forecasting a growth rate of approximately 7.5pc amid rampant inflation and regional conflicts was unrealistic.

Despite these concerns, the Prime Minister reiterated that Ethiopia boasts one of Africa’s largest economic growth rates, even claiming the highest economic growth rate in East Africa this year at around 6.5pc. However, this assertion does not take into account the difference between nominal and real GDP rates. Governments typically use nominal GDP rates, which consider current prices and multiply them with output, to report economic growth.

In contrast, international think tanks and investors prefer real rates that account for inflation or deflation when conferring economic development.

Arega illustrated teff, a staple grain in Ethiopia, whose price skyrocketed from 4,000 Br a quintal five years ago to 10,000 Br last week. Without an increase in production volume, he argued, an increase in the monetary value of the output could be misleadingly portrayed as economic growth, while it is merely a reflection of inflation.

“Constant prices over five years reveal no significant increase in production,” he told Fortune, criticising the misleading figures of nominal GDP.

Arega postulated that the 7.5pc growth rate posited by the Prime Minister while the IMF’s projected real GDP growth rate for the country at 6.1pc is likely an indication that the government is attempting to avoid exaggerated expectations.

Data from the central bank reveals that real interest rates have been negative over the last few years, registering around 26pc below zero for the 2021/22 fiscal year due to 34pc headline inflation rates. According to an IMF working paper by Omar Lugo, real interest rates influence the rate of savings and private investments. Declined real interest rates result in a decrease in the purchasing power of money and a fall in investment.

However, the Prime Minister referred to inflation as a “global pandemic,” attributing the fall in the exchange rate to the rise in interest rates by the US Federal Reserve.

As the new budget was being discussed, trepidations over an economy haunted by soaring inflation, regional instability, and concerns over the pending civil service restructuring that threatens new employment were echoed by house members. They also sought transparency on financing the Prime Minister’s ambitious resort, park, and palace projects.

One such query came from opposition party MP, Christian Tadele, who chairs a legislative standing committee on Public Expenditure Administration & Audit Affairs. He emphasised that any external financial support to a member of parliament was prohibited under the house’s administrative procedure.

Deputy Speaker of the House, Lomi Bedo, had hinted that requesting an audit was within MPs' rights.

The Prime Minister dismissed these inquiries with aplomb, attributing the funding of Unity Park, Friendship Park, and Jubilee Palace to the charity of leaders from the UAE, China, and France, respectively. He asserted that not a single note of these funds had entered the country’s coffers, adding a flippant remark about offering to purchase flight tickets for MPs interested in auditing these funds.

“We’ll buy you tickets,” he told MPs.

The debate over the new budget culminated in a turbulent Parliament session last week, where Prime Minister Abiy Ahmed faced a call for his resignation for the second time within a year.

Desalegn Chanie, an opposition MP from the National Movement of Amhara (NAMA), questioned the Prime Minister’s administrative capabilities. He labelled the ruling Prosperity Party (PP) and its governance competence a “failed leadership”, emphasising the economic struggle.

“Our people are being roasted by inflation and hunger,” he voiced in Parliament. “The middle class is falling below the poverty line.”

PUBLISHED ON

Jul 08,2023 [ VOL

24 , NO

1210]

Addis Fortune | May 12,2024

Editorial | Mar 28,2020

Commentaries | Nov 11,2023

Editorial | Oct 30,2022

Editorial | Apr 10,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...